Delphi Digital: Perp DEXs Poised to Replace Banks as “All-In-One” Financial Giants

Forget your local branch—the next financial superpower won't have a vault or a teller. It'll be a line of code.

The Rise of the DeFi Megabank

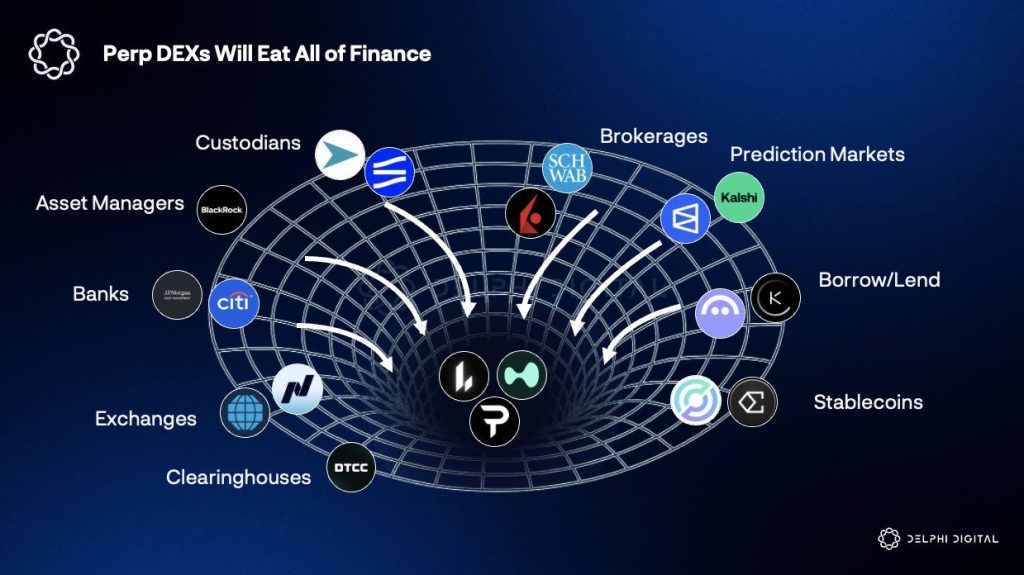

Perpetual decentralized exchanges are quietly assembling the pieces to become the everything-app of finance. They're not just for leveraged bets anymore. Think spot trading, lending, and yield generation—all wrapped into a single, non-custodial interface that cuts out the traditional middleman entirely. It's a direct challenge to the bundled services that have kept legacy banks profitable for decades.

Bypassing the Gatekeepers

The playbook is simple: aggregate liquidity, streamline user experience, and automate everything a traditional institution does manually. No loan officers, no compliance meetings that cost more than the loans they approve—just smart contracts executing with cold, algorithmic efficiency. This model doesn't ask for permission; it builds a parallel system where the only gatekeeper is the blockchain itself.

Why Banks Should Be Watching Their Back

It's about accessibility and ownership. Where a bank offers a savings account with fractional reserves, a Perp DEX can offer a yield-bearing position with full transparency. The user holds their keys, controls their capital, and accesses a global market 24/7. The old guard's moat—physical presence and regulatory complexity—is looking more like a puddle every day.

The final piece? Mainstream adoption. Once the UX is as smooth as a mobile banking app—and let's be honest, that's a low bar—the value proposition becomes undeniable. The future of finance isn't being built in boardrooms; it's being deployed on-chain, one block at a time. The banks just haven't received the memo yet—probably stuck in a committee for review.

Source: Delphi Digital

Source: Delphi Digital

Perp DEXs allow users to trade perpetual futures contracts with leverage and no expiry date, a product that has historically been dominated by centralized exchanges and traditional derivatives desks.

Perp DEXs Gain Ground as DeFi Bundles Trading, Credit, and Custody

Delphi Digital’s 2026 outlook noted that this segment of decentralized finance is now positioned to take further market share from legacy financial products, driven by structural efficiencies that are difficult for traditional systems to replicate.

The research firm argued that legacy finance remains fragmented and expensive to operate, while decentralized infrastructure can bundle multiple financial functions into a single on-chain stack.

In a post shared on X, Delphi Digital pointed to Hyperliquid’s move toward native lending as a key signal of where the sector is heading.

https://t.co/m1EcOi3uNS

— Delphi Digital (@Delphi_Digital) January 13, 2026Delphi noted that this opens the door for perp DEXs to operate as integrated financial platforms, handling trading, custody, clearing, and credit within a single on-chain system.

Competing platforms such as Aster, Lighter, and Paradex are now racing to develop similar capabilities.

This convergence reflects a broader trend in crypto, where trading venues are expanding beyond execution into lending, custody, and capital management.

The data shows that this transition is already well underway, as Perp DEXs have steadily taken revenue and volume share from centralized exchanges over the past three years.

CoinGecko data shows that perp DEXs accounted for just 2.1% of centralized exchange perpetuals volume in January 2023.

By November 2025, that figure had risen to a record 11.7% , meaning nearly one in every nine dollars traded in perpetual futures was executed on a decentralized platform.

For the full year, cumulative perp DEX volume tripled to $12.09 trillion, up from $4.1 trillion at the start of 2025.

About $7.9 trillion of that activity was generated during 2025 itself, highlighting how rapidly adoption accelerated over the past year.

The sector now holds more than $20 billion in total value locked, with monthly volumes frequently exceeding $1 trillion and open interest hovering around $20 billion.

![]() Crypto derivatives trading accelerated sharply in 2025 as traders increasingly turned to onchain perpetual futures.#Crypto #Derivativeshttps://t.co/NRfJCBERpc

Crypto derivatives trading accelerated sharply in 2025 as traders increasingly turned to onchain perpetual futures.#Crypto #Derivativeshttps://t.co/NRfJCBERpc

DEX Spot Trading Grows Sharply as the Gap With CEXs Narrows

Spot trading has followed a similar trajectory, though at a slower pace. Decentralized exchanges accounted for just 6.0% of spot trading volume relative to centralized exchanges in January 2021.

By November 2025, that ratio had climbed to 21.2%, with a peak of 37.4% reached in June 2025 during a surge in memecoin speculation and activity on PancakeSwap.

At the same time, the report and surrounding data highlight how far the sector still has to go.

The 12 trillion annual transaction volume that has been managed by perp DEXs is still low in comparison with the 846 trillion notional value of outstanding over-the-counter derivatives that could be reported by the Bank for International Settlement in mid-2025.

Traditional banks also retain advantages in regulatory clarity, fiat integration, and services such as uncollateralized lending and consumer protections.

Industry observers note that for perp DEXs to seriously challenge banks, they WOULD need to continue expanding beyond derivatives into lending, payments, and tokenized real-world assets, while also addressing security, user experience, and compliance.

Many platforms are already experimenting with on-chain order books, zero-fee models, incentive programs, and high-throughput blockchains to improve performance and accessibility.