Japan’s Largest Bitcoin Vault Now Issuing Dividend Shares to Investors

Japan's biggest Bitcoin holder is slicing its massive crypto treasury into dividend-paying shares—and opening the vault to outside investors.

From Cold Storage to Shareholder Payouts

The move transforms a colossal, static Bitcoin reserve into a tradable financial instrument. Investors no longer need to buy the underlying asset directly; they can buy a piece of the vault itself and receive a cut of its holdings. It's a classic Wall Street maneuver—securitize an asset, collect fees—just applied to the digital age's hardest money.

A Regulated Gateway to Crypto Yield

This isn't a shadowy fund operating in a regulatory gray area. The structure is built within Japan's stringent financial framework, overseen by the Financial Services Agency (FSA). That compliance badge offers institutional and retail investors a familiar, sanctioned path to Bitcoin exposure and potential yield—a rarity in many markets.

The Institutional Signal is Blaring

When the entity holding the most Bitcoin in a major G7 economy decides to financialize its stash, it's a statement. It signals that crypto's value proposition is maturing from pure price speculation to cash-flow generation and capital markets utility. Traditional finance is finally building bridges to the crypto fortress, not just staring at it from across the moat.

Forget mining rigs or trading fees—this is Bitcoin earning its keep by simply sitting there, now with a dividend wrapper. It's passive income, powered by proof-of-work. One cynical take? The finance industry never misses a chance to invent a new product to sell, even when the core asset was designed to bypass it.

2) Increase the total number of authorized… — Dylan LeClair (@DylanLeClair) December 22, 2025

The approvals included expanding authorized preferred shares to 555 million for both Class A and Class B structures, amending Class A shares to carry monthly floating-rate dividends under the MARS (Metaplanet Adjustable Rate Security) system, and authorizing the issuance of Class B preferred shares to overseas institutional investors.

Metaplanet Mirrors Strategy’s Dividend-Backed Bitcoin Funding Model

The MARS structure mimics Strategy’s STRC preferred stock, which launched in July and currently trades NEAR $98 with an annualized dividend of about 10.75%.

STRC’s dividend adjusts monthly to keep the stock near its $100 target price, reducing volatility while offering steady income to investors seeking Bitcoin exposure without direct equity risk.

Strategy has used STRC proceeds to fund bitcoin purchases, with about 21,000 BTC acquired from the program’s initial public offering alone.

Metaplanet’s Class A preferred shares will pay adjustable monthly dividends designed to deliver price stability, with rates rising when the stock trades below par and falling when it trades above.

Class B shares, branded “,” pay a quarterly dividend of 4.9% annually and offer the option to convert to common stock if Metaplanet’s share price triples from current levels.

The Mercury shares raised ¥21.25 billion ($135 million) in November through a third-party allocation to overseas institutional investors, with a conversion price set well above the prevailing market rate to limit near-term dilution.

![]() Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.#Metaplanet #Bitcoinhttps://t.co/pikptcs4nb

Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.#Metaplanet #Bitcoinhttps://t.co/pikptcs4nb

Back then, Gerovich stated the structure aims to “minimize dilution from common share issuances while continuing to expand BTC holdings,” calling it a “” the company’s Bitcoin treasury strategy.

The company also approved shifting capital stock and capital reserves to capital surplus, increasing capacity for preferred share dividends and potential share buybacks.

The Class B shares are subject to a 10-year 130% issuer call and include an investor put right, unless an initial public offering occurs within one year.

U.S. Trading Access Opens Through Sponsored ADR Program

The shareholder approvals followed Metaplanet’s launch of a Sponsored Level I American Depositary Receipt program, giving U.S. investors dollar-denominated access to the company’s equity under the ticker MPJPY.

Deutsche Bank Trust Company Americas serves as the depositary, while MUFG Bank acts as the custodian for the underlying shares in Japan.

Each ADR represents one ordinary Metaplanet share and trades on the U.S. over-the-counter market.

Gerovich said the ADR program “directly reflects feedback from U.S. retail and institutional investors seeking easier access to our equity.”

U.S. trading of Metaplanet ADRs begins December 19. Ticker: $MPJPY

This directly reflects feedback from U.S. retail and institutional investors seeking easier access to our equity. Another step toward broader global participation in Metaplanet. pic.twitter.com/XEvfAFw8Z3

The structure improves settlement efficiency, lowers transaction costs, and increases transparency for U.S. investors who face operational and regulatory hurdles when trading foreign-listed stocks directly.

Metaplanet’s shares previously traded in the U.S. under the symbol MTPLF, but that arrangement involved no formal agreement with a depositary bank and limited the company’s ability to provide consistent disclosures and investor support.

The ADR launch is not designed to raise capital and does not affect the number of issued common or preferred shares.

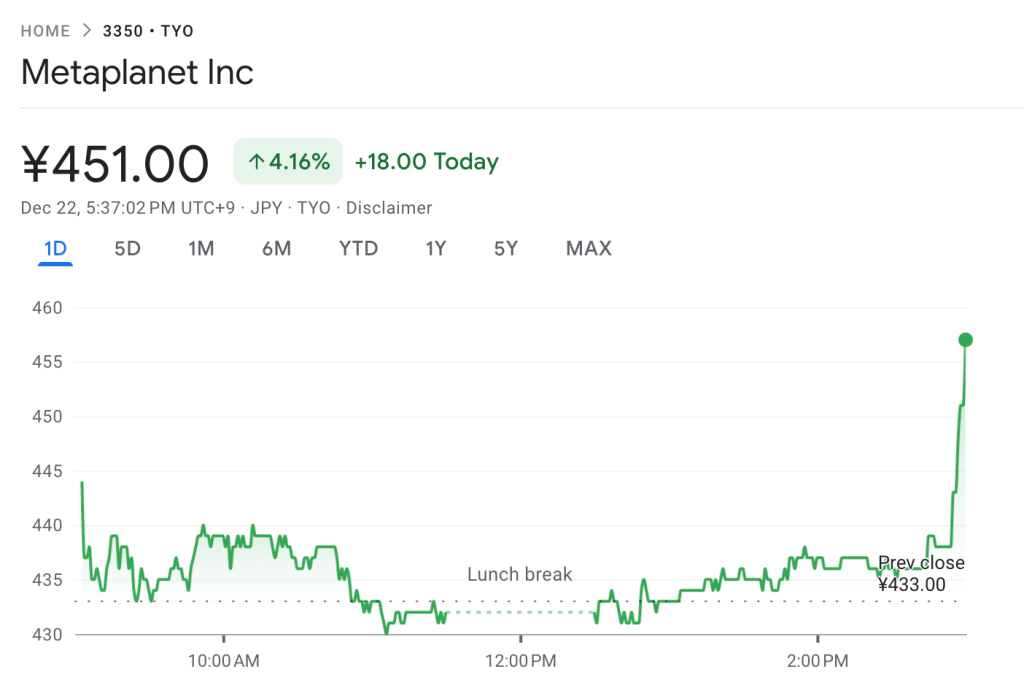

Notably, Metaplanet shares ROSE 4% today following the announcement, closing at 451 yen.

Metaplanet accumulated roughly 29,000 BTC in 2025 but paused purchases in late September amid volatility that pressured Bitcoin treasury companies.

The company also secured a $130 million loan in November backed entirely by Bitcoin under a $500 million credit facility, maintaining what it described as a sufficient collateral buffer even during periods of strong price volatility.