Ethereum Whales Gobble 400K ETH in 72-Hour Feeding Frenzy - $1.37B Buying Spree Signals Major Accumulation

Whale alert: Ethereum's biggest players just went on a shopping spree that would make BlackRock blush.

The Feeding Frenzy

Nearly 400,000 ETH vanished from exchanges faster than you can say 'gas fees.' That's over $1.37 billion in digital gold scooped up while retail investors were still checking Twitter sentiment.

Smart Money Moves

These whales aren't just dipping toes - they're diving headfirst into Ethereum's ecosystem. The timing? Impeccable as always. While Wall Street analysts debate whether crypto is a 'real asset,' the people actually making money keep stacking ETH like it's going out of style - which, given the numbers, it definitely isn't.

Market Impact

When whales this size move, the entire ocean feels it. This level of accumulation typically precedes major price movements - though whether that's up or down depends on whether you're holding bags or making them.

Remember: In crypto, the big fish eat first - everyone else gets the crumbs and pays the network fees.

Source: Lookonchain

Source: Lookonchain

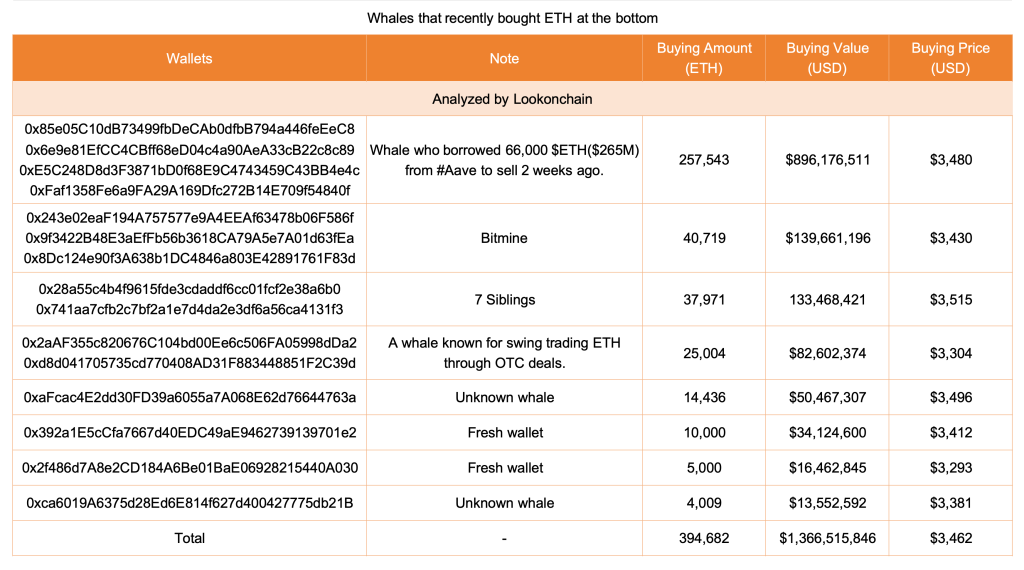

Whales keep accumulating $ETH — over the past 3 days, many whales have collectively bought 394,682 $ETH($1.37B).https://t.co/RhDYQM0yl6 pic.twitter.com/3qMSojTSTu

— Lookonchain (@lookonchain) November 6, 2025Per the detailed analysis, the largest buyer was an address that had previously borrowed 66,000 ETH from Aave. The whale has now repurchased 257,543 ETH at approximately $3,480, for a total of $896 million.

Besides, Bitmine, 7 Siblings, OTC traders and various new wallets have increased their ETH positions recently during the market correction.

Analysts Bullish on ETH’s Long-Term Prospects

Analysts are closely watching the recent massive whale accumulation, as they often precede significant market shifts. Analysts believe Ethereum could soon prepare for a strong rebound to new all-time highs, targeting up to $10,000.

Ethereum is currently trading at 3,421 at press time, a 3.72% increase over the past 24 hours. On the technical front, the momentum indicators show a bullish uptrend following recent short liquidations and institutional interest signals.

According to Indian crypto exchange CoinDCX, ETH is eyeing a promising $4,800 target and would soon hit $5K.

“Backed by network scalability improvements and rising institutional adoption, Ethereum price prediction models indicate a potential 25-30% upside by late 2025,” the exchange analysts wrote in a blog.

Lacie Zhang, Research Analyst at Bitget Wallet told Cryptonews that crypto markets are entering what can best be described as a “cautious calm.”’

“If macro data trends favorably, Ethereum may approach $4,200,” Zhang noted, adding that several factors could shape near-term direction.

Institutional Catalysts Have Bullish Impact on ETH

With anticipation built for December’s Fusaka upgrade, ETH has also attracted strong institutional interest. For instance, the on-chain data noted that Bitmine has added 40,719 ETH, worth nearly $140 million.

Analyst Ted Pillows noted that Bitmine’s ongoing ETH buys, reportedly ranging between $200 million and $300 million weekly, may tighten supply faster.

“A few more whales like BitMine, and the market’s tone could change overnight,” he said.

According to Zhang, the consolidation period is “constructive.”

“It flushes out leverage and speculative excess, creating the foundation for long-term growth and institutional re-entry.”