Ex-Citadel Engineers Secure $17M Funding for Stablecoin Payments Startup Fin

Wall Street's brightest are jumping ship—and they're taking the plumbing with them.

A team of former Citadel engineers just landed a $17 million war chest to build Fin, a payments startup betting that stablecoins will slice through the financial system's red tape. Forget waiting days for settlements or paying middlemen their pound of flesh. This crew is building rails for instant, global transactions—using the dollar, just digitized.

The Backroom Builders

These aren't crypto rookies. They're market structure veterans who've seen the legacy system's guts. Now they're applying that insider knowledge to bypass it entirely. The pitch? A payments network that's as reliable as traditional finance but moves at internet speed.

Why Stablecoins? Why Now?

The timing isn't accidental. As institutions finally warm to blockchain, the demand for compliant, scalable payment rails has exploded. Fin aims to be the bridge—offering the stability of fiat with the efficiency of crypto. No volatility drama, just clean execution.

The $17 million question: Can they actually make it stick? The market's crowded, but pedigree matters. When engineers who built titans like Citadel decide to tear it down, you pay attention. They're not selling magic internet money; they're selling a faster, cheaper pipe. And in finance, where milliseconds mean millions, that's a language everyone understands.

One cynical take? It's poetic. The very talent that propped up the old guard is now funded to dismantle it—proving that even in high finance, the most valuable asset isn't capital, it's the engineers who know how to move it.

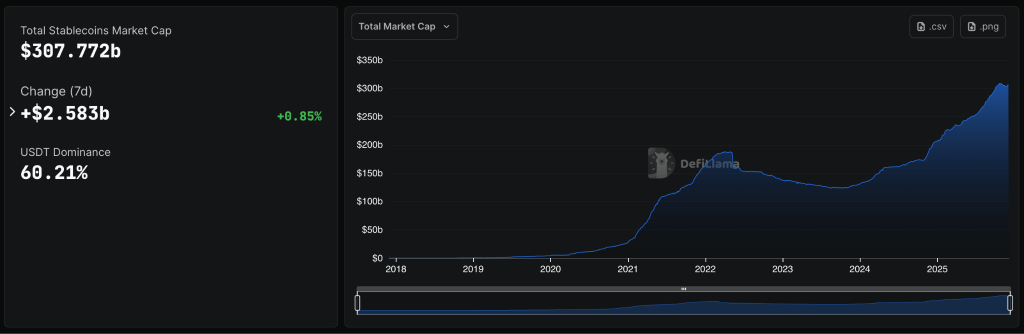

Source: DefiLlama

Source: DefiLlama

Krotinsky and Dheeraj discovered the friction in international payments while building side projects at Citadel, when they attempted to pay $50 to users who reached the front page of a Reddit-like platform they created.

Building Payment Infrastructure for Large Transfers

Fin targets a gap in existing payment systems by focusing on large-value transactions in the hundreds of thousands or millions of dollars.

The app allows users to send money to other Fin users, bank accounts, or crypto wallets, leveraging stablecoin rails to reduce transfer fees compared to traditional banking channels dramatically.

Krotinsky described the platform as “built as the payments app of the future,” emphasizing that it leverages the benefits of stablecoins “without all the complexity” and will work anywhere in the world.

The startup shared an exclusive walkthrough with Fortune, revealing a simple yet elegant design prioritizing user-friendliness over technical jargon.

Traditional wire transfers through commercial banks can take several days and incur substantial fees, particularly for international transactions between countries with different financial systems.

Fin aims to disrupt this model by offering near-instant settlement for scenarios such as Swiss watch dealers selling to US customers or domestic transfers exceeding the limits imposed by Venmo and Zelle, which cannot process payments of $100,000 instantly due to delays or verification holds.

Revenue Model and Competitive Positioning

The company plans to generate revenue through transaction fees, though these will remain cheaper than alternatives, plus interest earned on stablecoins held in Fin wallets.

While the app has not launched publicly, the pilot program with businesses in the import-export space represents the first step toward broader commercial availability.

Krotinsky positioned his startup against major commercial banks like JPMorgan Chase and Barclays rather than crypto-native competitors.

He argued that large financial institutions have built payment products incorrectly for decades and will struggle to migrate existing systems onto stablecoin rails.

“I think we have the opportunity of being the next largest payments app in the world,” Krotinsky said. “People are going to be surprised at how quickly we MOVE to get there.“

Stablecoin Sector Attracts Traditional Finance Giants

Fin’s funding follows major institutional moves into stablecoin infrastructure.

Citadel Securities, the market maker founded by Ken Griffin, invested $200 million in crypto exchange Kraken at a $20 billion valuation in November, deepening Wall Street’s commitment to digital assets after years of hesitation over regulatory uncertainty.

The firm also participated in Ripple’s $500 million funding round alongside Fortress Investment Group, which shows traditional finance is showing interest in established crypto platforms as regulatory clarity improves under the TRUMP administration.

Most recently, ten major European banks formed a consortium to launch a euro-backed stablecoin by mid-2026, addressing concerns about overwhelming reliance on dollar-denominated tokens, which currently account for 99.58% of the global stablecoin market.

![]() Sony Bank plans to roll out its 1:1 USD-pegged stablecoin for payments and settlement within its gaming and anime business.#SonyBank #SonyStablecoin $USDStablecoinhttps://t.co/8wVvOWo89Z

Sony Bank plans to roll out its 1:1 USD-pegged stablecoin for payments and settlement within its gaming and anime business.#SonyBank #SonyStablecoin $USDStablecoinhttps://t.co/8wVvOWo89Z

Sony Bank is also reportedly preparing to issue a GENIUS-regulated US dollar stablecoin for American customers as early as fiscal 2026, aiming to reduce payment fees across its gaming and anime businesses.

While there is a massive ongoing innovation in stablecoins with big firms positioning themselves for what they see as the next wave of financial revolution, Standard Chartered recently warned that over $1 trillion could FLOW from emerging-market banks into stablecoins by 2028 as global adoption accelerates.

In fact, Federal regulators are also advancing implementation of the GENIUS Act, with the FDIC expected to publish its first stablecoin rule framework later this month.

Acting FDIC Chair Travis Hill confirmed the agency is drafting rules for how stablecoin issuers will apply for approval, with separate prudential standards planned for early next year.