Bitcoin Open Interest Plummets 31% as Analysts Spot Market Bottom and Target $105k Breakout

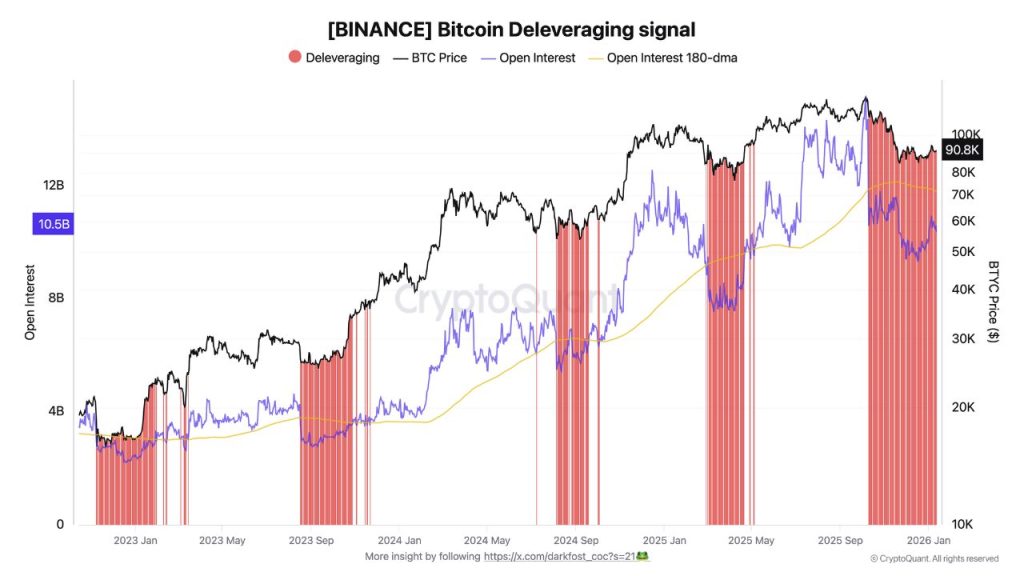

Open interest in Bitcoin futures just took a nosedive. A 31% drop, to be precise. That's not just a correction—it's a wholesale flush of speculative leverage. And according to a growing chorus of analysts, it's the classic signal we've been waiting for.

The Great Leverage Purge

When open interest collapses this hard, it means one thing: weak hands are out. Overleveraged longs got liquidated, and the hot money chasing quick gains has evaporated. What's left? Arguably, a cleaner, more stable market foundation. It's the financial equivalent of a controlled burn—painful in the moment, but necessary for healthy regrowth.

Bottom Callers Emerge from the Rubble

The timing of this leverage flush is key. It coincides with Bitcoin consolidating after its recent pullback. Technicians are pointing to this convergence as a strong indicator that a local bottom is in. The theory goes that with excess speculation wiped out, the path upward faces less immediate selling pressure. Of course, calling a bottom is the favorite pastime of every crypto analyst—right up there with revising their predictions after being wrong.

Eyes on the Prize: The $105k Threshold

So, if the floor is set, where's the ceiling? The next major target on everyone's radar is the $105,000 level. It's more than a round number; it represents a key psychological and technical resistance zone. A sustained breakout above it wouldn't just be another milestone—it would likely trigger a tidal wave of institutional FOMO and confirm a new bullish macro structure. The kind of move that turns cautious whispers into mainstream headlines.

The Road Ahead

Don't mistake this for a guaranteed, smooth ride to six figures. Markets love to test convictions. But the 31% drop in open interest provides a compelling narrative: the reckless bets are off the table. What builds now could be far more sustainable. Just remember, in crypto, 'sustainable' is a relative term—often measured in weeks, not decades. The stage might be set for a run at $105k, but in this theater, the script gets rewritten by the minute.

Market Reset Creates Foundation for Bullish Recovery

The October 10 market crash sparked a severe deleveraging event that purged excessive leverage from the system.

“This decline, amplified by massive liquidations, triggered a deleveraging phase, with OI falling below its 180-day moving average,” Darkorst explained.

These deleveraging periods serve a vital function in market structure. “Historically, they have often marked significant bottoms, effectively resetting the market and creating a stronger base for a potential bullish recovery,” he noted.

has responded with a 3% rally over the past 24 hours, holding firmly above $95,000 while demonstrating renewed strength across both futures and spot markets.

The price action suggests the worst of the correction may be over.

Futures Positioning Signals First Major Shift Since October Peak

Macro analyst Axel identified a critical turning point in futures market positioning.

A composite index tracking open interest dynamics, funding rates, and long-short ratios across major exchanges shows theclimbing from 2.1 to 3.5, marking the first breakout above 3 since October 6, when Bitcoin rallied toward $125,000.

The daily positioning index surged to 24, entering bullish territory amid aggressive long accumulation.

Open interest grew 1.89% with positive taker delta and funding at 0.0045 as price jumped 4.58% to $95,358, pushing total open interest to $12.18 billion.

Market sentiment reached a local peak of 93.15% yesterday evening at $95,061 before cooling to 70%, still well above the neutral 50% threshold and the 30-day average of 62.9%.

This contrasts sharply with mid-December’s extreme bearish readings of 10-15% during the correction to $85,000, when positioning turned overwhelmingly negative.

Resistance Cluster at $105k Holds Key to ATH Attempt

Axel emphasized that sustained momentum requires the simple moving average to hold above 2 for one week, which WOULD confirm the positioning shift and trigger a potential breakout above the psychological $100,000 barrier.

Crypto analyst Trader Mayne assessed the probability of a bullish recovery following Bitcoin’s breakout above two-month resistance at $94,000.

“If I had to handicap it, I’d say 70% chance of a lower high, 30% chance at new ATHs,” he stated.

However, he outlined a clear path forward if the bulls maintain control.

$BTC

Attempting to close through the range highs here.

I absolutely fumbled shorting the top and started longing a little too early on the way down.

That said, I got back in sync with things at the $80k low and am glad I stuck to my guns and didn't puke spot into the lows.… pic.twitter.com/CLu4NMLlDD

Holding comfortably above $94,000 would bring the next resistance cluster around $105,000 into focus, with a successful breach potentially launching Bitcoin back toward the $120,000 highs established earlier in the cycle.

Low Volatility Environment Points Toward Range Expansion

The Bitcoin Realized Volatility chart shows that the current market calm is approaching levels that historically precede significant price breakouts.

Current volatility readings sit NEAR the lower distribution zones for this market cycle, comparable to compression periods that preceded major moves throughout Bitcoin’s trading history.

These compressed regimes rarely persist over extended timeframes. As supply-demand imbalances accumulate beneath the surface, markets characteristically break from consolidation into range expansion phases, aligning with analyst projections for a $105,000 breakout that could catalyze a strong start to the 2026 rally.