XRP Smashes Records with 81.2% November Returns - Can 2025 Deliver Another Blockbuster Performance?

XRP just delivered a staggering 81.2% average return last November - making traditional investments look like pocket change.

The Million-Dollar Question

With crypto markets heating up again, everyone's wondering if XRP can repeat last year's explosive performance. The numbers don't lie - 81.2% monthly gains would make even the most seasoned Wall Street traders blush.

Market Momentum Building

Trading volumes are surging as investors position themselves for what could be another monumental run. While traditional finance struggles with single-digit returns, XRP's historical performance suggests we might be in for another wild ride.

Just remember - past performance doesn't guarantee future results, but in crypto land, who needs guarantees when you've got 81.2% monthly returns? Traditional finance is still trying to figure out how to pronounce 'blockchain' while digital assets are rewriting the rulebook on wealth creation.

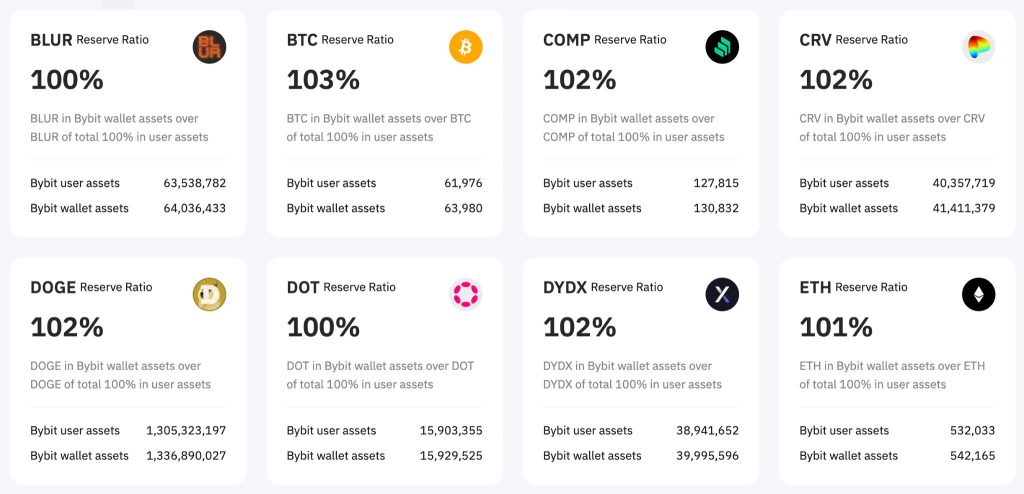

Source: Bybit

Source: Bybit

holdings declined even more steeply, falling 5% to 542,200 ETH, a loss of 28,549 coins.

Meanwhile, user USDT balances increased by 27.89% to approximately 6.389 billion, a rise of 1.393 billion.

The exodus from risk assets came as Bitcoin hovered near $108,000 and Federal Reserve Chair Jerome Powell indicated a slower path to policy relief.

Exchanges Maintain Strong Reserve Ratios Despite Asset Shift

Both platforms reported healthy reserve coverage despite the changes in user holdings’ composition.

Bybit maintained a 103% reserve ratio for bitcoin and a 101% reserve ratio for Ethereum, ensuring wallet balances exceeded user liabilities across all major tokens.

USDT reserves reached 110%, reflecting the platform’s ability to accommodate surging stablecoin demand during the flight to safety.

Gate released figures as of October 28 showing total reserves of $11.676 billion with an overall reserve ratio of 124%.

BTC reserves stood at 24,833 coins against user balances of 18,537, pushing the excess reserve ratio from 33.48% to 33.96%.

ETH reserves climbed to 419,096 tokens, lifting the excess ratio from 23.58% to 25.93%. USDT reserves grew to approximately 1.58 billion, covering user holdings of around 1.33 billion with an 18.74% buffer.

Reserve ratios for altcoins, including GT, DOGE, and XRP, all exceeded 100%, reaching 150.98%, 108.12%, and 116.66% respectively.

Gate’s reserves now cover nearly 500 types of user assets, the company said, using a Merkle Tree and zk-SNARKs algorithm for verification.

Market Pressure Mounts as Whales Move Coins and Retail Fades

Bitcoin slipped below $108,000 early Monday, extending a risk reset that accelerated late last week.

The pullback snapped October’s “” narrative, which traders now reframe as “” as they head into November.

Ether fell 3.8% to $3,737 while XRP dropped 3.1% to $2.43, dragging total crypto market capitalization down 3.1% to $3.69 trillion.

Thin holiday trading, with Tokyo closed for a public holiday, amplified intraday swings during the early Asian hours, according to a Cryptonews report.

![]() Bitcoin slipped below $108K in early Asia trade as fading Fed rate-cut hopes and Powell’s caution over a December MOVE ended its “Uptober” streak, keeping traders on edge.#bitcoin #CryptoMarket https://t.co/5jdPnMu9ZA

Bitcoin slipped below $108K in early Asia trade as fading Fed rate-cut hopes and Powell’s caution over a December MOVE ended its “Uptober” streak, keeping traders on edge.#bitcoin #CryptoMarket https://t.co/5jdPnMu9ZA

Elevated leverage built through October left long positions vulnerable, and as prices slipped, forced liquidations pushed spot levels lower.

Traders cited fading confidence in a faster easing cycle and a stronger dollar as the immediate catalysts for the selloff.

Large holders added to the selling pressure.

According to a latest Cryptonew report, on-chain data from Lookonchain shows that the pseudonymous whale BitcoinOG deposited roughly 13,000 BTC, worth $1.48 billion, to Kraken since October 1, including 500 BTC on November 2.

Early adopter Owen Gunden transferred 3,265 BTC, valued at $364.5 million, to Kraken since October 21, reactivating wallets that had been dormant for years.

Another Bitcoin OG, known for shorting Bitcoin during major swings, reportedly earned nearly $197 million by timing the October 11 crash.

Retail participation continued its steep decline. CryptoQuant data shows daily inflows from small holders to Binance have collapsed from around 552 BTC in early 2023 to just 92 BTC currently, a drop of more than 80%.

The 90-day moving average has declined by over five times since spot ETFs were launched in January 2024, as retail investors shifted to ETF products or moved into long-term holdings, leaving institutional players and corporate treasury strategies to dominate market flows.

Yet, even institutional appetite appears selective as they face sustainability challenges. “When digital asset treasury companies trade below NAV, that’s not a bubble bursting, that’s the market’s inability to price infrastructure during a phase transition,” said Eva Oberholzer, Chief Investment Officer at Ajna Capital.

“This is exactly what happened with internet infrastructure companies in 2001.” She noted that public equity markets are pricing digital asset treasury companies based on current cash flows.

She added that strategic buyers price them based on future utility value, creating systematic undervaluation currently, a pattern reminiscent of PayPal trading below its cash value in 2002 before surging 400% within eighteen months.