Poland Defies President, Pushes Crypto Bill Through Sejm Again — Will Restrictive Rules Hold?

Poland's parliament just doubled down on its crypto crackdown.

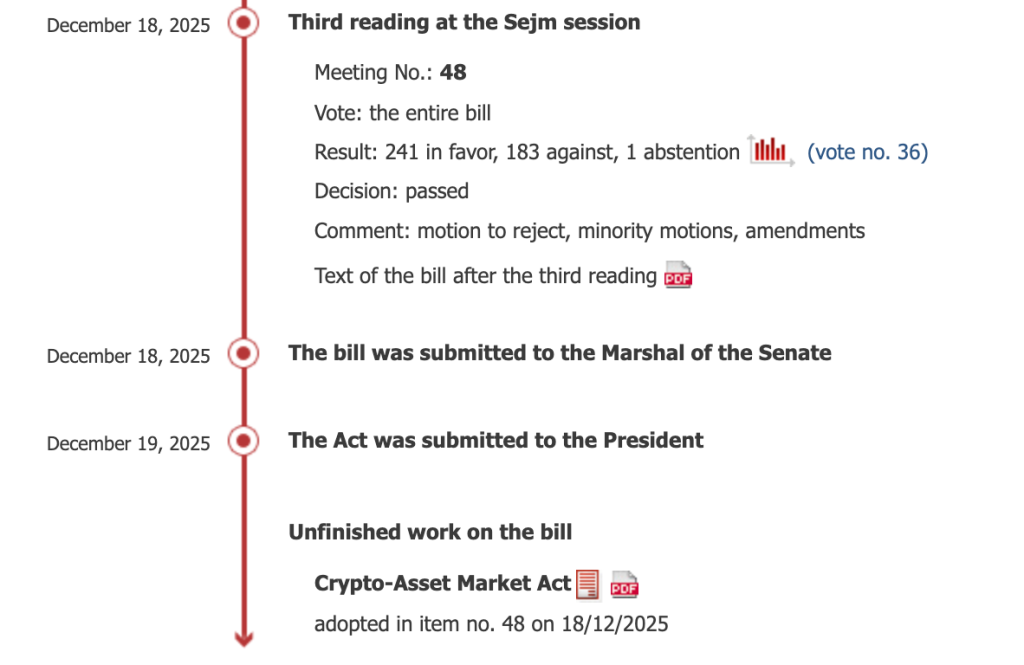

The Sejm has once again passed a controversial digital assets bill, directly challenging a presidential veto. This isn't a first draft—it's a defiant re-passage, signaling lawmakers are dead-set on implementing what the industry calls 'restrictive' oversight.

The Regulatory Standoff

Forget consensus-building. This is a legislative power play. The bill, which aligns Poland with the EU's Markets in Crypto-Assets (MiCA) framework, has cleared its final parliamentary hurdle for the second time. The president's objections? Overruled by sheer political will.

The core tension is classic: innovation versus control. The legislation mandates strict licensing for crypto firms, ramps up anti-money laundering (AML) protocols, and demands exhaustive reporting. Proponents hail it as necessary consumer protection. Critics see a straitjacket that could stifle a burgeoning sector and push talent—and capital—elsewhere.

Why This Time Might Be Different

Political momentum is a powerful force. By forcing the bill through again, the Sejm has shown its hand. The president now faces a constrained choice: promulgate the law or send it to the Constitutional Tribunal, kicking off a protracted legal battle with an uncertain outcome.

The clock is also ticking on MiCA compliance. Poland risks falling behind and facing EU scrutiny if it doesn't establish a national regulatory framework. This practical pressure may ultimately outweigh philosophical objections.

The Finance Sector's Cynical Wink

Let's be real—heavy-handed regulation often creates the very loopholes and offshore havens it seeks to eliminate. It's the financial world's oldest game: build a wall, and watch the architects of the best ladders get very, very rich.

Poland is at a crossroads. Will its rules become a model of secure, transparent crypto integration, or a case study in innovation flight? The bill is poised to become law. The real experiment—and its impact on wallets and startups—begins now.

Source: Sejm

Source: Sejm

The bill, which had previously been vetoed by Nawrocki, was forwarded to the Senate on Friday for further consideration.

Reintroduced Without Changes, Poland’s Crypto Bill Tests Presidential Limits

Lawmakers reintroduced the legislation without changes, despite the president’s earlier objections that it threatened civil liberties, property rights, and legal certainty.

The bill is designed to bring Poland’s crypto rules in line with the European Union’s Markets in Crypto-Assets Regulation, known as MiCA, which all member states must implement by July 2026.

Poland remains the only EU country that has not yet adopted a national framework to accompany the bloc-wide rules, a gap the government says has left the domestic market exposed to abuse and foreign interference.

The renewed vote follows weeks of political tension, as in December, Nawrocki vetoed the same legislation after it cleared both chambers of parliament.

Poland fails to override presidential veto on MiCA‑style crypto law, becomes the only EU state without formal crypto regulation

#Poland #MiCA https://t.co/31UF7UNNHd

They argued that it went beyond EU requirements and granted authorities overly broad powers, including the ability to block crypto-related websites through administrative orders.

At the time, lawmakers failed to secure the three-fifths majority needed to override his decision, forcing the government to restart the legislative process.

Poland’ Bill Tightens Grip on Crypto Firms

The legislation WOULD place crypto-asset service providers under the supervision of the Polish Financial Supervision Authority, or KNF.

Exchanges, custodians, and issuers would be required to obtain licenses, meet capital and compliance standards, and adhere to anti-money laundering rules.

The KNF would gain the power to impose fines of up to 10 million zlotys and, in serious cases, pursue prison sentences of up to five years.

Poland’s crypto-asset market bill advances to the Senate, introducing licensing, fines up to 10M PLN, and potential prison terms. #cryptobill #Polandhttps://t.co/a8R1O4iGBc

— Cryptonews.com (@cryptonews) September 29, 2025Critics across the political spectrum and within the crypto industry have warned that the framework is among the most restrictive in the EU.

Opposition lawmakers have pointed to the KNF’s average licensing timeline of around 30 months, the longest in the bloc, and argued that the rules could push firms to relocate to jurisdictions with lighter implementations of MiCA.

Poland’s President Faces Defining Choice on Contested Crypto Rules

Industry figures have said the bill risks disrupting a market estimated to serve about three million users in Poland.

Nawrocki, who took office in June after narrowly winning the presidency with 50.89% of the vote, previously aligned himself with industry concerns during the campaign.

![]() Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”#poland #cryptohttps://t.co/BVJXhQBnrK

Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”#poland #cryptohttps://t.co/BVJXhQBnrK

In a May post on X, he pledged that “no oppressive laws” would be imposed on the digital asset sector, saying Poland needed innovation rather than excessive regulation.

His office has since indicated openness to regulation in principle, provided it does not exceed EU standards. The government now suggests the standoff may be nearing its end.

A spokesperson said the president recently received a classified security briefing that gave him “full knowledge” of the bill’s implications, raising expectations in Warsaw that he may sign the law if it reaches his desk again.

If the Senate approves the measure without amendments, it will return to Nawrocki for a final decision.