Bitcoin Roars Back: Laser Digital Warns Short-Squeeze Fueling Post-Selloff Rally

Bitcoin shakes off weekend jitters with a vengeance—traders caught off guard as shorts scramble.

Laser Digital sounds the alarm: A coiled spring of pent-up demand could trigger a violent short squeeze. The crypto market's version of 'be careful what you wish for'—especially for those betting against digital gold.

No mercy for bears as BTC bounces: classic crypto volatility meets Wall Street's worst instincts. Just another Monday in the casino.

Laser Digital, part of the Nomura Group, said the cooling of spot-driven selling pressure has given the market “some room to stabilise” after a volatile few sessions. Still, derivatives positioning suggests the market remains fragile, and the next major move may depend on whether Bitcoin can reclaim key levels in the days ahead.

Perp Selling Drove the Move; Short Squeeze Setup in Play

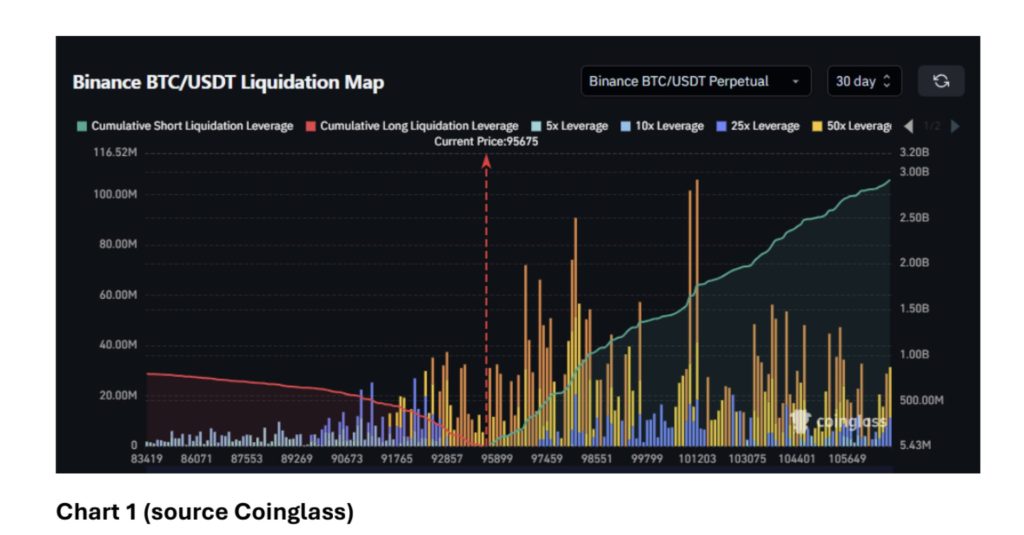

The desk highlighted that a “decent amount” of open interest was added during the selloff, pointing to perp-led pressure rather than spot liquidation as the primary driver. That dynamic is visible in the liquidation heatmap, which shows a heavy concentration of short-side leverage at current levels—creating conditions ripe for a squeeze should prices push higher.

Chart 1 (Coinglass) illustrates this asymmetry clearly: cumulative short-side liquidation leverage continues to build, while long-side leverage thins out above spot. According to Laser Digital, “a sustained move back above 98.5k WOULD be an important confirmation for bulls and could trigger meaningful short covering.”

Trading volumes remain elevated, though slightly below previous highs, while risk reversals continue to lean toward puts. The options term structure also remains steep, reinforcing the defensive positioning that has characterised crypto markets through November.

Given this backdrop, Laser Digital said traders looking to express a bullish view may find the cleanest expression in the options market. “Owning front-end topside optionality is likely a cleaner expression,” the desk wrote, noting that short-dated gamma could perform well if forced liquidations accelerate, and that call options continue to trade at a relative discount under current skew.

Macro Picture Clouded by U.S. Data Delays

Beyond crypto-specific flows, the macro outlook remains uncertain. The U.S. government shutdown has disrupted several official data releases, including the closely watched nonfarm payrolls (NFP) and consumer-price index (CPI) reports. The Bureau of Labor Statistics “has yet to provide clear guidance” on the timing of updated releases, Laser Digital noted, leaving the market to operate with incomplete information.

Broader sentiment took a turn after Meta’s Oct. 29 earnings, which reinforced investor concerns that AI-related capital expenditure may shift from being a growth engine to a potential drag on technology margins. That shift has weighed on risk appetite across equities and digital assets.

This week brings one major catalyst: Nvidia’s earnings, due Wednesday. With the chipmaker increasingly viewed as a barometer for AI spending and enterprise technology demand, Laser Digital said the results are likely to “shape the next move in macro,” with knock-on effects for bitcoin’s momentum and volatility.

For now, traders are watching whether bitcoin can reclaim the $98.5k level and absorb the build-up of Leveraged shorts. If so, the setup described by Laser Digital implies that the next significant move could be sharply higher—not because fundamentals have shifted, but because positioning leaves bearish traders vulnerable.