UBS Shatters Barriers: Tokenized Fund Transaction via Chainlink’s DTA Ignites On-chain Finance Revolution

Traditional finance just got its blockchain wake-up call.

UBS executes landmark tokenized fund transaction using Chainlink's Digital Token Architecture - cutting through legacy settlement delays like a hot knife through butter.

The New Architecture

Chainlink's DTA platform bypasses traditional intermediaries, slashing transaction times from days to minutes. No more waiting for paperwork to shuffle between custodians and transfer agents.

On-chain Verification Revolution

Real-world asset tokenization meets bulletproof oracle security. Every transaction gets cryptographically verified on-chain - take that, traditional audit trails.

Institutional Adoption Accelerates

Major financial players are finally realizing what crypto natives knew years ago: blockchain doesn't just reduce costs, it redefines what's possible in finance.

Meanwhile, traditional banks are still trying to figure out how to make their legacy systems talk to each other without crashing. The future arrives whether you're ready or not.

UBS Tokenize and DigiFT Advance On-chain Fund Operations

The live transaction was executed through UBS Tokenize, the bank’s digital asset initiative, in collaboration with DigiFT, a regulated decentralized exchange for real-world assets.

Together, they showcased how fund operations—including order taking, execution, settlement, and data synchronization—can be seamlessly automated on blockchain rails.

The transaction involved the UBS USD Money Market Investment Fund Token (uMINT), a money market investment built on ethereum distributed ledger technology.

Using the Chainlink DTA standard, DigiFT acted as the on-chain fund distributor, successfully completing a subscription and redemption request for uMINT. This demonstration represents the first in-production proof of concept for automating fund lifecycles entirely on-chain.

Efficiency, Transparency, and Real-Time Reconciliation

The new tokenized fund workflow provides a secure, compliant, and scalable model for financial institutions to handle investment fund operations in real time. By standardizing communication between on-chain and off-chain systems, the DTA protocol ensures seamless reconciliation, transparency, and operational efficiency.

“This transaction represents a key milestone in how smart contract-based technologies and technical standards enhance fund operations and the investor experience,” said Mike Dargan, Group Chief Operations and Technology Officer at UBS.

“Through our UBS Tokenize initiative, we are committed to fostering innovation and applying our DEEP expertise to support the development of digital strategies and products that meet our clients’ evolving needs,” adds Dargan.

Institutional-Grade Blockchain Integration

“This industry milestone with UBS and DigiFT shows how Chainlink enables secure, compliant, and scalable end-to-end workflows for tokenized assets, setting a new benchmark for institutional finance on-chain,” said Sergey Nazarov, Co-Founder of Chainlink.

“As the authorized on-chain fund distributor for uMINT, we demonstrated how fund operations can be executed and reconciled on-chain with real-time visibility. Leveraging the Chainlink DTA technical standard enables seamless subscription and redemption workflows directly integrated with institutional custody,” said Henry Zhang, Founder and Group CEO of DigiFT.

Setting a Benchmark for Tokenized Institutional Finance

UBS’s execution of the first tokenized fund transaction marks an advancement in the digital transformation of capital markets.

By integrating Chainlink’s standardized infrastructure and DigiFT’s on-chain fund distribution, UBS said it has proven that regulated institutions can operate efficiently, transparently, and securely within blockchain ecosystems—paving the way for a new era of tokenized finance.

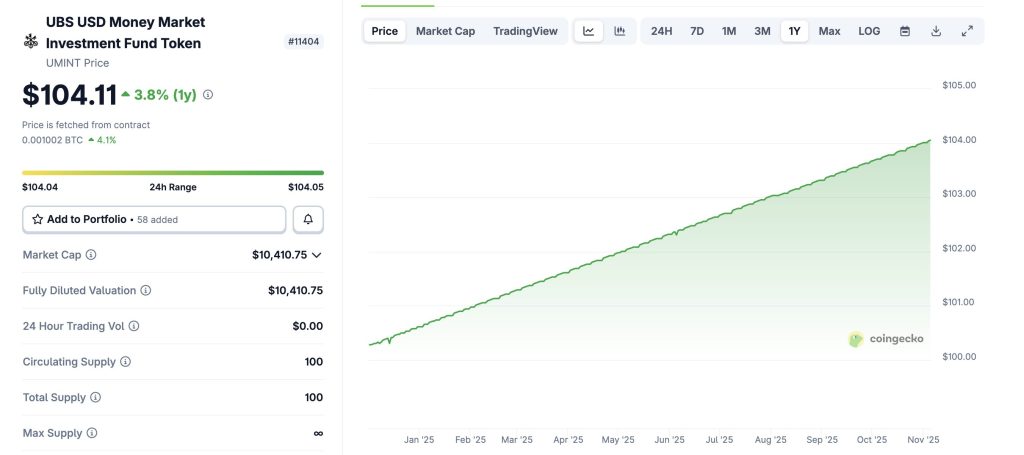

UBS USD Money Market Investment Fund Token Price Action

The UBS USD Money Market Investment Fund Token (uMINT), a blockchain-based version of the UBS USD Money Market Fund, is emerging as a model for how traditional financial products can transition into the digital asset era.

According to the latest data from CoinGecko, uMINT is trading at $104.11, up 3.8% over the past year, reflecting the stable yield characteristics typical of money market instruments.