EU Council Approves Digital Euro With ’Offline’ Mode — Is This the Privacy Breakthrough We’ve Been Waiting For?

The European Union just took a massive leap into the future of money. Its governing council has officially greenlit the framework for a digital euro, and it’s packing a feature that could change everything: offline functionality.

Spending Without a Trace (Almost)

Forget everything you thought about CBDCs being pure surveillance tools. This offline mode promises something radical—the ability to make small, peer-to-peer payments without an internet connection or an immediate central ledger record. It’s a direct nod to the cash-like privacy that citizens and critics have demanded. Transactions settle between devices, like passing a digital banknote, before syncing up later. The design aims to balance innovation with a fundamental right to financial anonymity.

The Fine Print and the Firewall

Don't start shredding your euros just yet. The ‘privacy’ comes with guardrails. Expect limits on offline holdings and transaction sizes to manage risk. And while the offline wallet might shield your coffee purchases from prying eyes, the system’s overarching architecture will still give authorities a macro-level view for things like anti-money laundering—because even in a digital future, regulators gotta regulate. It’s a classic EU maneuver: a bold technological step forward, wrapped in layers of compliance paperwork.

A Shot Across the Crypto Bow?

This move isn't happening in a vacuum. By baking in offline payments, the EU is directly co-opting a key perceived advantage of physical cash and even some cryptocurrencies. It’s a state-backed attempt to offer modern convenience without fully sacrificing a private sphere for small transactions. Whether it wins public trust remains the trillion-euro question. After all, convincing people to embrace a central bank digital currency requires selling them on both its utility and its restraint—a tough pitch in an era where financial institutions are about as trusted as a weather forecast.

The digital euro is now on the runway. It promises efficiency, innovation, and a sliver of hard-won privacy. But in the grand tradition of finance, it also offers a sleek new solution while quietly hoping you don't read all the terms and conditions.

Offline, Private, Digital: Is Europe Rebuilding Cash in Code?

A document released on Friday laid out the council’s stance, confirming that the digital euro would launch with both online and offline payment options.

EU officials say this two-track approach is meant to keep central bank money relevant as the economy becomes more digital while still preserving features traditionally associated with cash.

On the technical side, the European Central Bank has largely finished its groundwork after a two-year preparation phase that concluded in October 2025.

ECB President Christine Lagarde said last week that the technical work is done and that the next steps now depend on lawmakers.

![]() ECB President Christine Lagarde said that the digital euro is technically ready and is now awaiting legislative approval.#ECB #DigitalEuro #EUStablecoinhttps://t.co/4cdYV6UdSJ

ECB President Christine Lagarde said that the digital euro is technically ready and is now awaiting legislative approval.#ECB #DigitalEuro #EUStablecoinhttps://t.co/4cdYV6UdSJ

She added that political institutions will decide whether the European Commission’s proposal is adopted as written or changed.

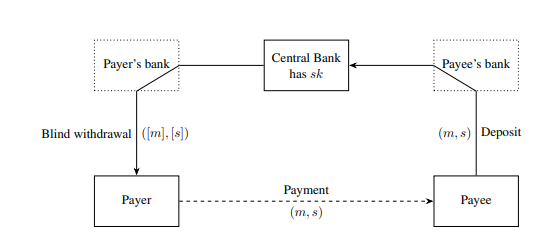

Much of the debate has focused on the offline option, which has raised privacy questions. Under the ECB’s design, offline payments would allow two users to exchange digital euro tokens directly between certified devices, such as smartphones or smart cards, with transaction details known only to the payer and payee.

Only the funding and defunding of the offline wallet would be recorded, a structure the ECB says offers a level of privacy comparable to cash for low-value payments.

Why the Digital Euro Can’t Fully Match Cash Privacy

At the same time, experts and regulators have acknowledged technical limits. The European Data Protection Board has warned that enforcing physical proximity in a digital system is difficult, as relay attacks could theoretically bridge near-field communication signals over the internet.

The board concluded that physical proximity, a defining feature of cash, cannot be reliably guaranteed in digital currency systems, even with safeguards in place.

As a result, the offline digital euro is described as highly private but not fully anonymous in the way physical cash is.

The online version is designed to support everyday digital payments, including e-commerce and remote transfers.

For these transactions, the ECB would see only pseudonymized data, meaning payments could not be directly linked to individuals.

Banks and other payment service providers would access only the information required to comply with EU anti-money laundering and counter-terrorism financing rules and would be barred from using payment data for commercial purposes without user consent.

Two Modes, One Goal: Inside the ECB’s Digital Euro Plan

ECB officials have stressed that the central bank has no interest in monetizing transaction data.

Beyond privacy, the two versions serve different practical roles. The offline digital euro is intended as a resilience tool, allowing payments to continue during network outages or power disruptions and supporting financial inclusion for people without reliable internet access.

The online version is meant to integrate with existing digital infrastructure, offering convenience, security, and compatibility with private payment services operating across the euro area.

The Council’s position also sets limits on how many digital euros individuals can hold to prevent large shifts of deposits away from commercial banks.

Fees for basic services would be prohibited for consumers, while additional services could carry charges.

The framework would also require device makers to grant payment providers fair access to hardware and software needed to support digital euro wallets.