Crypto Advisor Allocations Surge to 32% in 2025 as ETF Mania Meets Mainstream Adoption

Financial advisors are diving headfirst into crypto—allocations hit a record 32% in 2025 as ETF hype collides with easier access. The herd finally arrives, wallets in hand.

Demand for Bitcoin and Ethereum ETFs fueled the spike, with advisors citing 'client pressure' and 'FOMO' as top drivers. Because nothing inspires confidence like retail investors leading the charge.

Regulatory green lights and institutional-grade custody solutions removed the last barriers—or at least the excuses. Now even your grandma’s financial planner is pitching altcoins.

But here’s the kicker: 32% is just the beginning. With spot ETFs now hoovering up supply and halvings baked into the code, advisors are scrambling to get ahead of the next liquidity crunch.

Wall Street’s late to the party as usual—but at least they brought the leverage.

RIAs Lead Crypto Adoption As Access Widens

Client demand stayed steady, and advisors felt it. The survey said 94% of advisors received a question about crypto from clients in 2025, and 56% reported owning crypto in their personal portfolios, another record for the dataset.

Allocation rates varied sharply by channel. Registered investment advisors (RIAs) led with 42% saying they allocate to crypto in client accounts, followed by wirehouse representatives at 35%, and the report also tracked 33% for other financial professionals, 25% for independent broker-dealer representatives and 18% for financial planners.

Access keeps improving, and the numbers show it. The share of advisors who said they can buy crypto in client accounts ROSE to 42% from 35% in 2024, and 58% said they were unable to buy crypto in client accounts or unsure whether they could.

Image Source: Bitwise/VettaFi 2026 survey

Familiar Products Lead Advisor Crypto Strategy For 2026

Clients also keep taking matters into their own hands. Advisors said 74% of clients invested in crypto outside the advisory relationship in 2025, up from 71% in 2024, a pool of held away assets that firms can try to pull back into a broader wealth plan.

Sizing remains cautious, and it is rising. The survey said 83% of client portfolios with crypto exposure held less than 5% in crypto, and 64% of crypto-exposed client portfolios held more than 2%, up from 51% in 2024.

When advisors fund an allocation, they usually sell what they already know. Equities were the top source at 43%, followed by cash at 35%, with smaller shares citing commodities, bonds, and gold.

Image Source: Bitwise/VettaFi 2026 survey

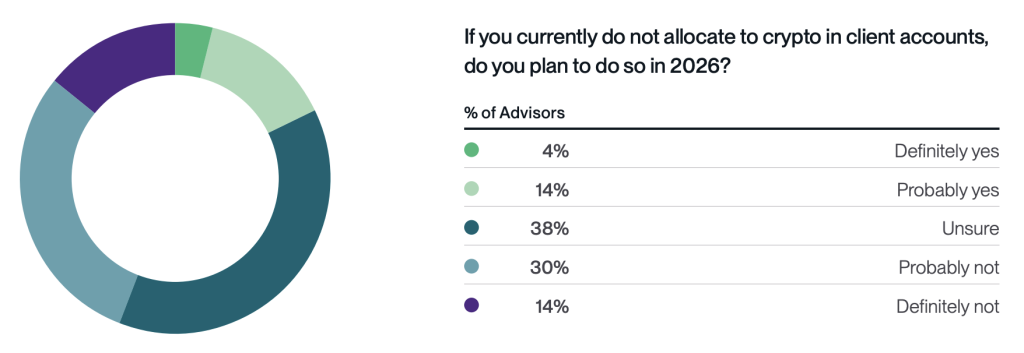

Looking ahead, the next wave may come from advisers who stayed on the sidelines. Among those who did not allocate to crypto in client accounts, 18% said they definitely or probably plan to add exposure in 2026, and another 38% said they are considering it. Among advisors already allocating, 99% plan to maintain or increase exposure.

Product preference is tilting toward familiar wrappers. Advisors again picked crypto equity ETFs as their top exposure for 2026, and the next choices included spot crypto ETFs at 16%, diversified crypto index funds at 14%, multistrategy solutions at 13%, and income-generating strategies at 9%.

The same report laid out the frictions holding adoption back, with volatility and regulatory concerns topping the list, and home office restrictions also showing up as a major constraint.