Pi Coin Price Prediction: $10M Fraud Lawsuit Hits as 2 Billion Tokens Dumped – Is Pi Coin Going to $0?

A $10 million lawsuit alleging fraud has slammed the Pi Network, just as a staggering 2 billion Pi tokens hit the market. The dual shockwaves have investors scrambling and asking one brutal question: is this the beginning of the end?

The Legal Hammer Drops

The lawsuit doesn't pull punches. It accuses the project's core team of orchestrating a scheme to enrich themselves at the expense of everyday miners, turning the 'earn-as-you-mine' promise into what plaintiffs call a sophisticated rug-pull in slow motion. Legal experts are watching closely—a ruling against Pi could set a precedent for how regulatory bodies view similar mobile-mined assets.

The Supply Tsunami

Timing is everything, and it's terrible for Pi. The lawsuit news broke almost concurrently with the release of a previously locked tranche of tokens. We're talking about 2 billion units suddenly seeking a bid. That kind of supply overhang doesn't just dilute value; it can overwhelm any nascent market, turning orderly exits into a panic-fueled stampede. Basic economics: when supply explodes and demand wobbles, price charts only go one way.

Behind the 'Mainnet' Curtain

Proponents point to the long-promised 'mainnet' as the salvation event. But critics see a different pattern: perpetual development phases, shifting goalposts, and a token that trades in IOUs on unregulated exchanges while the core asset remains non-transferable on the official app. It's the crypto equivalent of a company that's always 'about to go public'—a great story until the funding runs out or the SEC knocks.

Can Pi Recover?

The path forward is mined with obstacles. Restoring trust after fraud allegations is a Herculean task. Absorbing billions of tokens without cratering the price requires a level of organic demand and utility that Pi has yet to demonstrate. The project now faces a battle on two fronts: in the court of law and the court of market sentiment. One is bad; both together are often fatal.

For the broader crypto space, it's a stark reminder. Hype and a large user base are not a product. Real utility, transparent operations, and a clear path to liquidity are what separate the next Bitcoin from just another digital collectible—or worse, a line item in a fraud complaint. Sometimes, the most bullish move for the industry is seeing a weak project fail, freeing up capital and attention for the real builders. After all, on Wall Street and in crypto, the first rule of getting rich is: don't lose money. The second rule is remembering that if something looks too good to be true, it's probably a lawsuit waiting to happen.

I don't know if this is true or false, but I do know that its value will soon decrease, and people's trust in it will also diminish.@PiCoreTeam needs to respond now. pic.twitter.com/fMDQj5ouCD — The Times of PiNetwork (@PiNetwork24X7) December 7, 2025

Moen credits an April 10, 2024 unauthorized transfer of 5,137 PI tokens from his verified wallet to an unknown address to a scheme to dump over 2 billion PI of user funds.

He further added that the situation was worsened by the failure to migrate his remaining 1,403 tokens to the Pi Network Mainnet, exposing him to heavy unrealised losses.

The complaint also argues that despite marketing Pi Network as decentralized, the defendants allegedly maintained centralized control by operating only three validator nodes.

These accusations threaten to worsen Pi Network’s biggest pain point: adoption. The project already lacks a meaningful use case to sustain long-term growth, and now builders may sideline the layer-1 entirely.

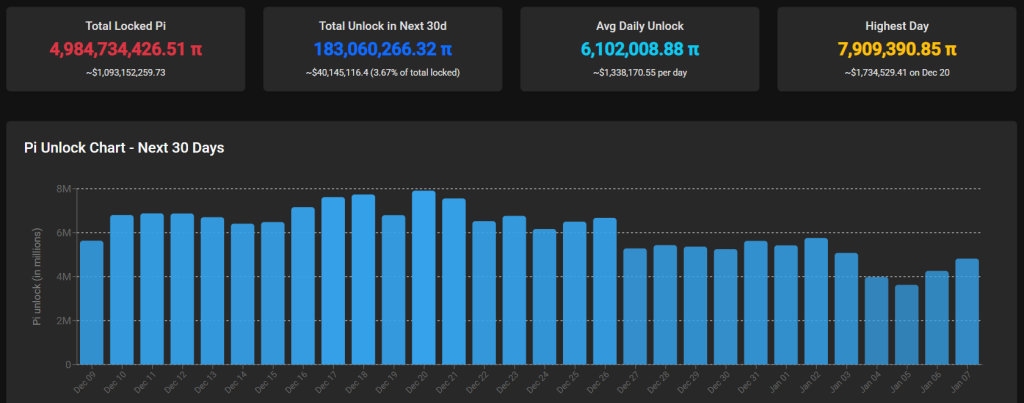

Its liquidity strain may deepen further, with short-term speculative trading amplifying deflationary pressure as token unlocks continue at an average pace of 6.1 million PI per day.

Pi Coin Price Prediction: Is a Recovery Still Possible?

The controversy comes as the PI coin price tests a strong confluence of support with the lower boundary of a 2-month ascending triangle and the 0.5 Fib retracement level.

Momentum indicators show bullishness peeking through. The RSI has bounced from near-oversold levels, typically a bottom marker in corrections.

The MACD also slowly closes in on a golden cross above the signal line, a sign of growing strength.

As a launchpad, this support could set up a breakout to the patterns $0.40 target, an 8-% gain from current prices.

Still, the lawsuit could dent bearish sentiment enough to disrupt the slow growth. A breakdown targets all-time lows, 30% lower at $0.15.

And below that lies a dangerous gap area, with little historical support to cushion downside, which opens the door to a 65% decline to the 1.618 Fib retracement at $0.075.

Bitcoin Hyper: A Layer-2 Attracting Talk For Better Reasons

Those who jumped to Pi Network as an alternative Layer 1 to the leading crypto may be forced to reconsider, as the Bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging, creating a new Layer-2 network that unlocks scalable and efficient use cases bitcoin couldn’t support alone.

The project has already raised almost $30 million in presale, and post-launch, even a small share of Bitcoin’s trading volume could push its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have capped Bitcoin’s potential – just as the market turns bullish.

To buy HYPER at the presale price and before it lists on exchanges, visit theand connect a crypto wallet such as Best Wallet.

You can swap crypto or use a bank card to make the purchase in seconds.

Visit the Official Website Here