Solana Price Prediction: The ’Zero Risk’ Myth Shattered – Did This Exchange Just Expose Crypto’s Hidden Danger?

The promise of 'zero risk' in crypto just got a reality check—and Solana's price prediction is caught in the crossfire. A major exchange's recent move peeled back the curtain on vulnerabilities many thought were theoretical. Suddenly, the narrative isn't just about gains; it's about gaps.

Beyond the Hype: The Infrastructure Crack

Forget the usual volatility chatter. This isn't about a market dip. It's about a foundational flaw—a hidden danger baked into the very systems touted as unbreakable. The exchange didn't just report a bug; it spotlighted a single point of failure that could ripple across networks. Solana, with its high-speed ambitions, now faces questions that strike at its core value proposition: scalability at what cost?

The Ripple Effect: Trust in the Machine

When an established platform exposes a vulnerability, it doesn't just affect one asset. It triggers a sector-wide stress test. Confidence, that fragile crypto commodity, takes a hit. Developers scramble. Validators re-check nodes. The 'decentralized' dream confronts its centralized bottlenecks—a classic case of the financial industry building faster horses while pretending to invent cars.

Solana's Path Forward: Pressure Makes Diamonds?

This isn't necessarily a death knell. For bullish builders, it's a brutal audit. Pressure forces innovation, and Solana's team is known for its aggressive iteration. The network's response to this exposed danger will be its real price predictor. Will it patch, adapt, and emerge stronger, or will the 'hidden danger' become a recurring headline? The market is watching, wallets at the ready—proving once again that in crypto, the only 'zero risk' is a forgotten seed phrase.

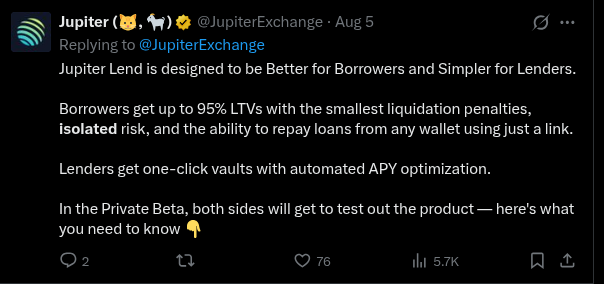

Example deleted post of “isolated risk” claims. Source: X, @JupiterExchange.

Example deleted post of “isolated risk” claims. Source: X, @JupiterExchange.

Jupiter COO Kash Dhanda clarified on X that while the vaults are isolated, the use of rehypothecated assets exposes users to risk as shocks in one part of the system can still pass through those reused assets.

The vaults are designed to limit contagion, but Dhanda acknowledged the team should not have implied they were completely insulated.

The correction has not stopped the crypto community from sidelining Jupiter. Lending protocol Kamino has blocked users from migrating funds to Jupiter Lend, citing the misrepresentation.

As a contributor to over $616 million in network activity, an exodus of Jupiter Lends could weigh on solana through weaker adoption and decreased usage of SOL as a utility token.

Solana Price Prediction: Can Solana Survive Without Jupiter Lends?

While Jupiter Lends has weakened as a contributor of inflows into the Solana ecosystem, the market reaction has not derailed a potential launchpad setup.

The formation of a higher low solidifies the $120 level as the base of a double-bottom pattern, a reversal setup that is now being reflected by momentum indicators.

The MACD is no longer declining, but holding a wide lead above the signal line, while the RSI continues to FORM higher lows as it approaches the 50 neutral line. Both are strong indicators of a bullish shift.

Still, the solana price has yet to surpass the double-bottom, a level it must reclaim as support for theto play out.

Such a shift WOULD set up a retest of the wider year-long descending triangle resistance, creating a breakout scenario targeting levels near.

A target that stands to extend much higher as the bull run matures in 2026, with anticipated U.S. interest rate cuts stimulating demand and a potential.

Solana appears more in tune with wider market narratives than the Jupiter controversy.

Bitcoin Hyper: Solana Might Be The Wrong Coin to Watch

Those who jumped to Solana as an alternative Layer 1 to the leading crypto may be forced to reconsider, as the Bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security and stability with Solana’s speed, creating a new Layer-2 network that unlocks scalable and efficient use cases bitcoin couldn’t support alone.

The project has already raised over $30 million in presale, and post-launch, even a small share of Bitcoin’s trading volume could push its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here