China Claims U.S. Behind $4B Bitcoin Heist – Unpacking the Crypto Cold War

Blockchain's biggest whodunit just went geopolitical. China's allegations of U.S. involvement in a $4 billion Bitcoin hack injects fresh tension into the digital asset space—right as institutional money floods in.

The accusation lands like a grenade in crypto markets already juggling regulatory scrutiny and ETF mania. Beijing's claims, while unproven, spotlight how nation-states now treat blockchain exploits as potential weapons.

Meanwhile, Wall Street keeps stacking sats—because nothing says 'risk management' like doubling down during an international incident. The hack's aftermath could accelerate calls for decentralized custody solutions as traders weigh sovereignty against security.

One thing's clear: When $4B vanishes, the only certainty is the lawyers getting paid.

Did Washington Crack the LuBian Hack? Blockchain Forensics Hint at a Hidden Operation

Chinese commentators and blockchain analysts argue that the seized Bitcoin may be the same as the LuBian funds, implying American authorities could have accessed them years earlier through a covert operation.

Blockchain forensics from Arkham Intelligence and Elliptic show that wallet addresses in the DOJ’s indictment match those linked to the 2020 LuBian hack.

On-chain records indicate that on the day of the attack, LuBian’s main wallet transferred 127,272 BTC to an unknown address, nearly the same amount later seized by U.S. officials.

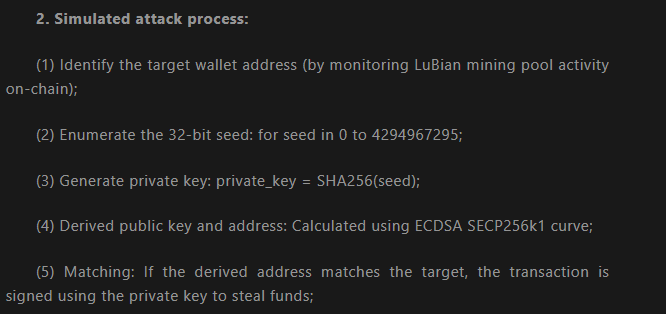

The 2020 breach exploited a flaw in LuBian’s 32-bit pseudo-random key generator, similar to the “MilkSad” cryptographic flaw revealed in 2023.

The defect made it possible for attackers to brute-force thousands of wallet keys within hours, draining more than 90% of LuBian’s holdings.

For years, the stolen Bitcoin remained unmoved. LuBian and Chen Zhi sent over 1,500 messages via Bitcoin’s OP_RETURN function in 2021 and 2022, pleading with the hackers to return the assets and offering a ransom. No response was ever received.

In June 2024, blockchain trackers observed renewed movement from the dormant wallets. About 127,000 BTC were transferred to new addresses, later tagged by Arkham as belonging to the U.S. government.

The DOJ’s announcement of the seizure came months later, a sequence that Chinese observers say raises questions about when and how the U.S. obtained access to the private keys.

The DOJ has not disclosed its technical methods but claims the assets were “linked to illicit operations and laundered through mining networks operating in China and Iran.”

However, on-chain data reviewed by analysts suggests the funds originated directly from LuBian’s compromised wallets.

Dormant LuBian Wallets Move $3.1B in Bitcoin Amid U.S. Enforcement Pressure

Adding to the confusion, LuBian-linked wallets have shown new activity since the DOJ’s announcement. On October 15, blockchain monitoring firm Lookonchain reported that a long-dormant address moved 11,886 BTC (about $1.3 billion) to several new wallets.

A week later, on October 22, another 15,959 BTC (worth $1.83 billion) was transferred to four additional wallets, according to OnChainLens.

![]() LuBian-linked wallets MOVE 15,959 BTC worth $1.83B, marking the second transfer in two weeks after the Oct 15 movement of 11,886 BTC worth $1.3B following the DOJ case.#Bitcoin #Lubian #DOJhttps://t.co/SLHs8g9uJF

LuBian-linked wallets MOVE 15,959 BTC worth $1.83B, marking the second transfer in two weeks after the Oct 15 movement of 11,886 BTC worth $1.3B following the DOJ case.#Bitcoin #Lubian #DOJhttps://t.co/SLHs8g9uJF

Analysts debate whether the transfers are defensive moves or reallocations ahead of potential liquidation.

All related wallets remain sanctioned, and Chen Zhi’s whereabouts are currently unknown. The LuBian case has become a cautionary tale for DeFi and crypto infrastructure security, and the hack has become a reference point for crypto’s early security failures.

The incident shows the dangers of weak random number generation, also affecting firms like Wintermute, which lost $160 million in 2022 due to similar vulnerabilities.

Meanwhile, both the U.S. and the U.K. have been involved in separate large-scale Bitcoin seizures tied to Chinese-linked operations.

In a parallel case, British authorities are managing a £5 billion ($7.2 billion) Bitcoin trove confiscated in 2018 from Chinese fraud suspects.

The U.K. High Court is currently deciding whether to return the funds to 130,000 Chinese investors or retain most of the proceeds for the government.