Democrats Blast SEC Over Justin Sun Case Dismissal—Cry “Pay-to-Play”

Washington’s crypto clash just got personal. Democrats are unloading on the SEC, accusing the regulator of dropping its high-profile case against Tron founder Justin Sun in a classic “pay-to-play” maneuver. The move cuts to the core of how crypto enforcement gets decided—and who really calls the shots.

The Backroom Brawl

Forget the legal fine print. This fight isn’t about token classifications or jurisdictional nuance. It’s about access, influence, and the old-school suspicion that deep pockets can make regulatory headaches disappear. The dismissal bypasses a lengthy court battle, saving Sun’s empire from a costly, drawn-out siege. Critics see a pattern: flash the right connections, and the gavel never falls.

Why It Stings

The SEC built its case on a foundation of unregistered securities sales and market manipulation allegations—serious charges that promised to set a precedent. Letting it vanish without a ruling leaves a gaping hole in the enforcement playbook. It tells every other crypto heavyweight that the real game isn’t in the courtroom; it’s in the corridors where policy gets traded like a speculative asset. Another reminder that in finance, the best compliance strategy is sometimes just a better Rolodex.

The fallout is immediate. Trust in regulatory fairness takes a hit. Market watchers are left wondering which enforcement actions are genuine and which are just negotiating tactics. For an industry begging for clarity, this episode offers the opposite—a masterclass in opaque, political deal-making. The takeaway? In the tug-of-war between innovation and regulation, money still talks loudest. Just ask your friendly neighborhood lobbyist.

Source: House Financial Services Committee Democrats

Source: House Financial Services Committee Democrats

Financial Connections Raise Red Flags

The Democrats’ letter outlines Sun’s extensive financial relationship with Trump family ventures, noting his $75 million investment in World Liberty Financial through multiple purchases and his position as an official adviser to the project.

Sun became the top holder of Trump’s memecoin, earning an invitation to a May 2025 WHITE House dinner for major investors.

Waters wrote that Sun’s activities “create the unmistakable appearance of a pay-to-play arrangement: a defendant to an SEC enforcement action pours tens of millions into ventures tied to the President’s family, and shortly thereafter his case is stayed.“

The letter emphasizes that crypto companies donated at least $85 million to Trump’s reelection campaign, with firms like Coinbase, Kraken, and Ripple contributing at least $1 million each to his inauguration.

![]() Coinbase, the largest crypto exchange in the United States, has announced a donation of $25 million to the pro-crypto super PAC Fairshake.#Coinbase #Fairshakehttps://t.co/4YOGU6AekK

Coinbase, the largest crypto exchange in the United States, has announced a donation of $25 million to the pro-crypto super PAC Fairshake.#Coinbase #Fairshakehttps://t.co/4YOGU6AekK

The timeline proves particularly significant. The SEC filed its fraud lawsuit against SUN in March 2023, alleging he orchestrated unlawful token sales and manipulated trading volumes.

Despite building, as Waters describes, a strong case with favorable judicial rulings, the agency requested a stay in February 2025 to explore a settlement.

Strong Legal Case Put on Hold

The original SEC complaint detailed serious allegations against Sun and his companies.

Regulators claimed Sun “engineered the offer and sale of two crypto asset securities” without proper registration while directing “hundreds of thousands of TRX wash trades” that generated approximately $31 million from unsuspecting investors.

According to Waters, Judge Vernon Broderick of the Southern District of New York sustained core allegations in a parallel private class action, finding that plaintiffs plausibly alleged Sun and tron illegally sold TRX as an unregistered security.

Several celebrities who promoted Sun’s tokens settled SEC charges and paid fines totaling hundreds of thousands of dollars.

Waters emphasized the case’s strength, stating “the SEC’s case was not speculative or marginal—it was built on a rigorous investigation that resulted in detailed allegations of systematic securities violations confirmed by judicial rulings and co-defendant settlements.“

No adverse rulings had impaired the SEC’s position before the stay.

Broader Enforcement Retreat Questioned

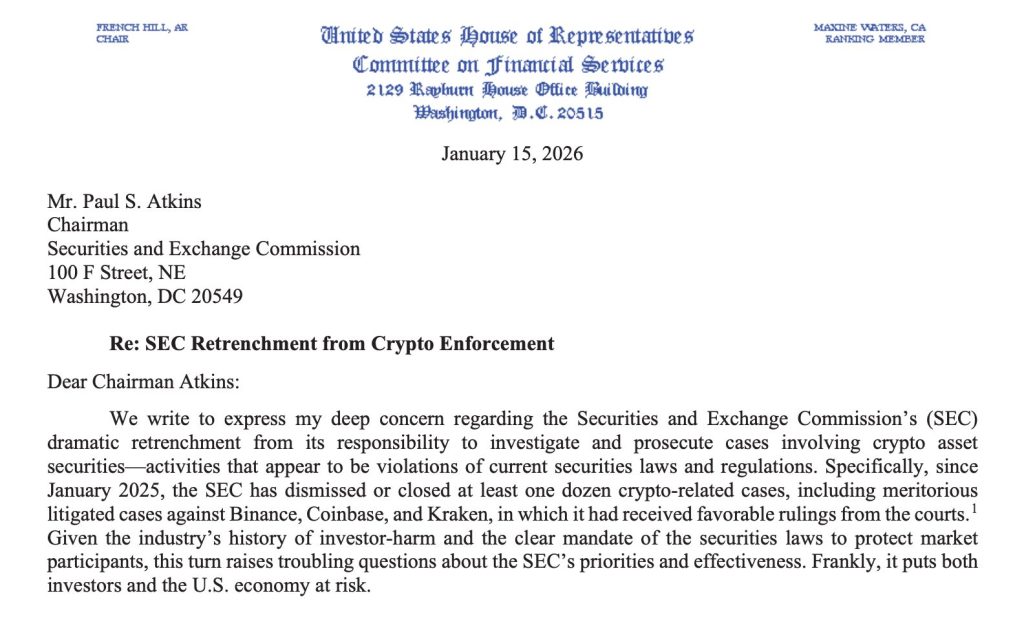

Beyond the Sun case, Democrats expressed alarm over the SEC’s dismissal of major enforcement actions against Binance, Coinbase, and Kraken.

The agency dropped its Binance case in May 2025 “as an exercise of discretion” despite favorable court rulings, while Coinbase and Kraken cases ended through joint stipulations citing the agency’s “ongoing efforts to reform its regulatory approach.“

Waters wrote that “the unjustified decision by the SEC to walk away from these and other meritorious enforcement cases against crypto firms has created the unmistakable inference of a pay-to-play scheme.“

She warned that this retreat “has left a vacuum whereby securities violations by crypto firms are not enforced and U.S. investors are not protected.“

The letter demands that the SEC either request that the court lift the stay and litigate Sun’s case in accordance with its original complaint or reach a settlement reflecting the case’s strength.

Democrats also requested preservation and production of documents regarding any communications with third parties seeking to influence the outcome.

The controversy adds to mounting scrutiny of the SEC’s dramatic policy shift under Chairman Atkins, who assumed leadership after Trump’s inauguration.

![]() Representative Maxine Waters calls for SEC oversight hearing as agency drops crypto enforcement cases against Coinbase and Binance under Chairman Atkins.#SEC #Cryptohttps://t.co/jrgJqAVibK

Representative Maxine Waters calls for SEC oversight hearing as agency drops crypto enforcement cases against Coinbase and Binance under Chairman Atkins.#SEC #Cryptohttps://t.co/jrgJqAVibK

Waters had previously requested that House Financial Services Committee Chairman French Hill schedule oversight hearings with Atkins to examine what she characterized as the agency’s unprecedented politicization and retreat from investor protection.