Cathie Wood Declares Bitcoin’s 4-Year Cycle Shattered as Institutional Giants Steady the Market

Forget the old playbook—Bitcoin's notorious four-year boom-and-bust rhythm is officially breaking down.

The New Market Architects

Institutional capital isn't just knocking on the door; it's reinforcing the foundation. Massive, steady inflows from pension funds, asset managers, and corporate treasuries are acting as a permanent shock absorber. This isn't speculative hot money—it's strategic allocation, smoothing out the wild volatility that once defined the asset.

From Speculative Asset to Strategic Holding

The narrative has flipped. Bitcoin is shedding its casino-chip reputation and being priced as a legitimate macro hedge and a next-generation store of value. The price action now responds more to treasury announcements and ETF flows than to obscure forum posts—a sign of a maturing, if not entirely predictable, market structure.

So, pour one out for the old four-year cycle. Its demise marks the end of an era and the awkward, profitable adolescence of a new financial system—one where Wall Street's steady hand is now firmly on the wheel, for better or worse. After all, nothing stabilizes a market like the same institutions that brought you the 2008 financial crisis.

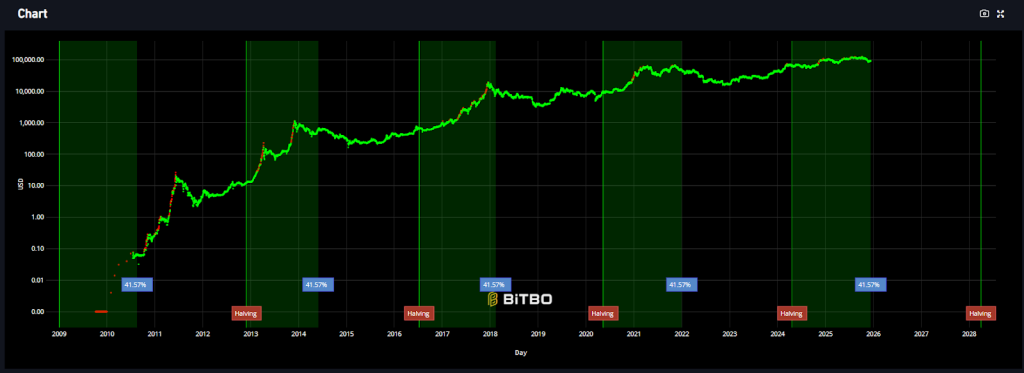

The most recent halving on April 20, 2024, cut the mining reward to 3.125 BTC, historically a trigger for supply squeezes and strong rallies.

However, Wood argues that the market’s behavior has shifted, as bitcoin trades more like a risk-on asset, moving in line with equities and real estate rather than acting as a hedge.

“Now, Gold is more of a risk-off asset,” she said, noting that investors use it to protect against geopolitical shocks.

Ark has continued adding crypto exposure, recently buying more shares of Coinbase, Circle, and its own Ark 21Shares Bitcoin ETF (ARKB).

A Growing Debate: Is the Four-Year Cycle Finished?

Wood’s comments land in the middle of a wider industry debate. Analysts across major institutions say Bitcoin no longer responds to halving cycles the way it once did.

Earlier this week, Standard Chartered said ETF buying has reduced the halving’s influence as a price driver.

Analyst Geoffrey Kendrick wrote that the pattern of prices peaking 18 months after each halving is “no longer valid,” lowering the bank’s 2025 price target from $200,000 to $100,000.

![]() Standard Chartered analyst Geoffrey Kendrick says Bitcoin's dip below $100,000 may represent the last buying opportunity at these levels.#Bitcoin #Diphttps://t.co/ovUdBhe9bg

Standard Chartered analyst Geoffrey Kendrick says Bitcoin's dip below $100,000 may represent the last buying opportunity at these levels.#Bitcoin #Diphttps://t.co/ovUdBhe9bg

On social media, the debate has been intense since late July.

Bitwise CIO Matt Hougan and CryptoQuant founder Ki Young Ju both said institutional inflows have effectively erased the traditional cycle. “The cycle is dead,” Ju wrote.

For years, Bitcoin followed a rhythm: accumulation, a rally tied to halving effects, a peak, then a multi-year downturn.

But this time, after hitting $122,000 in July, analysts say Bitcoin’s behavior looks different, slower, steadier, and less tied to retail speculation.

Sentora executive Patrick Heusser pointed to the Bitcoin Power Law model, which views price growth as part of a long-term curve influenced by time rather than strict four-year windows.

Halvings still matter, he said, but only as interruptions within a broader trend.

“Daily supply reduced by only 450 BTC,” he noted, calling it marginal compared to Bitcoin’s trillions in market value and the billions flowing into spot ETFs.

Institutional accumulation, from ETFs, corporate treasuries, and new regulated products, is widely seen as the biggest driver reshaping the market. These buyers rarely exit positions quickly, locking up supply in a way that smooths out volatility.

Bitcoin’s Market Structure Still Mirrors Past Cycles, Glassnode Argues

Still, some firms say the cycle remains intact. In August, Glassnode published data showing that the current cycle’s structure mirrors earlier ones, including long-term holder behavior and late-cycle demand softening.

![]() Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.#Bitcoin #Cyclehttps://t.co/qEureDHIyL

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.#Bitcoin #Cyclehttps://t.co/qEureDHIyL

Despite institutional involvement, Glassnode argued that Bitcoin’s timing still aligns closely with past multi-year peaks.

As experts debate whether the cycle is broken or simply evolving, most agree that investors should expect a market defined by longer trends instead of dramatic, fast swings.

Analysts say crashes may be shallower, closer to 30% to 50% instead of the deep drawdowns of past years, but rallies may also stretch over longer periods.

Strategies built around precise halving timing may no longer work with the same accuracy.

Macro analyst Lyn Alden recently said Bitcoin’s current market conditions lack the euphoria needed for a major collapse, adding that broader economic forces now dictate the asset’s movement.

She expects Bitcoin to reclaim $100,000 by 2026, but warned that the path there will be uneven.