Banks Are Rushing Into Stablecoins in 2025, Despite Adoption Being Years Away - Here’s Why

Traditional finance giants are diving headfirst into stablecoins while mainstream adoption remains a distant horizon.

The Great Banking Pivot

Major financial institutions aren't just dipping toes—they're cannonballing into stablecoin waters. JPMorgan's JPM Coin processes billions daily while BNY Mellon runs full crypto custody services. Yet consumer adoption? Still crawling at single-digit percentages.

Regulatory Chess Match

Banks navigate regulatory gray zones with one hand while deploying blockchain infrastructure with the other. The SEC watches warily as OCC greenlights limited stablecoin activities. Typical finance—building the plane while arguing about the flight manual.

Profit Over Progress

Institutional interest spikes not from blockchain idealism but cold calculation. Stablecoins slash cross-border settlement from days to seconds—and cut correspondent banking fees by 80%. Because nothing motivates banks like finding cheaper ways to move money.

The Adoption Paradox

Banks prepare for crypto winter while betting on digital spring. They're building infrastructure for technology most customers won't touch for years—the ultimate 'if you build it, they will come' gamble with shareholder money.

Why Banks Are Exploring Stablecoin Adoption in 2025

“Payments are a huge part of banks’ business,” said Paul Brody, global blockchain lead at EY, in an interview with Cryptonews.

“Now that banks are authorized to enter the market, they can serve the consumer and enterprise users that are looking for much lower costs on their payments, especially cross-border payments,” Brody added.

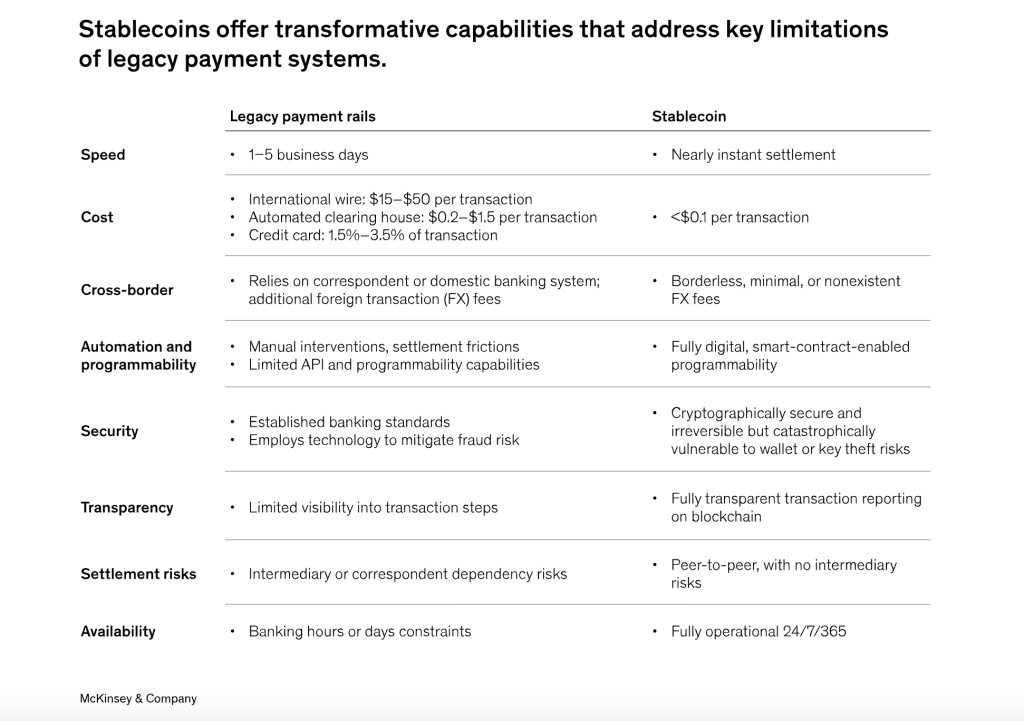

According to EY’s survey of over 250 financial services companies, reducing costs on cross-border transactions with partners and suppliers is the top priority. McKinsey & Company reports that stablecoin transactions can offer near-instant settlement, which has major implications for corporate treasury and global payments.

“Just over 50% of large financial institutions say they plan to be doing or testing this in some manner in the coming 12 months, which is an extraordinarily high rate of uptake,” Brody mentioned.

Banks Currently Looking at Stablecoin Implementation

Several banks are moving from exploration to action. On November 25, 2025, U.S. Bank announced a pilot issuing a custom stablecoin on the stellar network in collaboration with PwC and the Stellar Development Foundation (SDF).

José Fernández da Ponte, president and chief growth officer at SDF, told Cryptonews that blockchain technology makes business sense for institutions like U.S. Bank. He explained that transactions that cost thousands of dollars on legacy rails cost just a fraction of that on Stellar.

“Settlement times are also cut from days to approximately five seconds, reducing counterparty risk and intermediary fees financial institutions have to pay to MOVE money across the globe,” he added.

The Stellar network is already partnering with enterprise financial institutions like WisdomTree, Franklin Templeton, PayPal, and MoneyGram. Fernández da Ponte shared that next year, Stellar expects to see more growth in the ecosystem as institutions explore moving on-chain.

Other major banks, including Citi, Barclays, Bank of America, and more, have also announced plans to explore and potentially adopt their own stablecoins moving forward.

Beyond banks, Ripple announced that its USD-backed stablecoin RLUSD is now recognized as an Accepted Fiat-Referenced Token by Abu Dhabi’s Financial Services Regulatory Authority, allowing licensed companies to use it for permitted activities.

Compliance and trust are non-negotiables for institutional finance.

That's why $RLUSD has been greenlisted by Abu Dhabi’s FSRA, enabling its use as collateral on exchanges, for lending, and on prime brokerage platforms within @ADGlobalMarket—the international financial centre of…

Financial services giant Visa recently announced that it is expanding its stablecoin settlement capabilities across Central and Eastern Europe, the Middle East, and Africa (CEMEA) through a new partnership with digital assets platform Aquanow.

According to Visa, the integration of Aquanow’s digital asset infrastructure with Visa’s technology stack will allow issuers and acquirers across the CEMEA region to quickly settle transactions using approved stablecoins like USDC.

Adoption Takes Off, But Real Use Cases Years Away

Despite growing institutional interest, experts caution that mainstream adoption is still a few years away. Brody believes that it will take at least one to two years of network effects before banks and stablecoin usage increase.

“The benefits of stablecoins include speed, low cost, and full programmability,” he said. “But the biggest challenges are that there are still too few companies and countries connected to this expanding network and far too few foreign exchange currencies as well.”

Mike Villano, senior vice president of enterprise innovation at U.S. Bank, further noted that privacy remains a primary concern.

“One issue we hope to continue to work on with Stellar in future phases is privacy. One of the things a US Bank WOULD expect when we deliver a product to market will be to maintain the privacy of some of the balances on a blockchain.”

November also marked a turning point for the overall stablecoin sector. A report from CoinDesk published on Nov. 26 found that the total market capitalization of stablecoins contracted 1.48% to $303 billion.

The report notes that this $4.54 billion contraction marks the steepest monthly decline since the collapse of FTX in November 2022. This demonstrates a combination of stablecoin outflows and weakening digital asset prices, suggesting a broader withdrawal of liquidity and capital from the crypto markets.

The Long-term Outlook

Industry leaders remain optimistic, though. Danny Lim, co-founder of Pundi X and Pundi AI, believes that stablecoin outflows will not impact real-world use cases. Lim told Cryptonews that bank-issued stablecoins are not meant to replace USDT or USDC, but rather to change who is willing to come on board.

“If banks issue stablecoins on public or permissioned chains, merchants get the same 24/7 settlement speed and on-chain finality as today’s public stablecoins, but with a known regulated counterparty, deposit protection, full AML/KYC, and clear domestic rules behind the token,” he said.

Lim added that in regions like Turkey and South Africa, where Pundi X has been active for years, consumers are using stablecoins like USDT and USDC for everyday remittances, savings, and protection against currency swings. He explained that a bank-issued stablecoin will likely push this further by adding regulated on and off ramps, local Know Your Customer (KYC,) and a sense of safety that appeals to more traditional families and small businesses.