Bitcoin’s Crash Dragged Trump-Crypto Reddit into the Red - New Research Reveals

When Bitcoin tanks, even political memecoins feel the heat. New research spotlights a surprising casualty of the latest crypto downturn: the online communities betting on a Trump-themed digital asset revival.

The Symbiotic Slide

Forget insulated niches. The data shows a lockstep plunge—Bitcoin's sell-off triggered a parallel collapse in engagement and sentiment across pro-Trump cryptocurrency forums. It wasn't just portfolios bleeding red; it was entire subreddits.

Narrative vs. Network

Proponents pitch these assets as decoupled from traditional crypto cycles, powered purely by political sentiment. The market's brutal logic begged to differ. When Bitcoin sneezes, the whole digital asset ecosystem still catches a cold—political fervor be damned. It's the oldest story in finance, dressed in new tokens: everything's correlated when panic hits.

A Reality Check for Speculative Fever

This episode serves as a cold splash of water. It underscores that in crypto, technological promise and community hype often bow to the king: market-wide liquidity and risk appetite. The 'Trump trade' in digital assets proved to be just that—a trade, vulnerable to the same herd instincts that wipe out gains across the board. Maybe the only 'stablecoin' in politics is the unwavering predictability of a market punishing unfounded optimism.

A Community Split, but Slightly Pessimistic

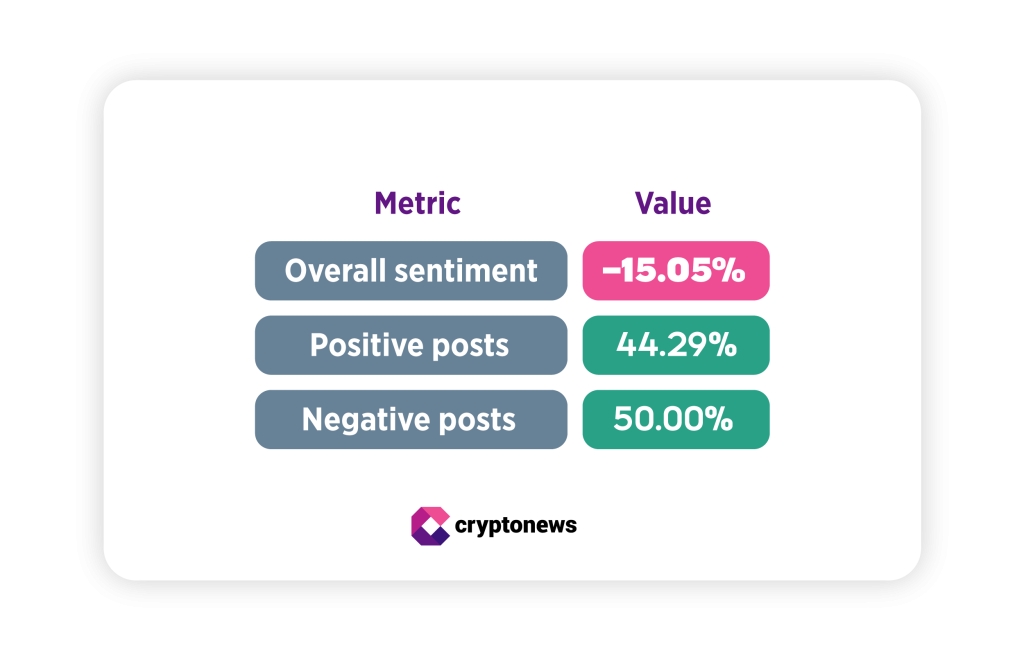

Across the full dataset, Reddit sentiment toward TRUMP and crypto was not one-sided. About, while, with the rest neutral.

However, once engagement was factored in — meaning posts with more upvotes and comments carried more weight — the overall sentiment score dropped to, indicating a mildly pessimistic tone. In other words, negative posts were fewer in number but louder and more influential. In particular, one extremely negative meltdown thread (originally shared on X) during the bitcoin crash drew outsized engagement and pulled the overall score lower, even though nearly half of all posts were positive.

The crypto collapse:

On October 6th, just 45 days ago, Bitcoin hit a record high of $126,272, worth $2.5 trillion.

Then, something "mechanical" seems to have shifted on October 10th, after President Trump threatened 100% tariffs on China.

Not only did this lead to the record… pic.twitter.com/vrcYqemoTE

Sentiment Tracked Bitcoin’s Market Moves — Almost Perfectly

When sentiment is viewed on a week-by-week basis, changes in tone appear to broadly track market conditions over the period.

The timing suggests that shifts in Reddit sentiment around Trump and crypto may have followed Bitcoin’s market moves, with negativity peaking during the market sell-off and easing as prices stabilized. Put simply, when Bitcoin sold off, Trump-linked crypto discussions on Reddit appeared to turn sharply negative as well.

What Happens When Trump Is Removed from the Picture

To understand whether this negativity was about crypto itself or about Trump, we ran the same analysis on general crypto posts that did not mention Trump.

Without Trump, overall crypto sentiment turned, with an average score of. Positive posts made up about, while negative ones fell to. The most viral post in this dataset was strongly bullish, not fearful.

That does not mean general crypto discussions ignored the crash. Sentiment still dropped during Week 3, falling from positive territory into the negative. But the decline was milder than in the Trump-related dataset.

How We Did the Research

We analyzed more than 400 Reddit posts published between November 3 and December 2, 2025. Each post was scored by a sentiment model on a scale from –1 (very negative) to +1 (very positive). Posts with more engagement — upvotes and comments — were weighted more heavily, since they shape what most users actually see.

Weekly and monthly sentiment scores were calculated by averaging these weighted results and rescaling them to a –100 to +100 range. We then compared Trump-related crypto discussions with general crypto posts to see how sentiment differed during the same market events.