Digital Asset ETPs Surge: $716M Floods In as Bitcoin, Ethereum, and XRP Lead Weekly Rally

Institutional money is charging back into crypto—and it's picking the usual winners.

The $716 Million Signal

Forget the noise. The real story isn't on social media; it's on the balance sheets of exchange-traded product providers. A fresh wave of capital, totaling $716 million, poured into digital asset ETPs last week. That's not retail FOMO—that's a calculated move by funds and institutions deciding the dip was a buying opportunity. It's the kind of vote of confidence that makes crypto skeptics in traditional finance shift uncomfortably in their leather chairs.

The Big Three Command the Flow

As usual, the lion's share of the action centered on the established giants. Bitcoin, the digital gold narrative firmly intact, soaked up the bulk of the inflows. Ethereum followed, with investors seemingly betting on its ecosystem's staying power beyond just speculative fuel. Then there's XRP, the perennial controversial asset, still managing to pull in significant institutional interest week after week—proving that in crypto, legal battles don't necessarily scare away money, they just create a different kind of risk premium.

This pattern reinforces a not-so-subtle truth in the institutional playbook: when in doubt, stick with liquidity and name recognition. It's a strategy as old as finance itself, just applied to a new asset class. The altcoin crowd might dream of disruption, but big money still loves a blue-chip—even if it's a digital one.

What the Flows Really Mean

This isn't just a bullish data point; it's a mechanism. Every dollar that enters a Bitcoin or Ethereum ETP typically requires the issuer to purchase the underlying asset, creating direct buy-side pressure on the spot markets. It's a virtuous cycle for prices: inflows beget buying, which begets price stability or gains, which begets more inflows. Meanwhile, traditional portfolio managers can now check their 'crypto exposure' box without ever touching a private key—a convenience that's apparently worth a $716 million weekly premium.

The trend highlights a maturation, or perhaps a sanitization, of crypto investment. The wild west of ICOs and meme coins exists in parallel, but the serious capital is building positions through regulated, familiar vehicles. It's a tacit admission that for all the talk of decentralization, the old financial world's infrastructure is still the preferred on-ramp for big bucks.

So, while crypto Twitter debates the next micro-cap moonshot, the smart money is quietly accumulating the majors through the front door. It's a reminder that in the long game, liquidity and legitimacy often trump pure technological promise. After all, Wall Street's embrace of crypto was never about the ideology—it was always about finding a new, uncorrelated asset to fee. Some things never change.

Investor Confidence Gradually Improves

CoinShares noted that digital asset funds have now posted their third consecutive week of modest inflows, reflecting what it described as a “cautious yet increasingly optimistic” investor base.

This comes despite mixed price performance following the US Federal Reserve’s recent interest rate cut, with post-decision trading marked by uneven flows and divergent sentiment across assets.

Total inflows across digital asset investment products reached $864 million over the broader reporting period, underscoring continued demand even as macro uncertainty persists. CoinShares said the data suggests investors are selectively increasing exposure rather than making broad risk-on bets.

US Dominates Regional Inflows

Inflows were broad-based geographically but heavily concentrated in a handful of markets. The United States led by a wide margin, accounting for $483 million of weekly inflows, followed by Germany with $96.9 million and Canada with $80.7 million.

Looking at a longer timeframe, the US continued to dominate sentiment, posting $796 million of inflows last week alone. Germany and Canada also remained net positive, with inflows of $68.6 million and $26.8 million respectively. CoinShares said these three countries have driven the bulk of demand in 2025, accounting for 98.6% of year-to-date inflows.

Bitcoin, Ethereum and XRP Lead Demand

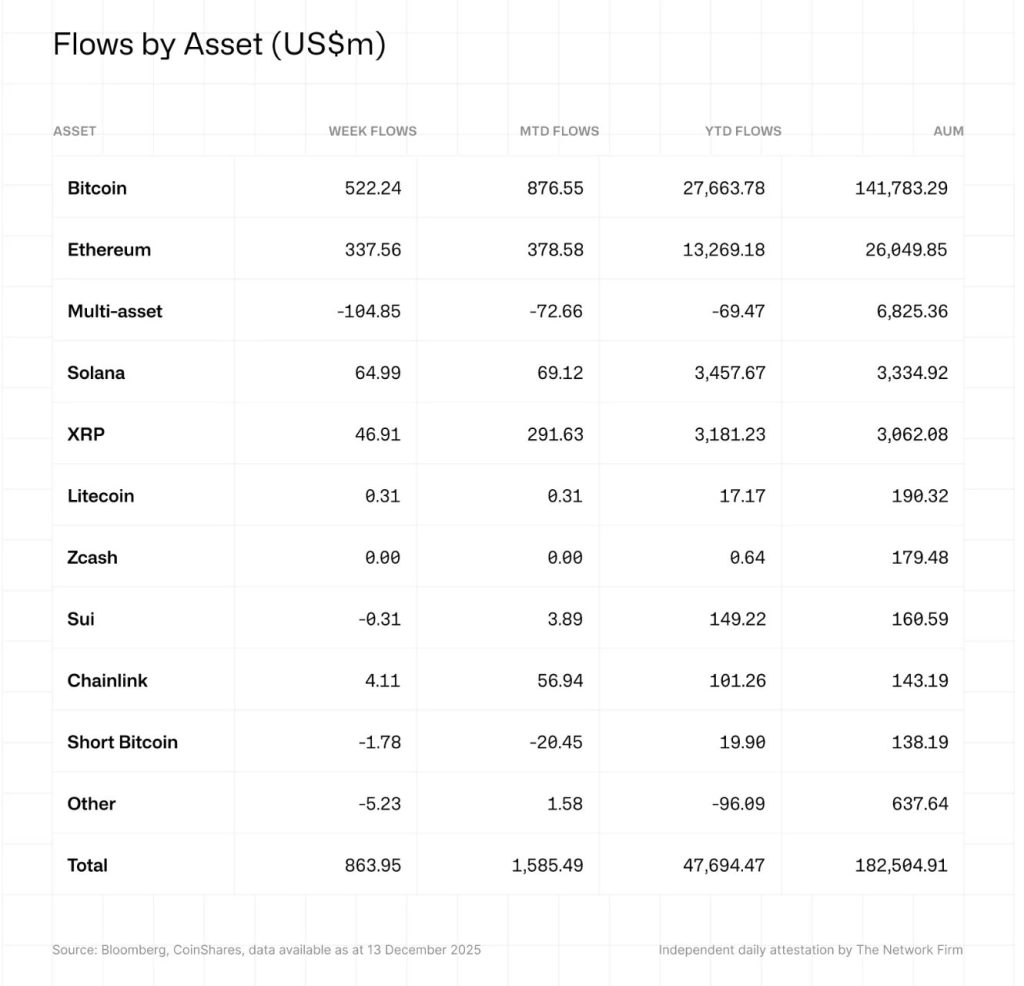

Bitcoin remained the largest beneficiary in absolute terms, attracting $352 million in weekly inflows. Notably, short-Bitcoin investment products recorded outflows of $1.8 million, signalling a further easing of negative sentiment toward the asset.

Despite renewed interest, CoinShares highlighted that Bitcoin has been a relative laggard this year, with year-to-date inflows of $27.7 billion compared to $41 billion over the same period in 2024.

Ethereum continued to close the gap, recording $338 million in weekly inflows and lifting year-to-date inflows to $13.3 billion. That figure represents a 148% increase compared to 2024, reflecting growing institutional engagement with Ethereum-based products.

XRP also stood out, drawing $245 million in inflows, while chainlink posted a record $52.8 million weekly inflow — equivalent to 54% of its total AuM.

Altcoins Show Selective Strength

Beyond the majors, Solana’s year-to-date inflows reached $3.5 billion, a tenfold increase compared to 2024, even though recent weekly flows were more muted. Aave and Chainlink recorded smaller weekly inflows of $5.9 million and $4.1 million respectively.

Not all assets benefited, however. Hyperliquid saw weekly outflows of $14.1 million, highlighting that investor appetite remains selective rather than indiscriminate.

Overall, CoinShares said the data points to a market that is stabilising, with capital gravitating toward large-cap and established digital assets as confidence slowly returns.