Australian Crypto Adoption Outpaces US, Data Shows

Australia surges ahead in cryptocurrency adoption, leaving the United States in its digital dust.

Down Under's Crypto Revolution

Recent market data reveals Australian investors are embracing digital assets at a faster clip than their American counterparts—proving once again that when it comes to financial innovation, sometimes the biggest moves come from the most unexpected places.

While Wall Street analysts debate regulatory frameworks, Aussie traders are busy stacking satoshis and building portfolios that would make traditional bankers nervous.

Market analysts note this acceleration mirrors global trends toward digital asset diversification, though Australia's specific regulatory environment appears particularly conducive to crypto growth.

Another case of the early bird catching the worm—or in this case, the kangaroo hopping ahead while the eagle's still preening its feathers.

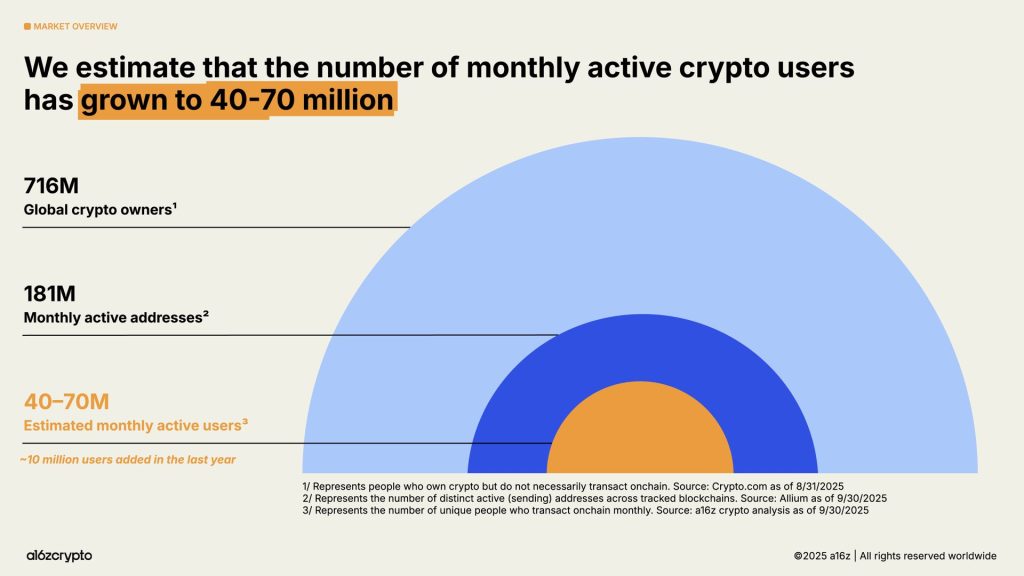

Source: a16z

Source: a16z

Australia Leads Developed Nations in Crypto Trading Activity

Australia and South Korea lead developed nations in token-related web traffic, while emerging markets like Argentina, Colombia, India, and Nigeria drive mobile wallet growth, with Argentina experiencing a 16-fold increase over three years amid an escalating currency crisis.

The report reveals fundamental shifts in crypto’s maturity, with traditional financial institutions including Visa, BlackRock, Fidelity, and JPMorgan Chase offering or launching crypto products alongside tech challengers like PayPal, Stripe, and Robinhood.

Blockchains now process over 3,400 transactions per second, representing 100-fold growth in five years, while stablecoins power $46 trillion in annual transactions, rivaling Visa and PayPal.

Australia’s regulatory framework has evolved to support this growth, with draft legislation released in September proposing penalties of up to 10% of annual turnover for digital asset platforms that breach new rules.

The proposal requires exchanges to secure an Australian Financial Services License, with firms facing fines of A$16.5 million, three times the benefit gained, or 10% of annual turnover for misleading conduct and unfair contract terms.

The consultation period for this draft law closes today, October 24.

Stablecoins and Institutional Investment Drive Mainstream Adoption

Stablecoins have done $46 trillion in total transaction volume over the past year, up 106% from the previous year, with adjusted figures showing $9 trillion in the last 12 months, up 87%.

Monthly adjusted stablecoin transaction volume approached $1.25 trillion in September 2025 alone, with activity largely uncorrelated with broader crypto trading volume.

The total stablecoin supply reached a record high of over $300 billion, with Tether and USDC accounting for 87% of that total.

Back in September, Australia’s securities regulator, ASIC, granted class relief for intermediaries distributing stablecoins issued by licensed Australian Financial Services providers, exempting them from separate market, clearing, and settlement licenses until June 2028.

Catena Digital Pty Ltd became the first issuer to benefit from its AUDM stablecoin, with ASIC planning to extend relief to other licensed issuers.

The temporary relief addresses commercial viability concerns raised during consultation, with stablecoin issuers indicating distribution WOULD not be viable without intermediary relief.

However, security remains a global concern, with Mitchell Amador, CEO of Immunefi, telling Cryptonews that “unless we bring hack rates below 1%, stablecoins will remain unbankable, and we’ll be subsidizing cybercrime for decades.”

Additionally, exchange-traded products drove institutional investment, with on-chain crypto holdings (Bitcoin and Ethereum) totaling over $175 billion today, up 169% from $65 billion a year ago.

BlackRock’s iShares Bitcoin Trust has been cited as the most traded Bitcoin exchange-traded product launch of all time.

Publicly traded digital asset treasury companies now collectively hold about 4% of total Bitcoin and ethereum in circulation, with these entities combined with exchange-traded products holding around 10% of both token supplies.

Pension Fund Push Signal Long-Term Growth

Australia’s $2.8 trillion pension pool, known as superannuation, has emerged as a major target for crypto adoption, with Coinbase and OKX rolling out products to steer retirement funds into digital assets.

Self-managed superannuation funds now account for a quarter of the pension system, with crypto exposure jumping sevenfold since 2021 to A$1.7 billion.

Coinbase is preparing to launch a dedicated SMSF service with over 500 investors already on its waiting list. Meanwhile, OKX launched a similar product in June that has seen demand exceed expectations, according to Australian CEO Kate Cooper.

![]() Crypto exchange @Gemini has launched a fully localized operation in Australia, marking its latest MOVE to expand across the Asia-Pacific region.#Gemini #Cryptohttps://t.co/mqKIIcLRNl

Crypto exchange @Gemini has launched a fully localized operation in Australia, marking its latest MOVE to expand across the Asia-Pacific region.#Gemini #Cryptohttps://t.co/mqKIIcLRNl

Earlier this month, crypto exchange Gemini also launched a fully localized operation in Australia, registering with AUSTRAC to operate as a licensed digital currency exchange.

The launch follows Gemini’s Nasdaq debut in September after raising $425 million in an initial public offering, with the Winklevoss brothers retaining 94.5% of voting power.