IMF Sounds Alarm: Fragmented Stablecoin Regulations Create Global ’Roadblocks’ - New Framework Drops

The International Monetary Fund just threw a regulatory grenade into the crypto sphere. Their latest warning? The patchwork of global stablecoin rules isn't just messy—it's actively blocking the financial system's future.

The Compliance Maze No One Can Solve

Forget seamless cross-border payments. The IMF paints a picture of a digital asset landscape fractured by conflicting national policies. One country's approved stablecoin is another's regulatory nightmare, creating dead ends for institutions and innovators alike. This fragmentation does more than annoy compliance officers—it stifles the very efficiency and financial inclusion that stablecoins promise.

A Blueprint for Order, or Just More Bureaucracy?

Enter the new guidelines. The IMF's framework aims to bulldoze these roadblocks, proposing a harmonized approach to oversight, risk management, and legal clarity. Think of it as a universal plug for a world full of different sockets. The goal is clear: prevent regulatory arbitrage, protect consumers, and maintain monetary sovereignty without choking innovation in its crib. It's a delicate dance between fostering progress and preventing the next 'stable' coin from collapsing—because nothing says stability like watching your life savings peg to a meme.

The ball is now in the court of national regulators. Will they adopt a cohesive playbook, or will geopolitical posturing and protectionism keep the roadblocks firmly in place? The trillion-dollar question remains: can global finance finally get its act together, or is it doomed to repeat the same fragmented mistakes, just with fancier technology?

Stablecoins Are Moving Faster Than Regulators Can Track, IMF Warns

The IMF said this regulatory patchwork allows stablecoins to MOVE across borders faster than oversight can follow.

Issuers can operate from lightly regulated jurisdictions while serving users in stricter markets, limiting authorities’ ability to monitor reserves, redemptions, liquidity management, and anti-money laundering controls.

The fund warned that this creates regulatory arbitrage and weakens global supervision.

The report also pointed to technical fragmentation. Stablecoins increasingly operate across different blockchains and exchanges that are not always interoperable.

According to the IMF, this lack of coordination raises transaction costs, slows market development, and creates barriers to efficient global payments.

Differences in national regulatory treatment further complicate cross-border usage and settlement.

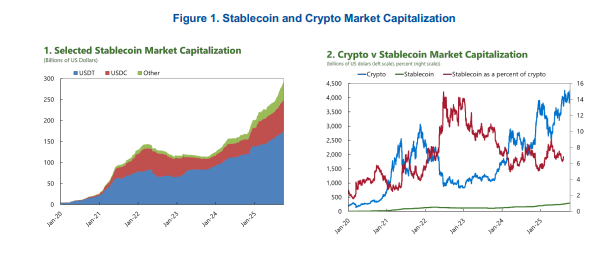

Stablecoins remain dominated by U.S. dollar-denominated tokens. The IMF said the global stablecoin market is now worth more than $300 billion. Tether’s USDT and Circle’s USDC make up the majority of that supply. About 40% of USDC’s reserves are held in short-term U.S. treasuries, while roughly 75% of USDT’s reserves are in short-term treasuries, with another 5% held in Bitcoin.

The concentration of reserves in government debt markets links stablecoins directly to traditional financial systems

Widespread use of foreign-currency stablecoins can weaken domestic monetary control, lower demand for local currency, and accelerate digital dollarization. Stablecoins also make it easier to bypass capital controls through unhosted wallets and offshore platforms.

In addition to monetary concerns, the fund cited broader financial stability concerns. Large-scale redemptions could force rapid sales of Treasury bills and repo assets, potentially disrupting short-term funding markets that are critical for monetary policy transmission.

The IMF also noted that the increasing interconnection between stablecoin issuers, banks, custodians, crypto exchanges, and funds also increases the risk of contagion spreading from digital markets into the wider financial system.

IMF Urges Unified Stablecoin Regulation as Cross-Border Risks Grow

To address these risks, the IMF released new global policy guidelines intended to reduce fragmentation. It called for harmonized definitions of stablecoins, consistent rules for reserve assets, and shared cross-border monitoring frameworks.

The fund said issuers should be subject to the principle of “same activity, same risk, same regulation,” regardless of whether the issuer is a bank, fintech company, or crypto platform.

The IMF also said stablecoins should be backed only by high-quality liquid assets such as short-term government securities, with strict limits on risky holdings. Issuers must guarantee full one-to-one redemption at par, on demand, at all times.

Strong international coordination on anti-money laundering enforcement, licensing, and supervision of large global stablecoin arrangements was also included in the new guidance.

The IMF’s warning comes as regulatory pressure is rising worldwide. In Europe, the European Central Bank recently warned that stablecoins, despite their small footprint in the euro area, now pose spillover risks due to their growing ties to U.S. Treasury markets.

![]() The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market. #Stablecoins #ECBhttps://t.co/ef16HZzqYL

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market. #Stablecoins #ECBhttps://t.co/ef16HZzqYL

The European Systemic Risk Board has also called for urgent safeguards against cross-border stablecoin structures operating under the EU’s MiCA framework.

In China, the central bank has described stablecoins as a threat to financial stability and monetary sovereignty, while the Bank of England and Basel regulators are reassessing how banks should hold capital against stablecoin exposure as usage expands.

The IMF concluded that without consistent global regulation, stablecoins could bypass national safeguards, destabilize vulnerable economies, and transmit financial shocks across borders at high speed.