South Korea’s Stablecoin Bill Faces Dec. 10 Deadline – Lawmakers Ready to Act Alone

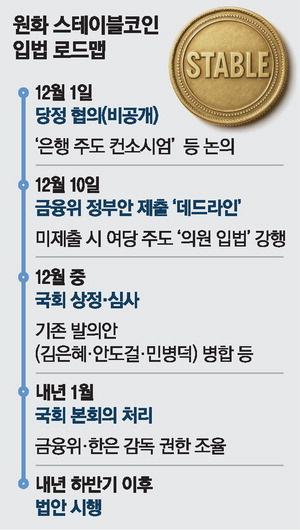

South Korea's stablecoin regulation hits a critical countdown. Lawmakers have until December 10 to pass a landmark bill—or they'll move without it.

The Regulatory Clock is Ticking

Parliament faces a hard deadline to formalize rules for digital currencies pegged to traditional assets. The proposed legislation aims to bring clarity to a market that's been operating in a gray zone, setting reserve requirements, issuer qualifications, and consumer protections.

Failure to pass the bill by the cutoff triggers a contingency plan. Key committees have signaled they're prepared to enact provisional measures, effectively bypassing the full legislative process to establish a basic regulatory framework. It's a move that highlights both the urgency of the issue and the political will to act.

Finance Gets a Crypto Reality Check

The push underscores a global trend: regulators are scrambling to catch up with an asset class that refuses to wait for permission. South Korea's approach could become a blueprint for other nations wrestling with how to oversee stablecoins without stifling innovation.

Traditional finance might scoff at the rush, but it's the same industry that took decades to implement real-time payments—a feature crypto nailed in its first white paper. The deadline isn't just about lawmaking; it's a test of whether old systems can adapt at internet speed.

Seoul Divided Over Whether Banks or Tech Firms Should Lead Stablecoin Issuance

According to reports from Seoul, the ruling party issued what it described as a final notice to financial authorities, urging them to submit the government’s proposal for the so-called “Phase 2 Legislation on Digital Assets,” which focuses specifically on stablecoin oversight.

Political and financial officials held a closed-door meeting at the National Assembly on December 1, where the biggest point of contention resurfaced: whether banks must take the lead in issuing stablecoins or whether technology firms should be allowed a more active role.

Some lawmakers have argued for a minimum 50% bank stake, citing the Bank of Korea’s long-standing warnings that privately issued digital won tokens could affect monetary policy and destabilize the financial system.

Others, including parts of the ruling party and the Financial Services Commission (FSC), prefer lowering the barrier to allow fintech participation, saying excessive restrictions could limit innovation.

The FSC later issued a public statement clarifying that no final decision had been made on whether a consortium or a 51% bank stake WOULD be permitted.

The regulator confirmed that stablecoin legislation was discussed during Monday’s policy consultation and that both sides agreed to prepare a government bill as soon as possible.

However, specifics remain unsettled, prolonging a delay that has already pushed expected timelines several times.

This debate has taken on broader urgency as rival political parties race to introduce their own drafts.

The National Assembly’s Political Affairs Committee is currently reviewing three separate bills, each proposing rules for issuance, collateral management, internal controls, and minimum capital requirements of about 5 billion won.

The bills differ on issues such as whether stablecoin issuers should be allowed to offer interest on holdings, reflecting ongoing disparities in policy direction.

New AML and Travel Rule Measures Add Pressure to South Korea’s Stablecoin Push

The pressure is further intensified by parallel regulatory developments across government. The Financial Intelligence Unit is reorganizing its anti-money laundering protocols for stablecoins and preparing research that will shape future AML guidelines.

![]() FIU has commissioned a comprehensive report for December this year; wants new AML guidelines for stablecoin issuers.#SouthKorea #StablecoinRegulationshttps://t.co/CzXbun21ia

FIU has commissioned a comprehensive report for December this year; wants new AML guidelines for stablecoin issuers.#SouthKorea #StablecoinRegulationshttps://t.co/CzXbun21ia

South Korea is also moving toward a tighter travel rule regime, with plans to extend reporting requirements to transactions under 1 million won to prevent users from bypassing identity checks.

Authorities have indicated that enhanced KYC rules and stricter oversight will accompany any new stablecoin system.

![]() South Korea will extend its crypto Travel Rule to cover sub-$700 transactions, closing a loophole used to evade identity checks.#SouthKorea #Cryptohttps://t.co/LBJKNcmMQg

South Korea will extend its crypto Travel Rule to cover sub-$700 transactions, closing a loophole used to evade identity checks.#SouthKorea #Cryptohttps://t.co/LBJKNcmMQg

Meanwhile, the Bank of Korea has expressed fresh concerns. In an October report, the central bank warned that improperly collateralized stablecoins could trigger depegging events and disrupt capital FLOW management.

It argued again that only regulated financial institutions should issue stablecoins, stressing that non-bank issuers could effectively engage in deposit-like activities without the safeguards banks must follow.

Despite regulatory disagreements, the domestic market is already moving ahead. Naver Financial has completed development of a stablecoin wallet for Busan’s Dongbaek-jeon program, which will convert the city’s prepaid local currency into a blockchain-based token.

![]() Naver Financial, the fintech arm of South Korean internet giant Naver, is preparing to roll out a stablecoin wallet in Busan.#SouthKorea #Cryptohttps://t.co/40QBNaXJ9C

Naver Financial, the fintech arm of South Korean internet giant Naver, is preparing to roll out a stablecoin wallet in Busan.#SouthKorea #Cryptohttps://t.co/40QBNaXJ9C

KakaoBank has begun building infrastructure for a KRW-denominated “Kakao Coin,” indicating growing corporate interest in digital won products. Major banks have also explored a consortium-issued stablecoin targeted for late 2025 or early 2026.

These advancements show why lawmakers are determined to meet the current legislative window.

However, the regulatory uncertainty mirrors other delays in South Korea’s digital asset agenda, including the country’s VIRTUAL asset taxation regime.

Despite being approved in 2020, Korea’s crypto tax law has been postponed multiple times and remains scheduled for 2027, with many of the required systems still incomplete.

![]() South Korea's crypto tax implementation may face fourth delay as infrastructure gaps and regulatory uncertainties persist ahead of 2027 deadline.#SouthKorea #CryptoTaxhttps://t.co/ZbbTDNBfnY

South Korea's crypto tax implementation may face fourth delay as infrastructure gaps and regulatory uncertainties persist ahead of 2027 deadline.#SouthKorea #CryptoTaxhttps://t.co/ZbbTDNBfnY

South Korea has fallen behind major economies such as the United States, the European Union, and Japan, all of which have already formalized stablecoin structures.

Industry groups warn that further delays could weaken competitiveness, especially as dollar-based tokens like USDT continue to dominate global markets.