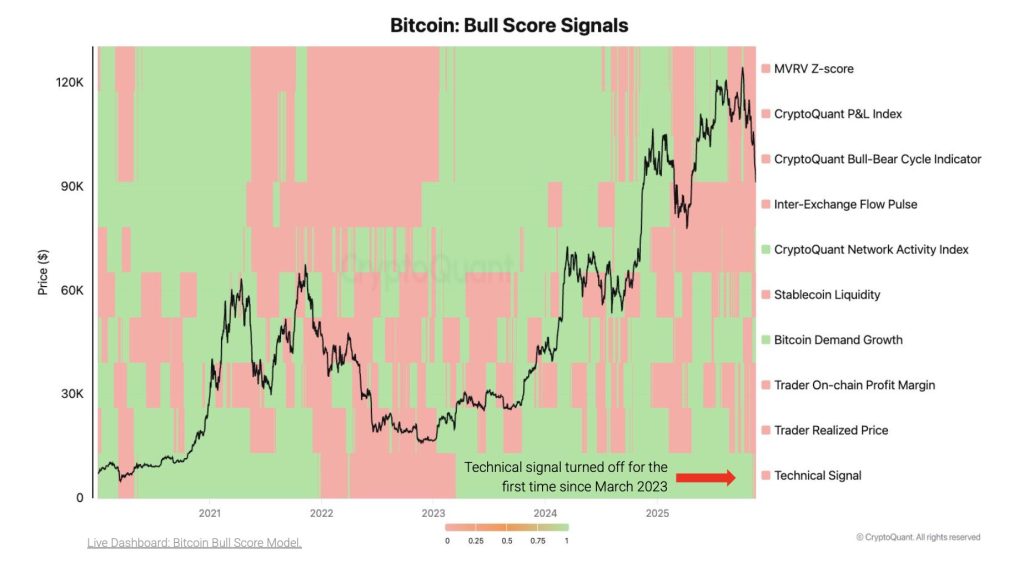

Bitcoin Plunges Into Most Bearish Territory Since 2023 - Demand Craters as Critical Support Levels Shatter

Bitcoin's foundation cracks under pressure - CryptoQuant data reveals the deepest bearish momentum in over two years.

Demand Evaporates

The digital asset's buying pressure vanishes faster than Wall Street's credibility during a market crash. Weakening institutional interest and retail pullback create the perfect storm.

Technical Breakdown

Key support levels that held strong through 2024's volatility just collapsed. The charts don't lie - this isn't a dip, it's a structural shift.

Market Reality Check

While traditional finance scrambles to understand what's happening, crypto veterans recognize this pattern. Sometimes the market needs to bleed before it can breathe again - even if it makes hedge fund managers sweat through their custom suits.

Adding to those pressures, Bitcoin has now broken below its 365-day moving average—a key trend indicator that signaled the confirmation of the 2022 bear market.

“Fundamental and technical indicators are both pointing in the same direction: we are in a bearish phase,” said a CryptoQuant analyst, noting that bitcoin managed to hold the 365-day moving average during every correction earlier in this cycle. “This breakdown is significant.”

Bitcoin has officially erased its yearly gains![]()

YTD Performance:

BTC: +0.1%

ETH: -7.2%

The market reset is real. pic.twitter.com/h1O4yKWowR

Treasury Company Demand Has Evaporated

One of the most striking shifts is the collapse of demand from Bitcoin Treasury companies—entities that earlier this year were major buyers of BTC. Many of these companies have seen their market capitalizations fall 70% to over 90%, pushing them below the value of their Bitcoin holdings. As a result, they can no longer issue new shares to raise capital and buy additional BTC.

Meanwhile Strategy—once the largest consistent buyer in the market—has sharply reduced its accumulation as its stock market valuation fell toward the value of its Bitcoin reserves.

“Strategy can’t do all the lifting in this market, and Treasury companies have effectively disappeared as a demand source,” the CryptoQuant analyst said.

Cycle Debate: End in 2025 or Extension to 2026?

Bitcoin’s past bull-bear cycles have neatly spanned four years (2014–2017 and 2018–2021), a pattern often attributed to the supply shock of halvings. The current cycle—2022 to 2025—would theoretically end this year. But some analysts argue the cycle may extend into 2026 as institutions and ETFs play a larger role.

CryptoQuant warns against assuming longevity simply because buyers are institutional. “Demand from long-term-oriented institutions can also dry up, just as we saw with Treasury companies,” the analyst noted.

The firm argues that Bitcoin cycles are ultimately about demand waves, not halving dates. In this cycle, the biggest demand catalysts—Trump’s election victory and the surge of Bitcoin Treasury companies—are already behind the market.

Support Holds, But Resistance Strengthens

Despite a 28% drawdown, Bitcoin is holding NEAR major support around $90,000–$92,000, and bear markets can still produce sharp relief rallies. But with the breakdown of the 365-day moving average, that level—now near $102,600—has become a major resistance zone.

“Bitcoin is vulnerable, but not doomed,” the CryptoQuant analyst said. “Support is strong, yet the next bullish catalyst remains unclear.”