Tether Poaches HSBC Metals Veterans in Bold Gold Play as Prices Soar Past $4,100

Tether makes power move—snagging HSBC's top metals brass to crack the gold market wide open.

Why now? Because $4,100 gold screams 'institutional FOMO.'

Gold's rally meets crypto's muscle—Tether's betting stablecoins and bullion can tango.

Wall Street's watching: will this be a masterstroke or just another shiny distraction?

Bonus jab: Because nothing says 'stable' like a volatile asset pegged to... another volatile asset.

HSBC Metals Leaders Join Tether’s Bullion Buildout

Vincent Domien is HSBC’s global head of metals trading and a board member of the London Bullion Market Association. Mathew O’Neill leads precious metals origination for Europe, the Middle East, and Africa. Both executives are serving notice periods before moving to Tether, according to the report.

HSBC runs a large precious metals franchise spanning futures, vaulting, and global logistics. Hiring two senior figures from that platform represents an effort to build internal execution and sourcing rather than relying only on external dealers.

Tether’s reserves include short-dated United States Treasuries alongside bullion. The firm also issues Tether Gold, or XAUT, with roughly $2 billion in circulation that its website says is backed by about 1,300 bars. Those tokens are separate from the gold held within USDT reserves.

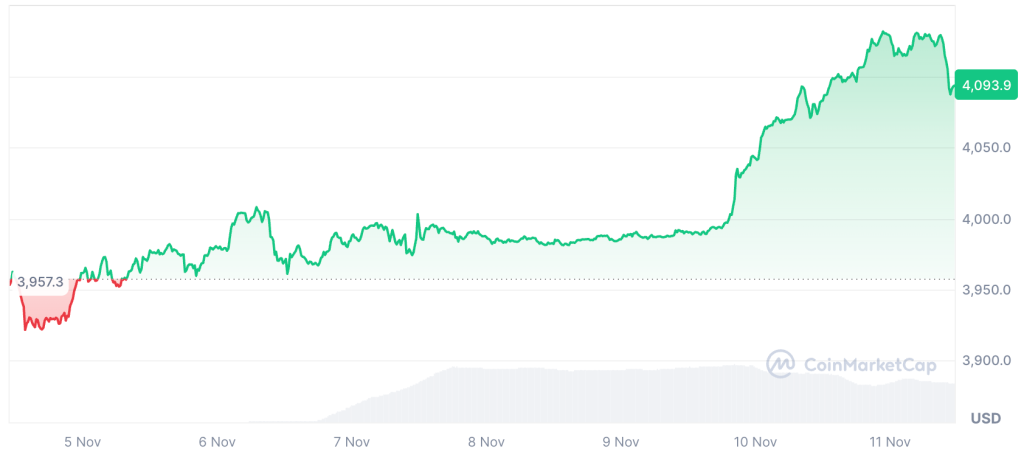

XAUT Price (Source: CoinMarketCap)

A larger in-house metals function can change how purchases are timed, hedged, and settled. Execution quality, storage arrangements, and insurance terms become central for an issuer that must manage liquidity needs while maintaining clear reporting on holdings and valuation.

Gold Reserves And Market Effects For Stablecoins

Gold’s rally has been supported by central bank buying and demand for stores of value. A nonbank buyer with steady dollar liquidity can influence flows during active windows, including lending markets, lease rates, and the balance between futures and physical delivery.

Gold’s scorching rally is likely to take prices above the $5,000 an ounce mark next year, driven mainly by buying from central banks in emerging-market economies https://t.co/ezfQQ3YEes

— Bloomberg (@business) November 10, 2025For stablecoin users, reserve composition and disclosure sit at the core. More bullion introduces custody and transport considerations, so reporting on bar lists, audit procedures, and pricing sources helps users assess how metal supports the balance sheet through different market conditions.

XAUT and USDT serve different functions. XAUt offers exposure to allocated bars, while USDT targets dollar parity for payments and trading. Keeping those tracks distinct in disclosures reduces confusion about how each product is backed and how redemptions interact with underlying assets.

Future attestations and reserve updates will show whether the metals sleeve grows further and how Tether integrates the hires into daily operations. Any shift in mix across Treasuries, gold, and other assets will be watched for effects on liquidity, settlement, and risk controls.