Variant, Coinbase Ventures, Gemini and More Pour $5M into Solana Staking ’Transformer’ Pye Finance

Big money just placed a major bet on a new way to stake Solana.

Pye Finance, a protocol aiming to reshape how users earn yield on SOL, just secured a $5 million investment round. The backers read like a who's who of crypto's institutional elite: Variant, Coinbase Ventures, and Gemini's venture arm, among others. They're not just funding another staking service—they're betting on what the project calls a 'transformer' for the entire process.

The Core Pitch: Cutting Out the Middleman

Traditional staking often involves locking assets with a validator, hoping for rewards, and dealing with illiquidity. Pye's model reportedly bypasses much of that friction. The details are still emerging, but the promise is a more efficient, liquid, and user-controlled staking experience directly on the Solana blockchain. Think of it as stripping out the legacy plumbing.

Why the Heavy Hitters Are In

For giants like Coinbase Ventures and Gemini, this isn't charity. It's a strategic play. Solana's ecosystem is heating up again, and staking remains its fundamental economic engine. A protocol that can streamline and supercharge that engine represents a massive opportunity—and a potential new revenue funnel. It's the kind of infrastructure bet that pays off if the underlying chain succeeds.

A Cynical Take on Yield

Let's be real: the finance sector has a long, storied history of repackaging basic concepts with flashy new names and calling it innovation. 'Transformer' might be the latest buzzword, but the core goal—finding smarter ways to put idle assets to work—is as old as money itself. The true test won't be the venture capital headline; it'll be whether real users get real, sustainable yield, not just the synthetic kind that vanishes in a bear market.

The final verdict on Pye is still out. But when crypto's institutional guard drops $5 million on a staking 'transformer,' it's a clear signal: the race to rebuild the fundamentals of digital finance is accelerating, and Solana is a primary battlefield.

Passive Billions ‘Turning’ Into Active Yield Market

Staking is shifting from a passive yield mechanism into a programmable financial layer, the team says. Institutional stakers look for transparent reward structures, customizable terms, and the option to trade or borrow against locked positions.

Therefore, Pye says it’s turning validators from node operators into yield providers who can “compete on product offerings rather than just commission rates.” It’s creating the first onchain marketplace for time-locked staking positions on Solana, it adds.

With this, they claim, they’ll turn Solana’s billions in locked stake into an active, programmable yield market.

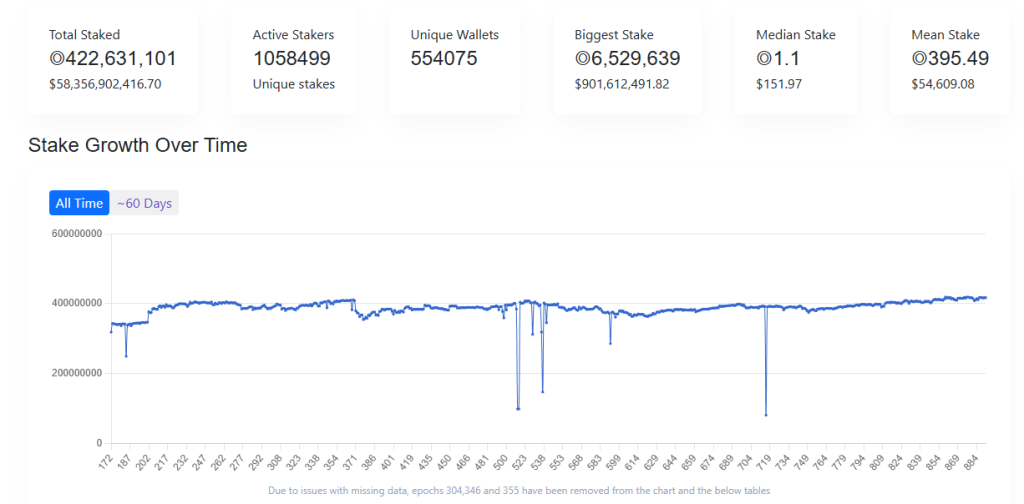

The total staked currently sits at 422.6 million SOL, or nearly $59 billion.

Notably, the team argues that these accounts have seen no updates in years and have no liquidity. Additionally, they lack customization and control over staking rewards.

At the same time, institutions and digital asset treasuries (DATs) are asking for a bigger piece of the reward pie, the Solana Foundation’s Delegation Program (SFDP) is seeing a cut, and smaller validators have to scramble to find ways to generate revenue or attract stakers.

Pye says its solution is an upgrade to Solana’s native Staked accounts. Validators gain control over their staking rewards and time locks. Validator agreements MOVE onchain as ‘transferable locked stake’ – they are locked but can be traded on secondary markets. These are split into a Principal Token and a Rewards Token (RT).

“The aim is to enable validators to offer more flexible and dynamic products, tapping into additional revenue opportunities while delivering greater utility to stakers,” the press release says. “Without the ability to structure term-based deals, reward loyalty, or provide additional utility–such as better accounting, rewards forwarding, or other features–many validators are left vulnerable to sudden outflows that can destabilize operations.”

Dan Albert,Executive Director, commented that Pye’s “tradeable, fixed-term positions at the validator level represent a major unlock for both rewards discovery and capital efficiency in proof-of-stake networks, and open up new opportunities.”

You may also like: Coinbase Launches Staking in New York After State Approval – ETH and SOL Yields Now Available Coinbase has activated staking services for New York residents, allowing users to earn yields on ethereum and Solana holdings for the first time. The rollout follows approval from state regulators under Governor Kathy Hochul's administration, ending a restriction that had separated New Yorkers from staking opportunities available to most other Americans. New York users can now stake ETH, SOL, and other supported assets directly through the platform, with rewards earned in the network's...