Binance Cleans House: New Listing Criteria Expose Blacklisted “Deal Brokers”

Binance just slammed the door on backroom deals. The exchange's new, stricter listing criteria are designed to flush out the shadowy middlemen who've long operated in the gray areas of crypto project onboarding.

The New Gatekeepers

Forget the old whispers and handshake agreements. Binance is now demanding full transparency. Projects must disclose all third parties involved in their listing process, with any undisclosed intermediaries facing immediate blacklisting. It's a direct shot at the so-called 'deal brokers' who promised access for a hefty fee.

Why the Crackdown?

This isn't just about cleaning up appearances. Opaque listing practices open the door to market manipulation, insider trading, and projects that prioritize connections over code. By cutting out these unvetted brokers, Binance aims to protect its users—and its own reputation—from the pump-and-dump schemes that give the whole industry a black eye. It's a move that, ironically, makes the wild west of crypto look a bit more like the regulated traditional finance it often mocks.

The Ripple Effect

The immediate impact? A chilling effect on the underground brokerage market. Long-term, it raises the bar for every project dreaming of a Binance listing. Merit, liquidity, and a legitimate user base become the real currency, not a well-connected fixer. Some will call it censorship; others will see it as the maturation the sector desperately needs. One thing's clear: the easy backdoor is now firmly shut.

New Listing Standards Aim to Boost Visibility and Quality on Binance

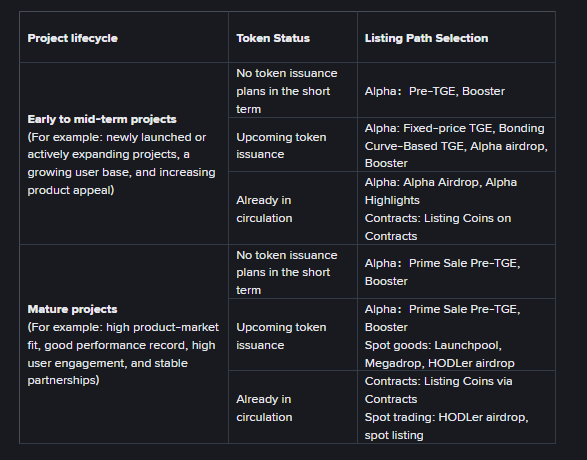

According to Binance, the new listing criteria cover the Alpha, futures, and spot markets and are designed to create a more structured and transparent framework for projects seeking exposure on the platform.

Binance’s Alpha platform targets early-stage tokens, providing distribution opportunities through Pre-TGE, Prime Sale, TGE community events, airdrops, and Booster programs, helping projects gain momentum before full market launches.

Binance’s contract platform allows users to access derivatives to hedge positions, establish long or short trades, or manage liquidity, while the spot platform remains the largest venue for direct trading and long-term holding of high-quality crypto assets.

The exchange also provides mechanisms like Launchpool, Megadrop, and HODLer airdrops to increase visibility for new projects, particularly those that have demonstrated progress, strong teams, and active communities.

Binance currently records $11.13 billion in 24-hour trading volume, reflecting a 28.2% decline over the same period. The exchange supports 441 listed coins across 1,638 trading pairs.

Binance Overhauls Listing Process After Criticism of Speculative Tokens

The new standards address several challenges Binance has faced over the past two years.

The exchange had previously announced token listings only hours before trading commenced, a practice that often caused price spikes on decentralized exchanges followed by rapid sell-offs on Binance itself, creating volatility that hurt late entrants.

Binance also confronted criticism for listing speculative or low-quality projects that failed to deliver long-term value, contributing to market losses and investor distrust.

Additionally, third-party intermediaries claiming to guarantee listings had become a major source of scams, misleading project teams and creating confusion around the legitimate application process.

These changes follow longstanding concerns expressed by Binance founder Changpeng Zhao, who in February 2025 described the listing process as flawed.

![]() CZ criticized Binance’s listing process, calling it a “bit broken.”#ChangpengZhao #Binance #TSTMemecoinhttps://t.co/y3o2rT6RPJ

CZ criticized Binance’s listing process, calling it a “bit broken.”#ChangpengZhao #Binance #TSTMemecoinhttps://t.co/y3o2rT6RPJ

Zhao noted that the short interval between listing announcements and actual trading created opportunities for rapid price manipulation and undermined confidence in the process.

Binance has since moved to introduce more structured due diligence, community co-governance voting for listing and delisting tokens, and a monitoring zone for projects that fail to meet ongoing reporting or activity requirements.

Community members can vote on whether projects should remain listed, adding a LAYER of public oversight.

Crypto Founders Raise Concerns About Binance’s Listing Requirements

The overhaul also comes amid high-profile controversies surrounding listing practices.

In October, CJ Hetherington, founder of the prediction market startup Limitless, claimed that Binance demanded 8% of his project’s token supply plus $2 million in additional payments to secure a listing and alleged that the exchange engaged in token “dumping” post-listing.

![]() CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it#ChangpengZhao #Opinionhttps://t.co/T0mbuyxHnA

CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it#ChangpengZhao #Opinionhttps://t.co/T0mbuyxHnA

Binance initially responded with threats of legal action, labeling Hetherington’s posts “false and defamatory,” though the company later acknowledged some of the details regarding token allocations.

Binance maintains that it does not profit directly from listing fees, asserting that allocated tokens are used for marketing, airdrops, and other initiatives that benefit users, rather than the exchange itself.

Despite the controversies, many crypto founders still view a Binance listing as highly desirable, given the exposure and liquidity the platform provides, though some have criticized the process as “predatory” or overly complex.