Tom Lee’s BitMine Bets Big: $112M Ethereum Buy Signals $2,500 Bottom is In

A major crypto fund just made its move—and it’s betting the house on Ethereum.

BitMine, the investment firm helmed by prominent analyst Tom Lee, has deployed a staggering $112 million into ETH. The timing isn't subtle. This massive capital injection comes with a clear signal from Lee himself: the floor for Ethereum is right here at $2,500.

Reading the Institutional Tea Leaves

This isn't casual accumulation. A nine-figure purchase is a statement of conviction, the kind of move that makes other funds check their spreadsheets and wonder if they're missing the boat. It’s capital voting with its wallet, declaring that the recent volatility is noise and the long-term signal is screaming 'buy.'

The Bottom Call That Echoes

Calling a bottom is a notorious way for analysts to look foolish. But when someone puts over a hundred million dollars behind that call, you pay attention. Lee's $2,500 target isn't just a hopeful prediction; it's now the calculated entry point for a fund positioning for the next leg up. It suggests the smart money sees the current levels as a discount, not a danger zone.

For the broader market, moves like this are a potential catalyst. They can shift sentiment, turning cautious optimism into decisive action. It’s a reminder that while retail traders are staring at charts, institutions are building positions—often with the cold, patient logic that leaves everyone else playing catch-up. After all, what’s a nine-figure bet to them? Just another Tuesday, while the rest of us debate our coffee budgets.

So, is the bottom really in? One fund just bet a fortune that it is. In crypto, that’s often the only signal that matters.

Wall Street Veteran Spots Ethereum’s Bitcoin Moment

Lee believes ethereum is entering the same explosive growth cycle that propelled Bitcoin from $1,000 to over $100,000 since his firm’s initial 2017 recommendation.

Speaking on Farokh Radio, he noted Bitcoin endured multiple 75% drawdowns during that period before ultimately delivering 100x returns to patient holders.

“We believe ETH is embarking on that same supercycle,” Lee stated, arguing current weakness reflects market doubt rather than fundamental deterioration.

The comparison carries particular weight given his track record of calling major market bottoms, including upgrading the S&P 500 at 720 in February 2009, one month before the generational low at 666.

His conviction stems from Wall Street’s accelerating blockchain adoption, particularly BlackRock CEO Larry Fink’s commitment to tokenizing traditional assets on Ethereum.

Lee emphasized that financial institutions require “a neutral and 100% uptime blockchain, and that’s Ethereum” to bring stocks, bonds, and real estate onto distributed ledgers.

He noted that tokenization addresses a market “in the quadrillions,” rather than merely replacing gold’s $20 trillion addressable market, as bitcoin does.

BitMine Doubles Down While Paper Losses Mount

The latest purchase follows BitMine’s acquisition of nearly $70 million in ETH over three days in early December, even as the firm sits on unrealized losses with an average cost basis of $3,008 per token.

Management claims it’s roughly 62% toward its long-term target of controlling 5% of total Ether supply, an ambitious goal that WOULD require accumulating approximately 2.5 million additional ETH at current levels.

This contrasts sharply with broader market behavior. Bitwise data shows that digital asset treasury companies purchased just 370,000 ETH in November, an 81% decline from August’s peak of 1.97 million ETH.

While competitors retreated amid volatility, BitMine accelerated buying, with Lee noting that his team purchased ETH at more than double the rate compared to two weeks prior.

![]() BitMine @BitMNR, the Ethereum-focused treasury firm led by Tom Lee, has added another $150 million worth of Ether to its balance sheet.#BitMine #Etherhttps://t.co/VCNXTuTuJP

BitMine @BitMNR, the Ethereum-focused treasury firm led by Tom Lee, has added another $150 million worth of Ether to its balance sheet.#BitMine #Etherhttps://t.co/VCNXTuTuJP

Lee dismissed concerns about the four-year Bitcoin cycle theory, suggesting it may no longer apply.

“If Bitcoin closes above $126,000 by January 31st, then there’s no four-year cycle,” he told Farokh Radio, adding that traditional market indicators like the ISM manufacturing index and copper prices have already broken their historical four-year patterns.

This challenges widespread beliefs among original crypto investors who expect 2026 to bring weakness.

The company recently appointed Chi Tsang as chief executive, replacing Jonathan Bates as part of a leadership transition aimed at positioning BitMine “to become a leading financial institution.”

Three new independent board members also joined alongside the management change.

Technical Setup Mirrors Pre-Rally Conditions

Ethereum’s current price action around $3,100 carries technical significance beyond simple support levels.

The asset retested $2,870 support, the same level that preceded a 72% rally to all-time highs NEAR $4,900 in August.

Lee referenced this pattern when declaring that the bottom is likely in place, though he acknowledged the asset has “” been in a sustained downtrend.

Market indicators reflect extreme pessimism that historically precedes reversals.

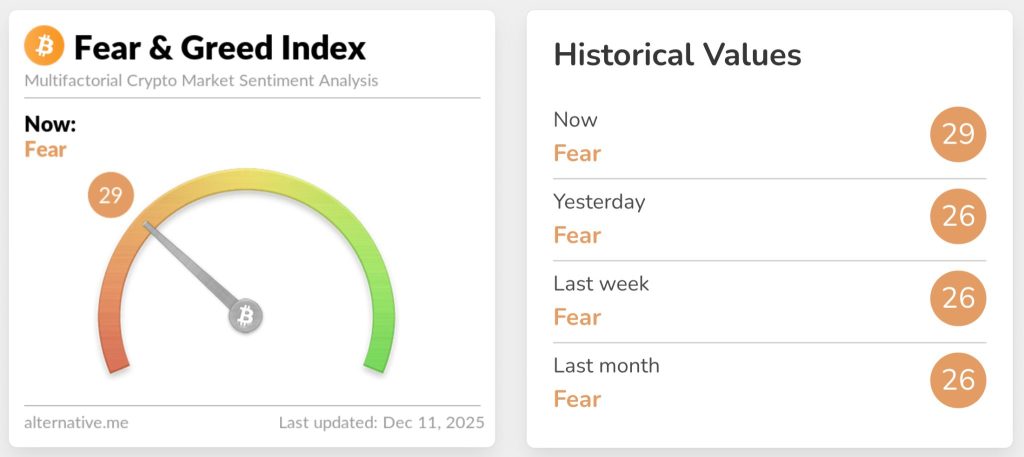

Currently, the Crypto Fear & Greed Index sits near 29, indicating that there is still some “fear” in the market, which often marks accumulation zones.

Speaking with Cryptonews, Ignacio Aguirre, chief marketing officer at Bitget, projects ETH could climb toward $3,800 as “institutional flows resume and macro conditions stabilize” following yesterday’s Federal Reserve rate cut.

Bitcoin traded around $90,000 at press time while Ethereum held above $3,200, with both assets pulling back roughly 2% in early Asian trading hours today.