Solana Price Prediction: 21 Days of Straight ETF Inflows – Is SOL the Strongest Bet in Crypto Right Now?

Wall Street's money hose just found a new crypto target—and it's not Bitcoin.

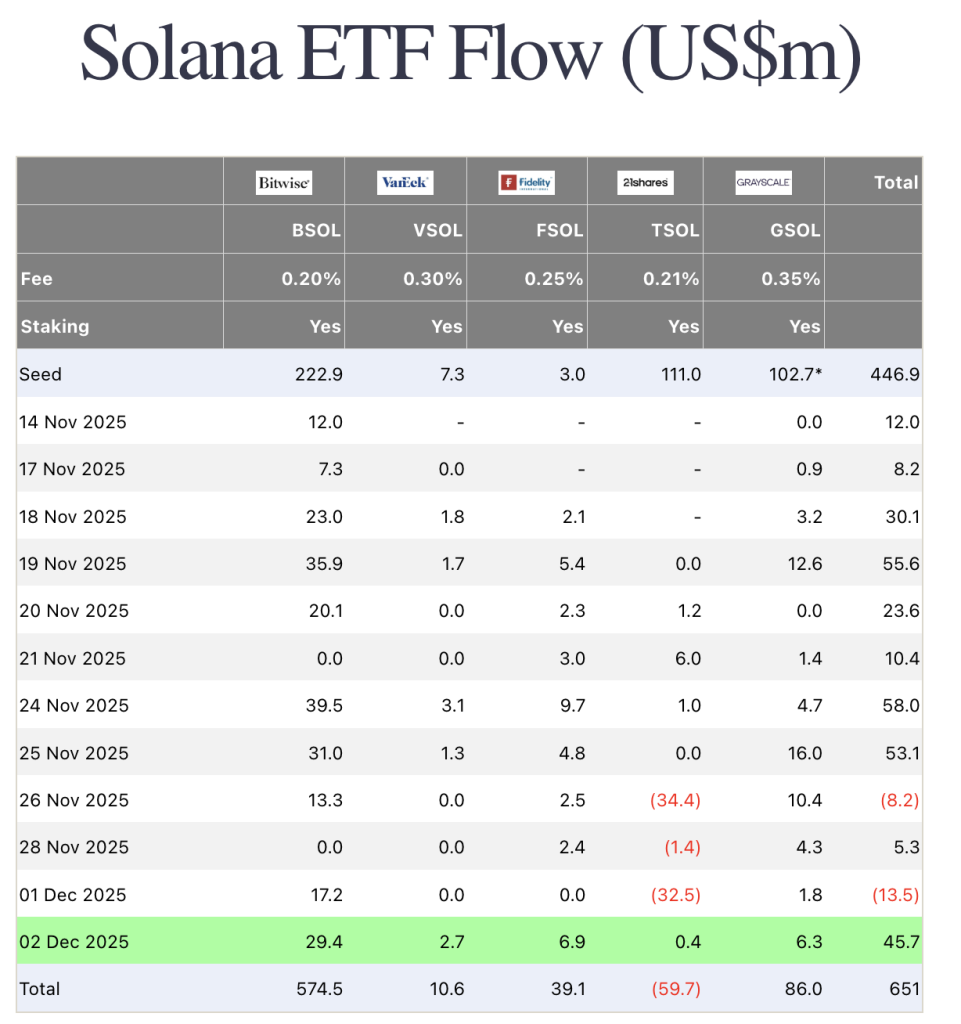

For 21 consecutive trading days, exchange-traded funds have poured capital into Solana-related products. That's not a blip. That's institutional momentum building behind the blockchain that refuses to die.

The ETF Whisper

Forget retail hype. The real story unfolds in the cold, hard data of fund flows. Three straight weeks of inflows signal a profound shift: asset managers are placing strategic bets on Solana's infrastructure, betting its high throughput and low fees will eat Ethereum's lunch in the next cycle.

Beyond the Hype Cycle

Solana's narrative transformed from 'the chain that went down' to 'the chain that came back stronger.' Developers never left. User activity surged. Now, the big money arrives, looking past memecoins to the underlying tech—a scalable L1 that actually works.

The Contrarian Calculus

Is SOL the strongest bet? It's certainly the boldest. While Bitcoin ETFs hoover up safe-haven flows, Solana's inflows represent a growth gamble. It's a wager on adoption, on applications, and on a team that somehow coded its way out of a total collapse. A classic finance move: pile into the asset everyone wrote off six months ago.

The tape doesn't lie. Twenty-one days of institutional buying creates its own gravity. Whether it's smart money or just money chasing the next shiny thing remains to be seen—after all, Wall Street's genius is often just being late with more capital.

Source: Farside Investors

Source: Farside Investors

Since launching, SOL ETFs have brought in more than $650 million in net inflows. During that same period, investors pulled more than 3 billion from Bitcoin ETFs and over 1 billion from ethereum ETFs. That kind of contrast makes Solana look like one of the strongest bets in crypto for the coming months.

Solana Price Prediction: Why $127 Dip Could Have Been A Gift

Solana is currently sitting around $141 and is once again trying to retest the $144 level, which turned into one of November’s toughest resistance zones. SOL hit this level multiple times already and has not managed to break through even once.

If the price can finally close above $144 with strength, the SOL/USDT pair could push toward $160, and from there, a revisit of the $170 area becomes possible.

If it fails again, though, we could see it drop back toward the $120 zone before going even lower, and that is the last scenario SOL bulls want to watch play out.

Could Bitcoin Hyper Compete With Solana?

While Solana wrestles with heavy volatility, failed breakouts, and a market that cannot decide whether to punish or reward its ETF flows, one project is managing to push forward with momentum that is actually holding up even in the chop.

That project is Bitcoin Hyper, and it is quietly becoming one of the strongest early-cycle plays of 2025.

Bitcoin Hyper is building a high-speed bitcoin Layer 2 powered by the Solana Virtual Machine, giving it Solana-level performance while still settling back to Bitcoin for actual security. It is the mix traders are rotating into right now: fast, scalable, and backed by Bitcoin’s base layer instead of relying on unstable L1s.

And the numbers explain why confidence is rising. The presale has already raised more than $28.9 million, which is massive considering how shaky the market has been. Early buyers have not slowed down at all, and staking rewards still sit at a heavy, making it one of the strongest yield opportunities tied to the Bitcoin ecosystem.

If the market rotates back into high efficiency ecosystems, Bitcoin Hyper does not just have momentum… it has timing.

Visit the Official Website Here