Vanguard’s SOL Backing Sparks $1,000 Solana Price Prediction: Is the Trillion-Dollar Nod a Game-Changer?

When a traditional finance titan like Vanguard takes a position in Solana, the crypto world sits up and takes notice. The trillion-dollar asset manager's move isn't just a vote of confidence—it's a seismic shift in institutional perception, sending analysts scrambling to revise their price targets upward.

The Institutional Floodgates Creak Open

Vanguard's backing cuts through the noise of retail speculation. This isn't a meme-fueled pump; it's a calculated bet by one of the world's most conservative capital allocators. The signal bypasses the usual crypto echo chambers, landing directly on the desks of pension funds and endowments still sitting on the sidelines.

Anatomy of a $1,000 Target

Hitting a four-digit SOL valuation requires more than hype. It demands sustained network growth, developer migration from more congested chains, and a relentless pace of technical upgrades. The Vanguard nod addresses the first major hurdle: credibility. Suddenly, the path to a trillion-dollar Solana ecosystem—and the asset price that comes with it—looks less like fantasy and more like a plausible roadmap. After all, if they can trust it with your retirement, maybe your crypto portfolio isn't so crazy.

The Fine Print and the Friction

Let's not pop the champagne just yet. Institutional adoption moves at a glacial pace compared to crypto Twitter. Regulatory overhangs persist, and network stability remains under the microscope. Every bullish case carries the quiet, cynical whisper of finance veterans: 'Great trade, terrible long-term asset'—a jab that only time, and real-world utility, can deflect.

The target is set. The player has entered the game. Now, the network just has to execute.

Even a small share of that capital would translate into explosive growth, and solana is a standout beneficiary as the proven institutional play of choice.

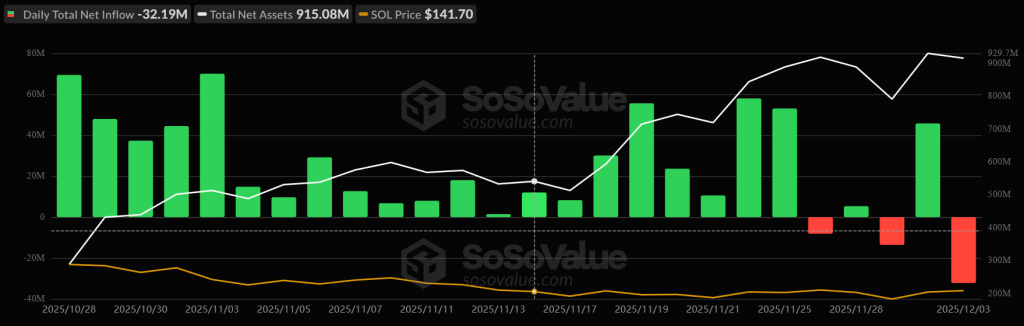

The altcoin saw a 22-day inflow streak during crypto’s second-worst month of the year as TradFi markets chose to buy the dip on Solana over other ETF offerings.

And with the fresh exposure, Solana ETFs are once again catching a bid from investors, with $46.7 million in inflows the day of the announcement.

Solana Price Predictions: Could Vanguard Fuel a $1000 Move

This fresh touch point for inflows arrives as Solana flashes its strongest bottom signal yet with a double bottom pattern forming along a historic support trendline.

The $120 level has marked local bottoms throughout the bullish phase of the market cycle, and it appears to act as a launchpad yet again as momentum indicators flip bullish.

The RSI is testing the neutral line after being trapped in oversold conditions for the past 2 months while the RSI builds a lead above the signal line. Both suggest that buyers are taking control of the prevailing trend.

With a decisive break above the double bottom neckline at $144, the fully realised structure eyes a push to $210.

This WOULD trigger a retest of a wider year-long descending triangle pattern, creating a potential breakout scenario eyeing much higher targets around $500, a 250% gain.

With anticipated U.S. interest rate cuts in December set to stimulate risk sentiment across investment markets, Vanguard exposure could fuel a larger.

SUBBD: An Early Play With Fundamentals Just as Strong

With market conditions shaping up for an explosive year-end, capital is rotating into the next high-upside contender, and increasingly, SUBBD ($SUBBD).

The project is redefining the $85 billion subscriber economy by giving creators true ownership and fans genuine access through an AI-powered content platform.

Never miss a sale again.

As a top creator, your audience is global. It's just not possible to cater to everyone – you can't be online 24/7![]()

That's where your personal AI Assistant comes in, to handle requests and secure payments. Sleep peacefully knowing you're making money… pic.twitter.com/ju9VjLBmea

By cutting out the middlemen, $SUBDD puts control back in the hands of those who create real value.

Creators can monetize directly, while fans gain access to exclusive content, early releases, and meaningful interactions through token-gated perks.

The concept is already gaining traction. $SUBBD nears $1.4 million in presale, as investors back the shift toward a decentralized creator economy.

With SUBBD, both sides of the community win — creators earn more, and fans get closer while embracing the decentralization use cases crypto was built for.

Visit the Official SUBBD Website Here