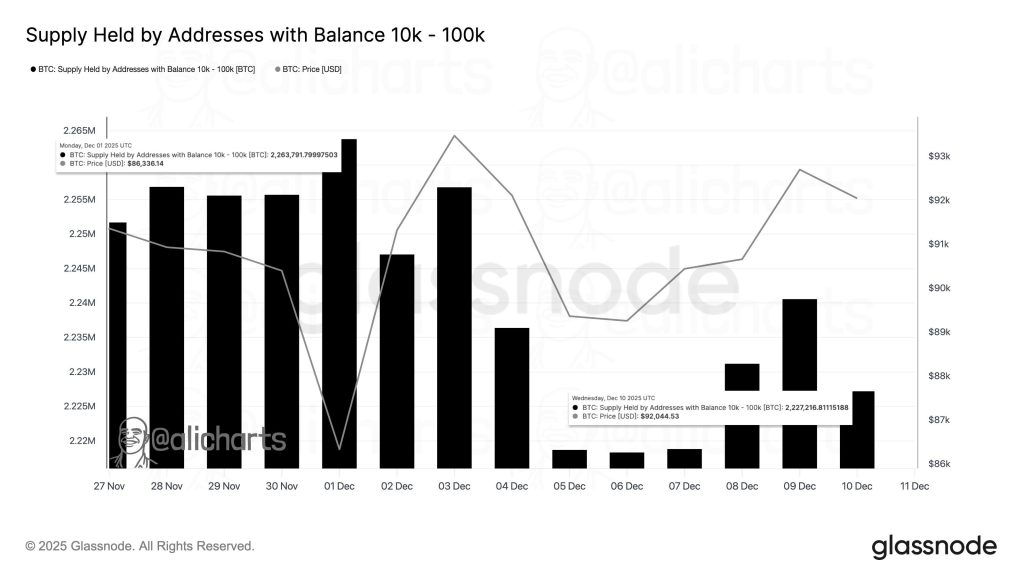

Bitcoin Whales Dump $3.4B in December as BTC Battles $92K Resistance: Glassnode Data Reveals

Bitcoin's biggest players just made a massive move—and the market felt it.

Glassnode's latest on-chain data shows a staggering $3.4 billion worth of BTC exited whale wallets in December alone. That sell-off slammed right into a formidable $92,000 price ceiling, stalling the rally dead in its tracks.

The Whale Exodus

When the entities holding the deepest pockets start cashing out, everyone pays attention. This isn't just profit-taking; it's a strategic repositioning that sends shockwaves through the order books. The timing suggests even the most bullish players see turbulence ahead of the $92K mark—a classic case of 'buy the rumor, sell the news' playing out on a billion-dollar scale.

Resistance is Not Futile

The $92,000 level has transformed from a target into a battleground. Each test consumes immense buying power, and without fresh institutional fuel, the rally is hitting a liquidity wall. It's a stark reminder that in crypto, technical levels aren't just lines on a chart—they're psychological fortresses defended by algos and emotion.

So, is this the top? Or just a healthy flush before the next leg up? The whales have cast their vote with a $3.4 billion sell order. The rest of the market is left to decipher whether this is smart money leading the way out or simply making room for a new wave of buyers—perhaps the same Wall Street suits who once called it a fraud, now quietly building positions. The irony is almost as rich as the whales themselves.

The Data Points

- The Cohort: Entities holding 10k-100k BTC (often institutional custodians or early miners).

- The Volume: ~$3.37 billion in selling pressure over 12 days.

- The Trend: This marks a shift from accumulation to distribution for this specific class, contrasting with retail sentiment which remains elevated.

Liquidity Drought

Market depth is thinning. Stablecoin liquidity, a proxy for buying power, has dropped significantly. Data cited by FX Leaders notes a 50% decline in stablecoin inflows since August, suggesting the current price levels lack the fresh capital support needed for a breakout above $100,000. Bitcoin is trading steadily near $92,000 as markets digest the Fed’s rate cut alongside its plan to inject liquidity by purchasing $40 billion in Treasury bills each month. While this liquidity boost will have a stronger long-term impact, near-term sentiment is also improving, supported by renewed institutional flows, noted Akshat Siddhant, Lead Quant Analyst, Mudrex.

Bitcoin and ethereum ETFs saw more than $610 million in inflows over the past two days, signalling growing confidence. For BTC to push toward the $100,000 mark, a daily close above $94,140 is key, with $90,000 acting as immediate support.

The Institutional Take

This divergence is the signal to watch. While retail chases the “Fed pivot” narrative, the smart money (10k-100k BTC tier) is using the liquidity to exit. The $3.4B outflow from this cohort, combined with the 50% drop in stablecoin reserves, indicates the current range ($88k-$94k) is being used for distribution, not accumulation. Expect volatility to increase if BTC loses the $88,000 support handle.