Solana Price Prediction: Institutions Pile In as Staking Hits 3.1M SOL – Could SOL Overtake Bitcoin in 2026?

Institutional money is flooding into Solana, locking up millions of tokens as staking soars. Is this the fuel for a historic rally?

The Big Money Bet

Forget the retail frenzy. The real story is playing out in the boardrooms. Major funds and financial institutions are quietly building massive positions, with over 3.1 million SOL now staked and effectively taken off the market. That's not speculative day-trading; it's a long-term conviction play on the network's infrastructure.

Beyond the Hype Cycle

Solana's recent performance isn't just about meme coins and social media buzz. The chain is processing transactions at a blistering pace and a fraction of the cost of its rivals. Developers are migrating. Real applications are scaling. The network is proving it can handle the load—something that crumbles the promises of many 'Ethereum-killers.'

The 2026 Question: Flipping the King?

Could SOL actually challenge Bitcoin's throne? It sounds like heresy in some circles—the ultimate cynical finance jab that every altcoin eventually makes before reality sets in. But the math is starting to whisper, not shout. If institutional adoption continues at this pace and Solana's ecosystem matures into the high-throughput financial rails it promises, the market cap gap doesn't look insurmountable. It's a bet on utility versus store-of-value, speed versus security.

One thing's clear: the smart money isn't waiting around to find out. They're stacking SOL now.

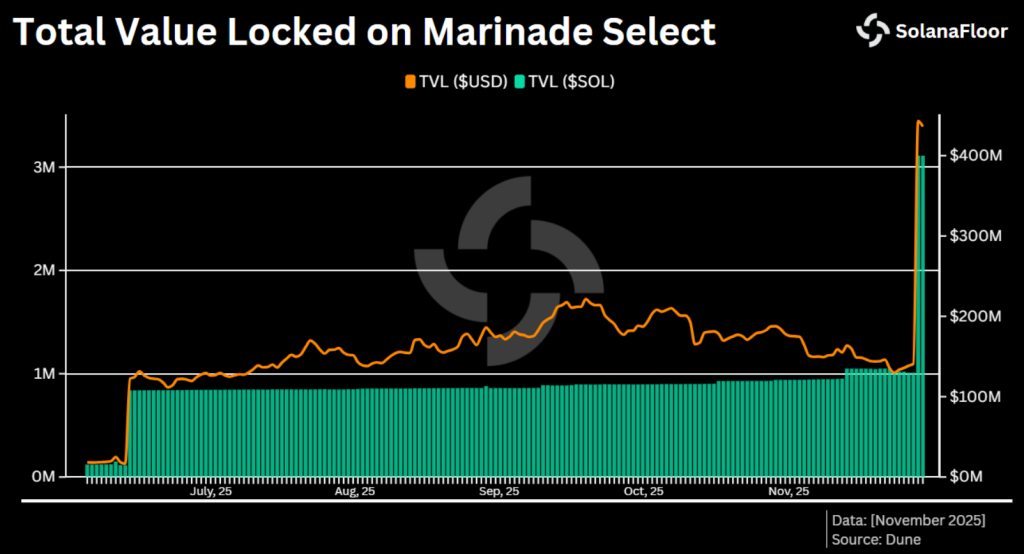

Marinade Total Value Locked (TVL). Source: SolanaFloor.

Marinade Total Value Locked (TVL). Source: SolanaFloor.

This adoption has been catalysed with the launch of several spot SOL staking ETFs as a regulated means to gain access to the altcoin’s yields.

Over November, these ETFs saw a 22-day inflow streak despite amounting to the second-worst month of the year. TradFi markets chose to buy the dip on SOL as other ETFs like Bitcoin bled.

Demand that only stands to grow with fresh touch points for institutional-grade exposure, like the recently unlocked 50 million clientele of the second-largest asset manager, Vanguard.

As the favored accumulation strategy over Bitcoin, Solana is in a favorable position to outperform the leading cryptocurrency if the bull run returns for 2026.

Solana Price Prediction: Where Could Solana Go In 2026

December is shaping a strong launchpad into 2026 as Solana forms a clean double-bottom pattern along a firm support throughout the bullish phase of this market cycle at $120.

And with momentum indicators verging on bullishness, the structure is acting as a clear bottom to the two-month solana price decline.

While its most recent attempt has ended in rejection, the RSI is now testing the 50 neutral line after weeks in DEEP oversold territory. The MACD has also built a strong lead on the signal line.

Both suggest the early stages of a fresh uptrend as buyers step back in.

Still, the Solana price has faltered at the double-bottom neckline around $145, a level it must reclaim as support for the $210 target to play out.

Such a shift WOULD set up a retest of the wider year-long descending-triangle resistance, creating a breakout scenario targeting levels near $500 for a potential 260% gain.

Though a near-term catalyst, such as a decision to ease U.S. interest rates next week, may be required to stimulate risk sentiment.

And with further macroeconomic easing expected through 2026 and growing institutional involvement, the setup could extend toward a much larger move,

Bitcoin Hyper: A Reason Bitcoin Could Still Outpace Solana

Those who jumped to Solana as an alternative Layer 1 to the leading crypto may be forced to reconsider, as the bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security and stability with Solana’s speed, creating a new Layer-2 network that unlocks scalable and efficient use cases Bitcoin couldn’t support alone.

The project has already raised over $30 million in presale, and post-launch, even a small share of Bitcoin’s trading volume could push its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have capped Bitcoin’s potential – just as the market turns bullish

Visit the Official Bitcoin Hyper Website HereVisit the Official Bitcoin Hyper Website Here