Iran Evaded Sanctions With $1B in Secret Crypto Flows Through UK Platforms: Report

Digital assets just demonstrated their ultimate superpower—operating where traditional finance can't.

How Crypto Became the Sanctions Bypass

Forget complex banking corridors. A recent report reveals a staggering $1 billion in capital moved through UK-based crypto platforms, allegedly facilitating flows for a nation under heavy international restrictions. It's a stark case study in decentralized finance's raw utility.

The report details a network leveraging the borderless nature of digital assets. Transactions that would be frozen or flagged in seconds within the legacy system found a path through crypto exchanges and wallets. It highlights a fundamental tension: the very features that promise financial inclusion—permissionless access and global reach—also create channels outside state control.

Regulators are playing a perpetual game of catch-up. While compliance frameworks exist, the report suggests enforcement gaps allowed these substantial flows to persist. It's a multi-billion-dollar reminder that for every institutional ETF filing, there's a parallel ecosystem moving value on its own terms.

This isn't just about evasion; it's about efficacy. The $1 billion figure proves the network's scale and operational success. It cuts through geopolitical barriers as easily as sending an email—posing perhaps the most compelling argument yet for crypto's disruptive potential. Traditional finance, with its miles of red tape and watchdog approvals, simply can't compete on speed or stealth.

For the crypto-skeptic, it's a nightmare scenario. For the believer, it's validation of a core thesis: when you build a better, more open financial rail, people—and nations—will use it, regulatory preferences be damned. Sometimes the most powerful technology isn't the one that asks for permission.

Source: TRMLabs

Source: TRMLabs

Network Processed Record IRGC Flows Through Shell Structure

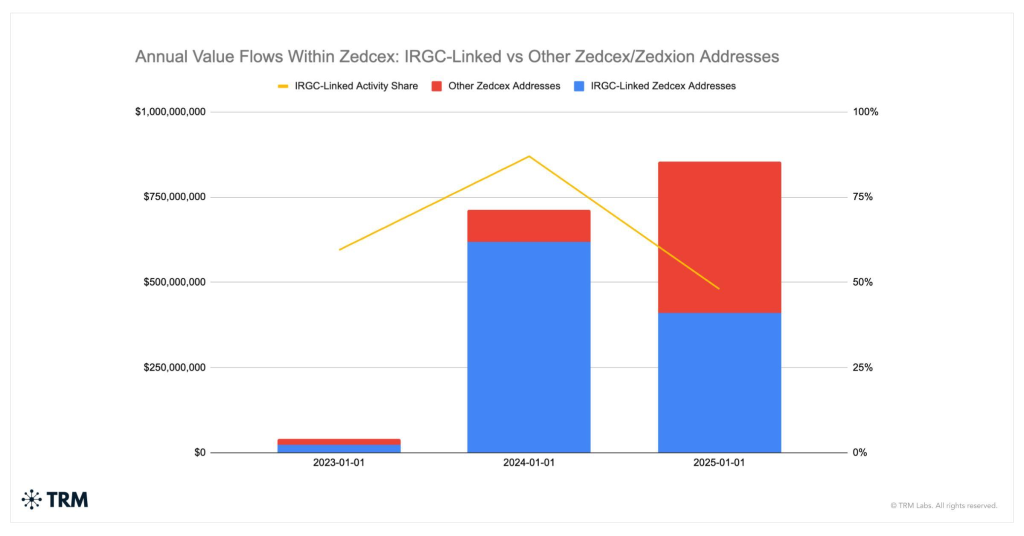

IRGC-linked addresses at Zedcex processed $23.7 million in 2023, representing 60% of total activity, before surging to $619.1 million in 2024 when the IRGC share jumped to 87%.

Activity declined to $410.4 million in 2025 as non-IRGC flows increased, reducing the corps’ share to 48%.

The two exchanges operated as a single enterprise despite separate UK incorporation, with both entities sharing directors, addresses, and coordinated timing that indicated continuity rather than independence.

Zanjani’s withdrawal from Zedxion in 2022, followed immediately by Zedcex’s incorporation under the same control structure and address, suggested operational continuity rather than separation.

After being arrested in Iran and sentenced to death for embezzling millions from Iran’s National Oil Company, his sentence was commuted in 2024 after repaying funds, and he re-emerged publicly with proximity to regime-linked economic projects through DotOne Holding Group, a conglomerate spanning cryptocurrency, foreign exchange, logistics, and telecommunications.

TRM analysis linked Zedcex wallets directly to addresses designated by Israeli authorities as IRGC property under the Administrative Seizure Order ASO-43/25, issued in September 2025, many of which Tether subsequently blocklisted.

Transfers conducted almost entirely inon the TRON blockchain routed funds between designated IRGC addresses, offshore intermediaries, and domestic Iranian exchanges, including Nobitex, Wallex, and Aban Tether.

The exchanges also integrated with Zedpay, a Turkey-based mobile payment processor that maintains relationships with Turkish financial entities, including Vepara, whose license was later suspended amid money laundering concerns, and Vakif Katilim, a state-owned Islamic bank previously scrutinized for facilitating Iran-linked financial activity.

This integration extended capabilities beyond trading to support fiat settlement and real-world payments for actors under sanctions constraints.

Direct Terrorist Financing Links Established On-Chain

On-chain tracing revealed that over $10 million in USDT transferred directly from wallets dually attributable to Zedcex and the IRGC to addresses controlled by Sa’id Ahmad Muhammad al-Jamal, who is sanctioned by the US Treasury for providing material support to the IRGC and operating smuggling networks that generate revenue for Yemen’s Houthis.

The absence of intermediary routing established Zedcex infrastructure as an active funding rail rather than an incidental touchpoint.

The case emerges as sanctioned nation-states increasingly dominate crypto crime statistics, with Chainalysis reporting illicit addresses received at least $154 billion in 2025, marking a 162% jump from $59 billion in 2024, driven largely by a 694% increase in sanctioned entity activity.

Stablecoins accounted for 84% of all illicit transaction volume, mirroring broader ecosystem trends in which these assets offer easy cross-border transfers and lower volatility.

Iran’s broader crypto operations have faced mounting pressure throughout 2025, with flows involving Iranian entities falling to $3.7 billion between January and July, a 11% decline from 2024.

The Treasury Department sanctioned two Iranian nationals in September for coordinating over $100 million in cryptocurrency oil sales benefiting the IRGC, while Iran has explored accepting digital currencies for advanced weapons sales, including ballistic missiles and drones marketed through its Ministry of Defense Export Center.

Russia launched its ruble-backed A7A5 token in February 2025, processing over $93.3 billion in transactions in less than a year as Moscow similarly Leveraged crypto infrastructure to circumvent Western financial restrictions.