MSCI Index Shakeup Threatens $15B Crypto Treasury Exodus

Index providers are moving the goalposts—and billions in corporate crypto holdings might get caught offside.

The Compliance Carousel Spins Again

Forget market sentiment or technical analysis. The real volatility driver this quarter could be a spreadsheet update from a major index compiler. New eligibility rules are on the horizon, and they don't play nice with digital assets on corporate balance sheets. It's the kind of dry, procedural change that makes traders' eyes glaze over—right before it liquidates positions.

A $15 Billion Question Mark

The math is simple and brutal. Apply the potential new filters to current treasury holdings, and you get a staggering figure. We're talking about a forced sell-off in the realm of fifteen billion dollars. That's not panic selling; it's automated, institutional portfolio rebalancing on a scale the crypto market has never absorbed at once. Liquidity will be tested.

The Great Unwinding

This isn't about belief in the technology. Fund managers bound by index mandates won't have a choice. If an asset falls out of the benchmark, it gets sold. Period. The process would be methodical, cold, and entirely divorced from the asset's fundamentals or future potential. It's finance in its purest, most cynical form: a rules-based purge that treats Bitcoin and a poorly performing stock exactly the same.

Watch the gatekeepers, not the charts. Sometimes the biggest market moves come from a committee meeting in a glass-walled office, not a whale on a trading floor. Just another reminder that in traditional finance, innovation often meets its match in a compliance manual.

Source: BitcoinForCorporation

Source: BitcoinForCorporation

The consultation closes December 31, with a final decision expected January 15, 2026, targeting firms whose digital asset holdings exceed 50% of total assets, with implementation scheduled for February’s Index Review.

Strategy Inc. formally challenged the proposal in a December 10 letter, signed by Executive Chairman Michael Saylor and CEO Phong Le, calling the move “” and “” to capital markets and U.S. digital asset leadership.

The company argued that the proposal conflicts with the current administration’s pro-innovation digital asset agenda, including initiatives such as a StrategicReserve and efforts to expand retirement plan access to digital assets.

Operating Companies Face Investment Fund Classification

Strategy’s Core argument centers on distinguishing operating businesses from passive investment vehicles.

The company emphasized that it runs a Bitcoin-backed corporate treasury and capital markets program, issuing equity and fixed-income instruments with varying levels of Bitcoin exposure.

BitcoinForCorporations’ technical analysis demonstrates MSCI’s proposal violates CORE benchmark principles of representativeness, neutrality, and stability under IOSCO and BMR standards.

We spell out the potential implications of MSCI's proposed 50% DAT exclusion rule: https://t.co/ceJZU0dRTP pic.twitter.com/5CixFrEYVR

— George Mekhail (@gmekhail) December 17, 2025The group notes that MSCI has historically included REITs despite their 75% real estate concentration, Berkshire Hathaway, with its large investment portfolio, and mining companies holding substantial Gold reserves.

Yet, it has never excluded operating companies based on their treasury asset composition.

Strategy warned MSCI’s 50% threshold is arbitrary, noting crypto volatility and divergent accounting standards could cause companies to “” indices as valuations fluctuate.

Industry Coalition Challenges Methodology

Strive Asset Management also submitted opposition on December 6, with CEO Matt Cole arguing that the proposal misunderstands the role of Bitcoin-focused firms in AI infrastructure.

Miners, including MARA Holdings, Riot Platforms, and Hut 8, are retooling data centers for high-intensity AI workloads. “Many analysts argue that the AI race is increasingly limited by access to power, not semiconductors,” Cole wrote.

Strive proposed a parallel “ex-digital asset treasury” index version, allowing selective avoidance while maintaining full market exposure for others.

For now, BitcoinForCorporations’ petition opposing the exclusion has gathered over 1,000 signatures, while Bitwise Asset Management has also voiced its support for the strategy, arguing “.”

Bitwise supports @Strategy inclusion in MSCI's Global Investable Market Indexes. https://t.co/TXtKb8SvAN pic.twitter.com/sOa4v6sCyh

— Bitwise (@BitwiseInvest) December 11, 2025Financial Impact Analysis Reveals Concentrated Risk

Before now, JPMorgan analysts have previously estimated that Strategy alone could face $2.8 billion in outflows, with $9 billion of its market capitalization held by passive funds.

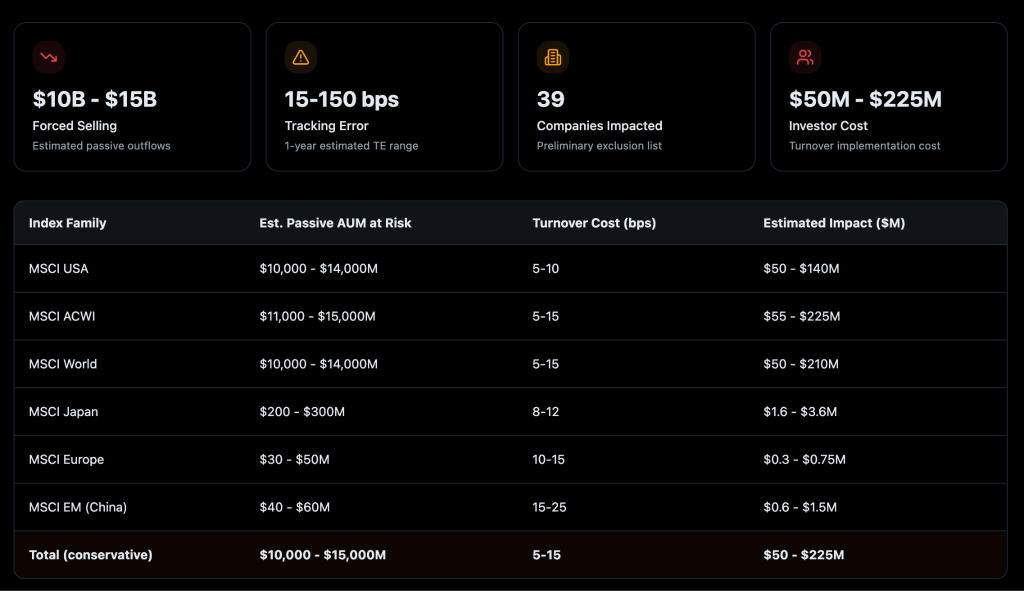

BitcoinForCorporations’ analysis projects total forced selling between $10 billion and $15 billion, with tracking error ranging from 15 to 150 basis points, depending on volatility, particularly harmful to institutional mandates with 20 to 50 basis point tracking tolerances.

The preliminary list includes 18 current constituents representing $98 billion in float-adjusted market capitalization facing immediate removal, accounting for 87% of total capital impact.

An additional 21 non-constituents, worth $15 billion, face permanent exclusion, representing massive pre-emptive blocking in MSCI’s methodology. Strategy accounts for 74.5% of the total impacted market cap at $84.1 billion.

Implementation costs are estimated between $50 million and $225 million across index families, with turnover costs ranging from 5 to 25 basis points. The MSCI ACWI faces the highest estimated impact, ranging from $55 million to $225 million.

Speaking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, explained that markets are pricing in potential forced flows.

“The market is assessing not only the likelihood of a decline in stock prices of companies whose balance sheets are tied to Bitcoin’s movements, but also potential chain reactions within funds using these indices as benchmarks,” Ehsani said.

Affected companies collectively hold over $137 billion in digital assets.

The industry awaits MSCI’s January 15 decision. Strategy urged MSCI to reject the proposal, stating “the wiser course is for MSCI to remain neutral and let the markets decide the course of DATs.“