Grayscale’s Bold Forecast: Bitcoin to Shatter Records with New All-Time High by Early 2026

Another day, another price target from the big players. This time it's Grayscale stepping up with a timeline that's got the crypto crowd buzzing.

The Institutional Crystal Ball

Forget tea leaves—asset managers now run the numbers. Grayscale's analysis points to early 2026 as the moment Bitcoin finally punches through its previous ceiling. They're not whispering it; they're putting it in reports that land on institutional desks.

Timing the Cycle

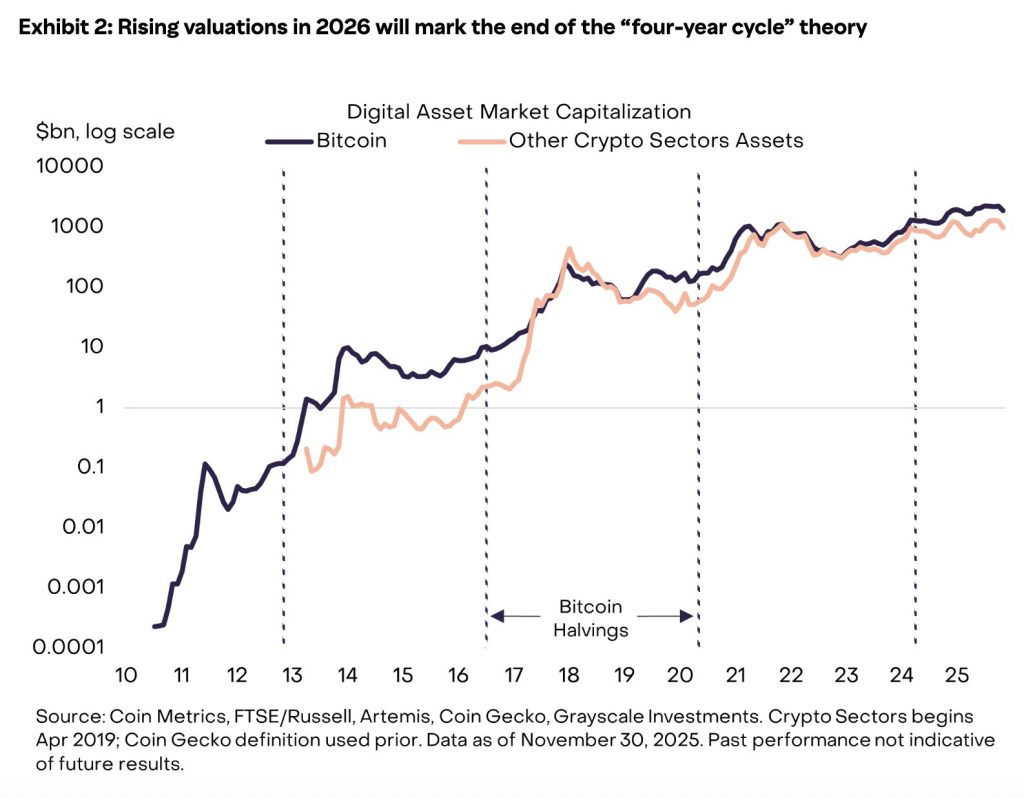

Market cycles have a rhythm, and the prediction hinges on that beat. The early 2026 target isn't pulled from thin air—it aligns with historical post-halving momentum and the gradual digestion of macro pressures. It's a bet on pattern recognition over panic.

The Mechanics of a Breakout

What gets us there? Scarcity's already baked in. The real thrust will come from a cocktail of continued institutional adoption, regulatory clarity that doesn't strangle innovation, and that old crypto standby: a wave of new retail interest once prices start moving. The infrastructure, from ETFs to custody, is now in place to handle the flow.

A Dose of Street Skepticism

Let's be real—forecasting is the finance industry's favorite parlor trick. For every precise prediction, there's a hedge fund manager quietly adjusting their model. But when a firm with Grayscale's skin in the game talks timeline, it's worth noting. They have a vault to fill, after all.

The countdown to 2026 is on. Whether this forecast hits or joins the pile of missed targets, one thing's certain: the market will be watching every tick.

Image Source: Grayscale

Rising Debt And Inflation Fears Drive Demand For Scarce Crypto Assets

Crypto has already grown from a niche experiment to what Grayscale calls a mid-sized alternative asset class, with millions of tokens and roughly $3T in combined market value.

Bitcoin and Ether sit at the Core of that universe as scarce digital commodities and alternative monetary assets. Grayscale says rising debt and inflation worries will keep portfolio demand for such assets growing as investors look for ballast against fiat currency debasement.

Supply dynamics are part of the story. Bitcoin’s issuance rate has dropped below 1% and the 20 millionth coin is expected to be mined in March 2026. In Grayscale’s view, that kind of transparent, capped supply looks increasingly attractive as fiscal imbalances mount, and it expects investors to treat BTC and ETH more like strategic holdings than short-term trades.

2026 may be the year digital assets enter their institutional era.

Grayscale believes macro tailwinds and regulatory clarity will drive demand for scarce assets like $BTC & $ETH.![]()

![]() https://t.co/ReaqqGksni

https://t.co/ReaqqGksni

Regulation is the other pillar. The firm notes that in recent years US authorities pursued investigations or lawsuits against many major crypto companies, but says that posture has started to shift.

Bipartisan Legislation Expected To Cement A Clear US Crypto Rulebook

Court wins opened the door to spot exchange traded products, Bitcoin and Ether ETPs launched in 2024, and the GENIUS Act on stablecoins passed in 2025. Grayscale now expects bipartisan crypto market structure legislation to become law in 2026, giving the industry a clearer rulebook and deeper access to capital markets.

Spot ETPs are already pulling money in. Since US bitcoin products debuted in Jan. 2024, global crypto ETPs have seen about $87B in net inflows, according to the report.

Even so, Grayscale estimates that less than 0.5% of US-advised wealth is allocated to crypto, leaving plenty of room for slow-moving institutional capital to come in as platforms complete their due diligence and add tokens to model portfolios. Early adopters include names such as Harvard Management Company and Abu Dhabi’s Mubadala.

That institutional tilt has also changed how Bitcoin trades. Previous bull runs saw 1,000% plus gains over a single year. This cycle’s maximum year-over-year increase, around 240% into March 2024, is far tamer.

Grayscale reads that as a sign of steadier buying from large pools of capital instead of a one off retail melt up, and it sees a relatively low chance of a deep, prolonged drawdown in 2026.

Grayscale Maps 10 Themes Shaping Digital Assets In The Year Ahead

Macro policy could add fuel. The last two major cycle peaks arrived while the Federal Reserve was raising rates. This time, the Fed cut three times in 2025 and is expected to continue easing next year.

Kevin Hassett, seen as a contender to replace Jerome Powell as chair, recently said President TRUMP will choose someone who helps Americans get cheaper car loans and easier access to mortgages at lower rates. Grayscale argues that a growing economy and broadly supportive Fed stance would align with stronger appetite for risk assets, including crypto.

Around that CORE view, the firm maps ten big themes it thinks will drive digital assets in 2026, from dollar debasement and regulatory clarity to the expansion of stablecoins under the GENIUS Act, asset tokenization, privacy tooling, the intersection of AI and blockchains, faster DeFi lending, next generation infrastructure and default staking in proof of stake networks.

It expects investors to favour tokens with clear use cases, measurable revenue and access to regulated venues.

Two hot talking points do not make Grayscale’s main list. The report argues that quantum computing risk is real but still too distant to MOVE prices next year, and that digital asset treasuries, despite owning chunks of BTC, ETH and SOL, are unlikely to drive major waves of forced selling or new demand in 2026.

Taken together, the outlook paints 2026 as the dawn of what Grayscale calls crypto’s institutional era, one where the story is less about halving folklore and more about regulation, macro hedging and steady flows from traditional portfolios.

In that world, it says, new highs for Bitcoin look more like a base case than a stretch target.