U.S. CPI Prints 0.3% in Dec; BTC Holds $92K as Rate-Hold Odds Firm

Inflation cools—again. Bitcoin shrugs.

The Numbers Don't Lie

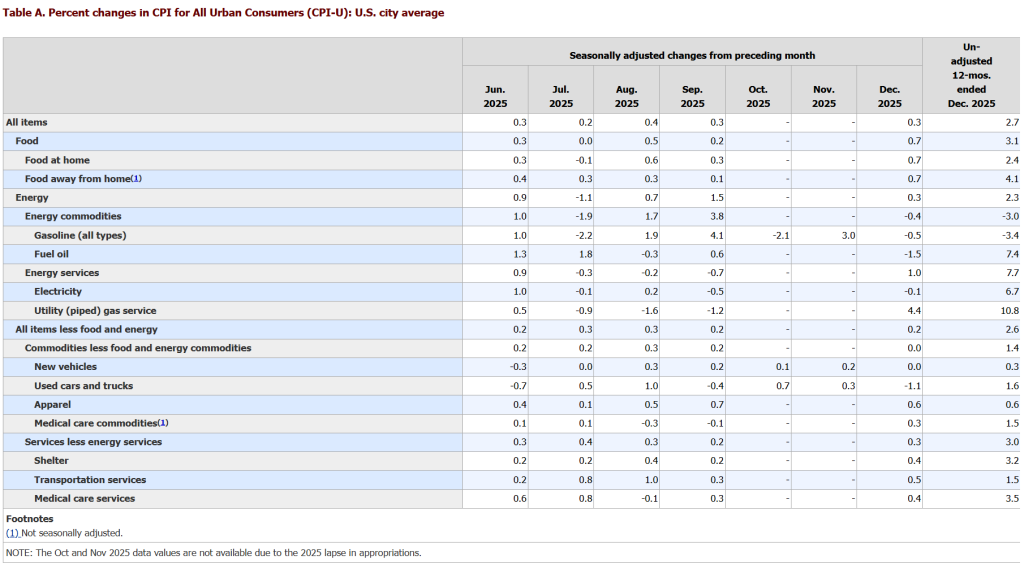

December's Consumer Price Index landed at 0.3%. It's a whisper, not a shout. The kind of data that makes central bankers nod slowly, their hawkish talons retracting just a fraction. Market odds for a continued rate hold are solidifying into concrete. The old guard's primary lever—interest rates—is stuck in neutral, and everyone's watching the fuel gauge.

The Digital Canary

While traditional markets parse the tea leaves, Bitcoin's doing its own thing. Holding firm at $92,000, it's not just weathering the macro news—it's ignoring the weather report entirely. This isn't a reaction; it's a statement. The asset continues to trade on its own thesis: digital scarcity versus monetary dilution. The CPI print is just background noise to a symphony that's been playing for over a decade.

A Tale of Two Systems

One system tweaks rates by fractions and waits months to see the effect. The other operates on a predictable, pre-programmed monetary policy that no committee can vote to change. Guess which one is providing price clarity right now? The cynic might say the Fed's biggest achievement this cycle has been making a 0.3% inflation print feel like a victory lap.

Forward, Unchanged

The path is set. With rate-hike fears receding, the liquidity landscape looks stable—maybe even accommodative. For Bitcoin, this is just another brick in the wall of its resilience. It doesn't need rates to fall; it just needs the traditional money-printing playbook to stay recognizably flawed. And on that front, the data delivers. The hold is on. The king holds its ground.

Source: bls.gov

Source: bls.gov

Bitcoin was trading at approximatelyat the time of the release.

Market Reaction and Rate Outlook

Core inflation stayed contained on the headline release. BLS printedand, which aligns with the market’s “Fed stays parked” base case into theFOMC meeting.

“The index for shelter ROSE 0.4 percent in December and was the largest factor in the all items monthly increase,” according to the release.

Rate pricing remains the key transmission channel into crypto beta. Public snapshots of CME FedWatch-derived odds circulating in late December showed a rate-hold skew for January, with “no change” probabilities clustered around therange, according to KuCoin.

Vol markets signal the same macro posture. Deribit’s own documentation defines DVOL as the options-implied volatility benchmark that settles via a 60-minute TWAP.

What It Means for Crypto Markets

Shelter-led CPI keeps the term premium sticky, butlimits the “higher-for-longer” tail risk that typically pressures BTC duration trades hardest.

Awith akeeps the front end anchored and pushes the crypto reaction function back to real yields and positioning: systematic funds that key off macro surprise indices get no fresh signal, while discretionary desks keep running BTC as a rates-vol proxy because subdued implieds (DVOL-linked products) lower the carry cost for convexity into themeeting and the, CPI release date that BLS already scheduled.