Bhutan’s $1 Billion Bitcoin Bet: Building a ’Mindfulness City’ Without Selling a Single Satoshi

Bhutan just rewrote the sovereign wealth playbook. The Himalayan kingdom is channeling a cool billion from its Bitcoin treasury into a futuristic 'Mindfulness City'—and it's doing it without touching its core reserves. This isn't a sale; it's a strategic deployment.

The Bitcoin-Backed Blueprint

Forget bonds and bullion. Bhutan is leveraging its digital gold stash as foundational capital. The plan? Use the asset's value to secure financing and kickstart a massive geo-economic project. It's a masterclass in treating Bitcoin not as a speculative toy, but as sovereign-grade collateral on the national balance sheet.

Collateral, Not Cash-Out

The key move here is what they're *not* doing. No mass offloading onto exchanges. No panic selling to fund the budget. Instead, they're using their Bitcoin holdings as a financial lever—borrowing against an appreciating asset to build tangible, long-term infrastructure. It’s the kind of move that makes traditional finance ministers, still obsessed with negative-yielding bonds, look positively medieval.

A New Model for National Treasuries

This pivot signals a profound shift. A nation is actively building its future using crypto-native finance, bypassing the traditional debt markets entirely. It proves Bitcoin's utility extends far beyond the trading screen—it's becoming a cornerstone of sovereign economic strategy. One cynical take? It’s a more sophisticated wealth management plan than most hedge funds have managed in a decade.

Bhutan isn't just building a city. It's building a case study. The world is watching to see if a billion dollars in Bitcoin can literally lay the foundation for a new economy—mindful, modern, and financially sovereign.

Source: Breathe Bhutan

Source: Breathe Bhutan

Sovereign Mining and Clean Energy Foundation

Bhutan ranks as the world’s fifth-largest government bitcoin holder, having mined 13,011 BTC since 2021 using surplus hydroelectric power from Himalayan rivers.

The renewable energy-powered mining operation converts excess national grid capacity into digital assets without additional environmental impact, with crypto holdings now exceeding 11,286 BTC, valued at $1.28 billion, according to Bitbo data.

The Kingdom’s hydroelectric resources at times exceed domestic demand, enabling clean energy to be converted into long-term national assets through the national power generation utility.

This mining strategy accounts for over 25% of Bhutan’s GDP while maintaining environmental sustainability commitments central to the nation’s development philosophy, which balances economic progress with ecological stewardship.

The Kingdom established Green Digital Ltd through GMC to develop blockchain infrastructure and, recently, partnered with Cumberland DRW on digital asset trading frameworks, sustainable mining expansion, AI compute facilities, and national stablecoin development.

Gelay Jamtsho, Green Digital chairman, said the collaboration connects Bhutan’s renewable energy infrastructure with institutional-grade liquidity to support the country’s diversification agenda beyond traditional economic sectors.

Blockchain Integration Across National Systems

Beyond mining, Bhutan has deployed blockchain-based national identity systems serving 800,000 citizens on ethereum after migrating from Polygon, with the transition completed in October, enabling Verifiable Credentials and digital signing capabilities.

Prime Minister Tshering Tobgay said leveraging Ethereum’s globally distributed network strengthens the security, transparency, and resilience of digital infrastructure serving nearly the entire population.

![]() Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain.#Bhutan #EthereumBlockchain #BhutanNDIhttps://t.co/GxMSpUcuN3

Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain.#Bhutan #EthereumBlockchain #BhutanNDIhttps://t.co/GxMSpUcuN3

Back in May, the Kingdom enabled crypto payments across tourism merchants through partnerships with DK Bank and Binance Pay, allowing visitors to use over 100 cryptocurrencies for everything from airline tickets and hotel stays to roadside fruit stalls.

Over 100 local merchants now accept digital assets, with Damcho Rinzin, tourism director, describing the system as advancing innovation and inclusion while supporting sustainable development goals.

Most recently, Bhutan launched TER, a Solana-based token backed by physical Gold reserves distributed through DK Bank, positioning the nation among the few experimenting with state-backed tokenized assets.

Mindfulness City as Economic Catalyst

Gelephu Mindfulness City operates as a Special Administrative Region designed to attract international capital through regulatory clarity and modern financial connectivity while preserving cultural values.

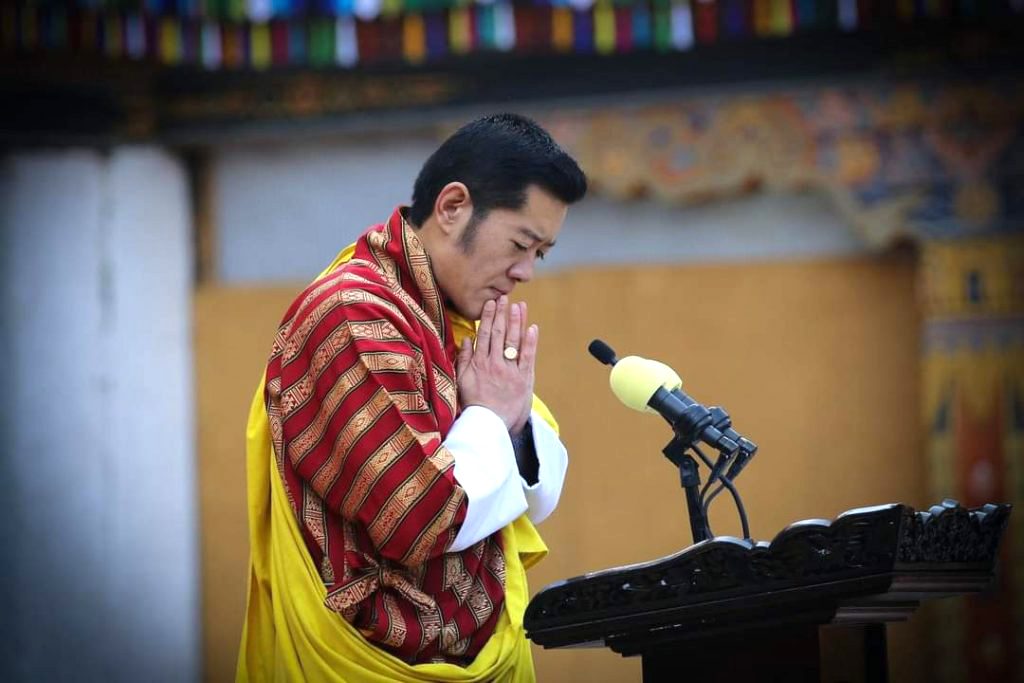

King Jigme Khesar Namgyel Wangchuck framed GMC as a shared national enterprise in which citizens function as stakeholders, with new land policies ensuring that Bhutanese from all regions benefit from development proceeds, since most acreage remains state-owned.

“As your King, I must ensure that every Bhutanese is a custodian, stakeholder, and beneficiary of GMC,” the monarch said. “Think of GMC as a company and landowners as its shareholders.“

Market Outlook Supports Strategic Holding

Bitcoin traded at $87,274 today, up 1.9% in Asian hours as exchange reserves hit record lows and traders awaited US inflation data.

Major asset managers, including Bitwise and Grayscale, project that Bitcoin will exceed its previous all-time highs in 2026, despite traditional cycle theory predicting corrections, as institutional capital inflows through platforms like Morgan Stanley and Wells Fargo accelerate adoption.

![]() Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.#Bitcoin #Bitwise #Grayscalehttps://t.co/mL6smmtfjl

Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.#Bitcoin #Bitwise #Grayscalehttps://t.co/mL6smmtfjl

Bhutan’s pledge aligns with the growing sovereign and corporate adoption of digital assets, as global crypto ETPs have attracted $87 billion in net inflows since US products launched in January 2024.