Digital Asset ETPs Surge: $716M Weekly Inflows Propel AuM to $180B Milestone

Institutional money floods crypto corridors.

The Big Picture

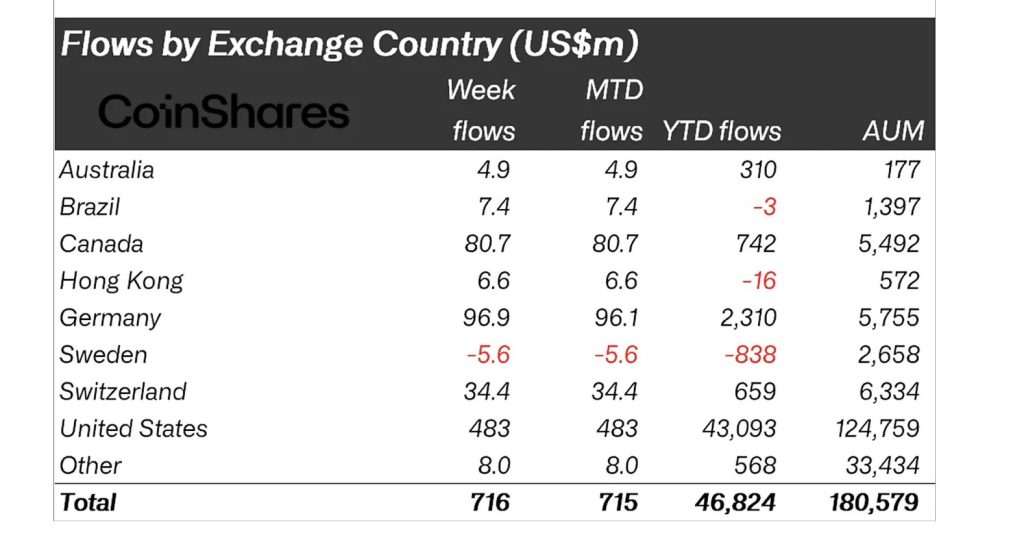

Exchange-Traded Products tracking digital assets just notched another record week. A staggering $716 million poured in, pushing total assets under management to a colossal $180 billion. The figures, fresh from CoinShares, signal a tidal wave of mainstream capital seeking exposure.

Decoding the Flow

This isn't retail FOMO. These inflows represent sophisticated capital—hedge funds, family offices, maybe even a pension fund or two dipping a cautious toe. They're bypassing direct custody headaches for the familiar, regulated wrapper of an ETP. It's the path of least resistance for big money, even if the underlying asset still gives traditional portfolio managers heartburn.

Why It Matters Now

The $180 billion AuM mark isn't just a number; it's a legitimacy checkpoint. It proves the product-market fit for institutional-grade crypto vehicles. Every billion added builds more infrastructure, attracts more liquidity, and quietly normalizes digital assets as a viable portfolio component. The market's building its own on-ramp, one billion at a time.

The Bottom Line

While Wall Street debates theoretical adoption, the tape tells a different story: cold, hard capital voting with its feet. The cynic might note this is the same industry that once scoffed at 'internet stocks'—now it's racing to package the new digital scarcity. The inflows won't go in a straight line, but the direction is clear. The dam has cracks, and $716 million a week is a pretty good leak.

Bitcoin Leads Inflows While Short Products Reverse

Bitcoin remained the primary focus for investors, recording $352M in inflows last week, contributing to year-to-date (YTD) inflows of $27.1B. This remains below the record $41.6B seen in 2024; however, continued inflows suggest persistent appetite for exposure despite reduced volatility and slower price momentum compared to previous cycles.

In contrast, short-Bitcoin investment products saw outflows of $18.7M — the largest since March 2025. Analysts note that the previous occurrence coincided with price lows and later recovery, hinting that current negative sentiment may have exhausted itself, with investors positioning for a more favourable outlook.

The reversal in short-Bitcoin demand could be interpreted as a tactical shift, where investors are less confident in prolonged downside risk and increasingly reassessing the potential for stabilization or upside in digital asset markets.

XRP Sees Strong Momentum as Institutional Interest Accelerates

XRP continued to draw attention, with $245M flowing into ETPs last week, bringing YTD inflows to $3.1B — a dramatic increase compared to $608M in 2024. The surge reflects heightened institutional engagement following greater clarity around its legal and regulatory landscape, which has broadened access and improved sentiment.

The continued rise in XRP ETP demand marks one of the strongest comparative growth stories in the digital asset space this year, suggesting that investors may now be reassessing exposure beyond Bitcoin and ethereum as the market diversifies.

Chainlink Records Largest Inflows on Record

Chainlink registered $52.8M in weekly inflows, representing over 54% of its total assets under management — the largest on record for the token. The surge highlights growing institutional and developer interest in the tokenized asset and oracle infrastructure ecosystem that chainlink underpins.

As tokenization of real-world assets expands and demand for reliable data connectivity increases across blockchains, Chainlink’s growth may indicate a long-term thematic trend rather than short-term speculation.

Digital asset ETPs saw US$716m in weekly inflows, lifting total AuM to US$180bn, though still well below the US$264bn all-time high. Bitcoin attracted US$352m while XRP (US$245m) and Chainlink (US$52.8m) also saw strong demand. Short-Bitcoin products saw outflows of US$18.7m, the…

— Wu Blockchain (@WuBlockchain) December 8, 2025