XRP Plunges to Weekly Low Amid Market Rout – Is This the Start of a Bear Market?

XRP just hit its lowest point in a week, dragging down with it a sea of red across the crypto board. The sudden drop has traders scrambling and one question echoing through every chatroom: is the party over?

The Fear Gauge Spikes

Forget gentle corrections—this felt like a trapdoor opening. The sell-off wasn't isolated to XRP; it was a broad-based retreat that wiped out gains and tested key support levels. Liquidity vanished faster than a meme coin's promises, leaving charts looking more like cliff faces.

Decoding the Drop

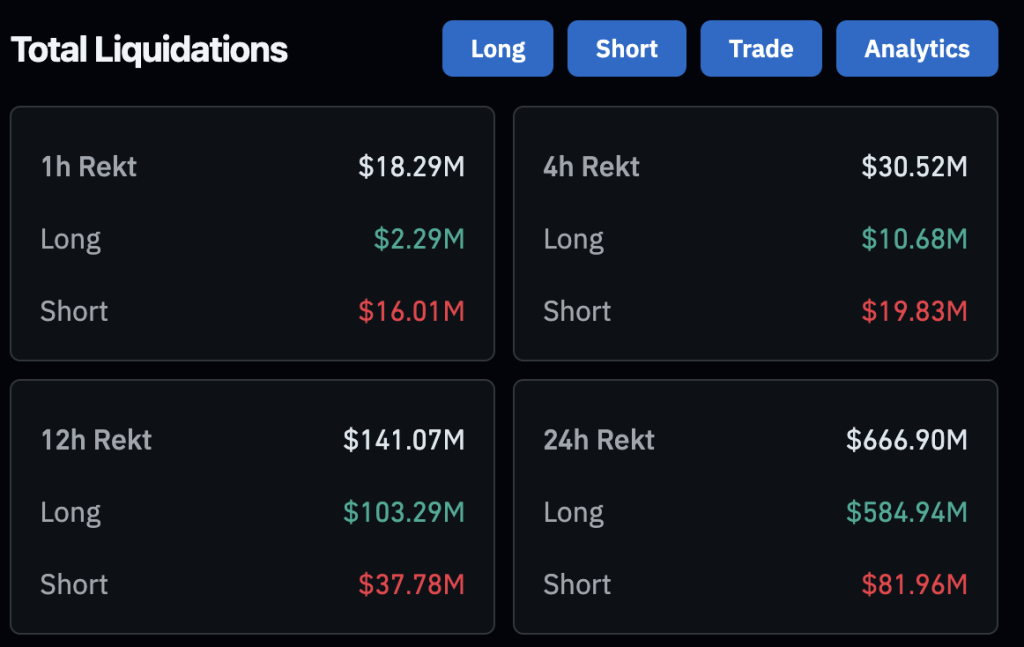

So, what triggered the plunge? Analysts are pointing to a perfect storm: overheated leverage getting flushed, macro jitters seeping in from traditional markets, and that old crypto favorite, a wave of profit-taking. It's the market's way of a brutal, real-time stress test—one that many portfolios failed spectacularly.

Bear Market or Just a Breather?

Calling a full-blown bear market after one bad week is like declaring bankruptcy after a single expensive dinner—it's dramatic, but probably premature. True bear markets are defined by sustained downtrends and broken fundamentals, not just a volatility spike. This could simply be the market taking a painful, but necessary, pit stop.

Remember, in crypto, the line between 'healthy pullback' and 'the beginning of the end' is often drawn with the benefit of hindsight—and usually by the same people who didn't see the drop coming. The only certainty? Volatility never takes a vacation.

The market had been finding support at this key psychological price level for days, but buying interest was weak and failed to ignite a rally despite efforts by bulls to defend this zone.

Trading volumes have doubled in the past day as well, currently standing at $3.9 billion. This implies strong selling pressure following this bearish breakout.

Despite the drop, XRP-linked exchange-traded funds (ETFs) have attracted positive net inflows for 21 consecutive days now, reflecting strong interest from institutional buyers and long-term holders in the regulated markets.

XRP Price Prediction: Break Below $1.86 Could Result in Another 10% Drop

Heading to the charts, the 4-hour time frame shows that a break below the $2 level with strong volumes occurred yesterday.

This quickly triggered a stronger drop toward the next area of support at $1.86.

Bulls are now trying to defend this mark as a move below could result in a drop to the token’s October 10 lows of $1.58. This translates into a downside risk of 10% in the NEAR term.

Notably, however, the Relative Strength Index (RSI) has hit extreme oversold levels at 21.5 in this lower time frame. The last two times this has happened, the price recovered slightly.

However, a break below $1.86 WOULD mean that the market is ready to resume its downtrend.

As well-established tokens like XRP struggle to recover, investors may find better opportunities in top crypto presales, such as Maxi Doge ($MAXI).

The meme coin has raised over $4 million, with many analysts comparing it to the early days of Dogecoin.

Maxi Doge ($MAXI) Brings Doge’s Viral Energy to the Trading Community

Inspired by the viral Doge meme, Maxi Doge ($MAXI) is a hyped-up character that embodies the energy that comes with bull markets.

$MAXI holders gain exclusive access to an idea hub, where they can,and.

$MAXI holders can prove their abilities to the community through fun competitions like Maxi Ripped and Maxi Gains, showcasing their ROI to earn attractive rewards and bragging rights.

Pumped by Red Bulls and eager to leave mom’s basement, like so many ‘degens’ are, this project embraces the “up only” culture that has made retail traders a recognizable force in today’s markets.

To get involved, simply head to the official Maxi DOGE website and link up your wallet (e.g. Best Wallet) to get started.

You can swap USDT or ETH or use a traditional bank card to buy $MAXI tokens.

Visit the Official Maxi Doge Website Here