China Emerges as Third-Largest Bitcoin Mining Powerhouse - Here’s Why It Changes Everything

China's crypto mining operations just flipped the global power dynamics - securing the third-largest Bitcoin mining footprint worldwide.

The Mining Metamorphosis

While regulators elsewhere debate hypothetical frameworks, Chinese miners are quietly building industrial-scale operations that now command significant global hash rate share. Third-largest positioning isn't just a statistic - it's a strategic foothold in the infrastructure layer of digital finance.

Geographic Arbitrage in Action

Cheap energy, established manufacturing ecosystems, and operational expertise create the perfect storm for mining dominance. Unlike traditional finance where location matters less in digital markets, mining profitability lives and dies by geographic advantages - and China's playing that game better than most.

The Infrastructure Play Everyone Missed

While Wall Street analysts obsess over price predictions, the real money in crypto has always been in picking the picks and shovels. Mining operations represent the physical backbone of decentralized networks - and controlling that backbone offers influence that transcends mere token ownership.

Global hash rate distribution just got a lot more interesting - and for once, the traditional financial centers aren't calling the shots. Maybe that's why legacy institutions still treat crypto like a speculative toy while the real builders are busy securing the network's foundation.

Source: Luxor

Source: Luxor

China Leads in Global Bitcoin Mining

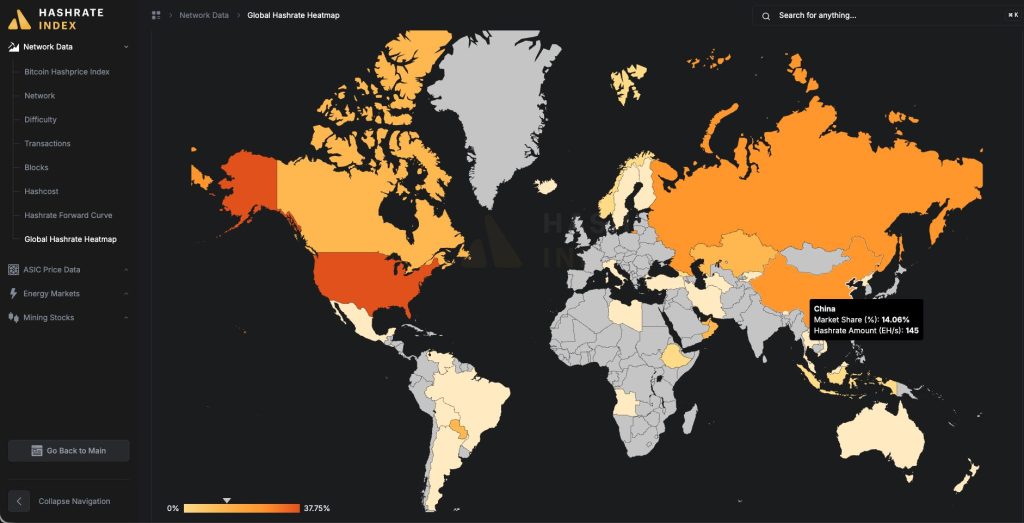

Kaan Farahani, research associate at Luxor, told Cryptonews that Luxor’s Global Hashrate Map estimates the geographic distribution of bitcoin mining activity across the world.

“The map provides weighted hashrate concentration across regions by incorporating mining pool data, ASIC trading flows, and firmware adoption trends,” Farahani said.

Based on the recent data, China is the third-largest contributor globally to Bitcoin mining, just behind the U.S. and Russia.

Luxor’s findings do not show where specifically the hashrate resides. According to Miner Weekly, multiple sources across the ASIC supply chain have pointed to one possible destination, which is Xinjiang. The region’s relative isolation and abundant energy resources have made it a longtime hub for Bitcoin mining before China’s ban in 2021.

China Reveals Underground Bitcoin Mining Operations

While China’s continuation of Bitcoin mining may not come as a complete shock, this illustrates the murky, underground nature of the mining industry.

Kent Halliburton, CEO and co-founder of Bitcoin mining platform Sazmining, told Cryptonews that he is not surprised to see mining still occurring in China.

“This is one of the beauties of Bitcoin mining. It’s a cypherpunk way to generate Bitcoin, meaning that as long as you have electricity and hardware, you can generate Bitcoin for yourself. It’s tough to shut down mining on the outskirts, and that is why I believe the hashrate we see in China continues to exist,” Halliburton said.

Other regions where Bitcoin mining is considered illegal are also showing signs of growth. For example, Farahani noted that Luxor’s Hashrate Map gives insight into Iran, estimating that around 8 EH/s of hashrate is operational in the region as of Q4-2025. This represents 0.75% of global market share.

According to Halliburton, Iran is another good example of where Bitcoin mining has been occurring, but has largely been illegal. Iran initially banned Bitcoin mining in May of 2021 for four months. The region’s second ban took place in December 2021. Prior to this, Iran’s bitcoin mining was estimated to make up between 4% and 8% of the global BTC network.

“Essentially, any country with stringent controls on capital outflows is likely to restrict or attempt to ban Bitcoin mining,” Halliburton said. “But if you have power, you can generate Bitcoin as long as you have the right hardware to harness it. That means that if you’re trying to stem the FLOW of capital from leaving your country, you have a way to do that with Bitcoin mining.”

China’s Concerning Mining Infrastructure Empire

In addition to mining, recent findings from Bitcoin solutions manufacturer Auradine found that over 95% of Bitcoin ASIC mining equipment is manufactured by Chinese firms like Bitmain, MicroBT, and Canaan. Auradine’s report notes that Chinese equipment manufacturing poses a major threat to U.S. national security and key infrastructure.

Sanjay Gupta, chief strategy officer at Auradine, told Cryptonews that China’s mining infrastructure operations are concerning for a number of reasons. For instance, he mentioned that there are over a million Chinese-based Bitcoin mining machines with foreign firmware connected to the U.S. electrical grid.

“This poses a potential serious cybersecurity risk to the electrical grid across multiple states,” Gupta said. “If there is embedded software in these Chinese miners that is triggered for a coordinated cyber attack to drive a large number of miners to simultaneously go in rapid over- or underdrive, this could cause a catastrophic failure of the U.S. electrical grid.”

And they WOULD have gotten away with it too, if not for President Xi and President Putin.

China, Russia and co-operative nations within BRICS have enough control over BTC mining repositories to bring Bitcoin to ZERO.

The U.S. will not get away with this. pic.twitter.com/Ylx81nBFw0

Gupta added that the BTC mining hardware supply being highly concentrated poses a major risk of a potential 51% takeover of the bitcoin protocol in a hostile geopolitical situation. This has become even more of a threat with the recent tariffs imposed on China by President Trump, which could rise to 155% in the coming weeks.

“This could cause a dramatic impact on the value of BTC and Ripple effect in financial markets,” Gupta remarked.

Is China A Threat To Bitcoin Miners?

It’s clear that Bitcoin mining and manufacturing continue to take place in China despite bans. So what does this mean for miners based in regions where BTC mining is considered legal?

According to Farahani, Luxor is unaware of challenges or threats based on China’s mining operations.

On the other hand, Gupta believes that Chinese firms supplying mining equipment will create complexities for other regions.

“To combat this, we need to enable strong U.S.-based Bitcoin mining suppliers that can drive continuous innovation and performance for mining operations,” he said.

The ongoing trade tensions between the US and China are having a significant and costly impact on the Bitcoin mining industry. According to a new report from The Miner Mag, rising tariffs on mining equipment have exposed American companies to substantial financial liabilities.…

— Dr Martin Hiesboeck (@MHiesboeck) August 21, 2025Gupta added that moving forward, Bitcoin miners should have technology that allows energy demand response with the ability to rapidly increase or decrease power consumption based on the needs of a state or region’s electrical grid.

In the meantime, the architecture and legacy of mining in China will likely continue to loom over the global network. In crypto’s ever‑shifting world, China isn’t gone—but rather simply operating in the margins.