Crypto Regulation Breakthrough: Bipartisan Bill Gains Steam as Coinbase CEO Predicts Thanksgiving Progress

Washington's crypto stalemate finally shows cracks as bipartisan support builds for market structure legislation.

The Regulatory Turning Point

After years of regulatory uncertainty, Democrats and Republicans are finding common ground on digital asset framework. The proposed legislation would establish clear rules of the road for cryptocurrency exchanges and token classification—something the industry has been begging for since Bitcoin was trading under $100.

Coinbase's Optimistic Timeline

Brian Armstrong sees tangible progress happening before Thanksgiving, telling reporters the bill has 'unprecedented momentum' despite previous congressional gridlock. The Coinbase CEO's prediction comes as major financial institutions increasingly demand regulatory clarity before diving deeper into digital assets.

Wall Street's watching closely—though they'll probably still find a way to charge 2% management fees on any resulting crypto products.

“We had great meetings with Democrats and Republicans today,” he said. “There’s strong bipartisan support to get this market legislation done. It’s important for America and for the 15 million Americans involved in crypto.”

The comment comes as Armstrong said a day earlier that he is “eager” to get to work on crypto market structure legislation as key Senate Democrats are set to meet with top digital asset executives on Wednesday.

Coinbase’s Armstrong: Crypto Regulation “90% There” as CLARITY Act Advances in Senate

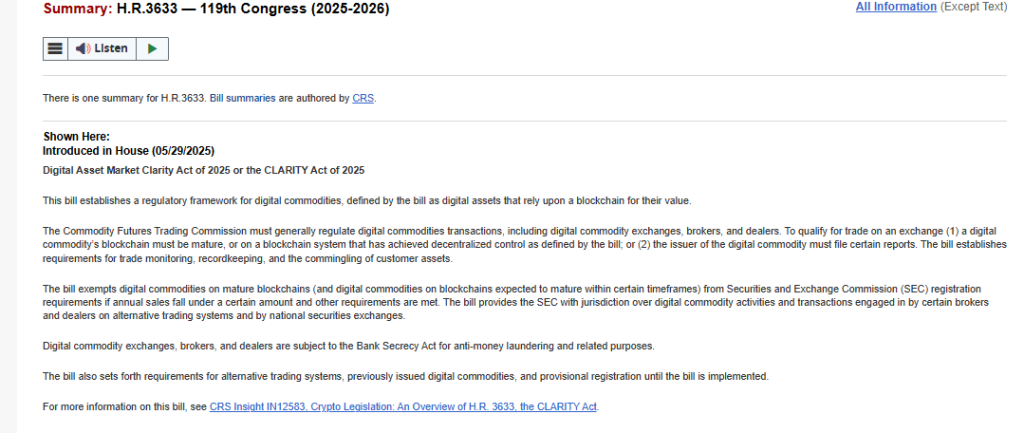

Armstrong’s remarks echo the growing sense of momentum surrounding the Digital Asset Market Clarity Act, also known as the CLARITY Act, which passed the House of Representatives in July with strong bipartisan support in a 294–137 vote.

According to Armstrong, roughly 90% of the bill’s issues have already been resolved, with the remaining details expected to be ironed out once lawmakers meet to finalize the text.

“A lot of collaboration is happening,” he said. “The last 10% of issues will be worked out once everyone gets in the room together.”

The bill, now under Senate review, seeks to end years of uncertainty in U.S. crypto regulation by clearly distinguishing between securities and commodities in the digital asset market.

Notably, under the proposed framework, digital assets built on sufficiently decentralized networks WOULD fall under the oversight of the Commodity Futures Trading Commission (CFTC), while more centralized or early-stage tokens would be classified as securities regulated by the Securities and Exchange Commission (SEC).

The bill also outlines clear rules for decentralized finance (DeFi), secondary market trading, and institutional custody, areas that have long lacked consistent federal guidance.

“This is a critical moment for the crypto industry in the U.S.,” Armstrong said. “It will provide clarity, foster innovation, and ensure that the U.S. remains a leader in the global digital economy.”

Crypto Leaders and Senators Signal Breakthrough in Bipartisan Market Structure Talks

The comments come as a wave of senior industry executives, including Armstrong, Kraken co-CEO David Ripley, Uniswap Labs founder Hayden Adams, and chainlink Labs’ Sergey Nazarov, met with lawmakers on Capitol Hill earlier this week.

The meetings, attended by figures such as Senate Banking Committee Chair Tim Scott (R-SC) and New York Senators Chuck Schumer and Kirsten Gillibrand, lasted nearly three hours and centered on advancing the market structure legislation.

Participants described the discussions as more substantive and high-level than previous industry engagements.

Nazarov noted that “more senior senators were speaking at once,” showing a shift in tone among policymakers who “realize the economic value of the industry and need to address it correctly.”

Sergey Nazarov chopping it up with the Senate Democrats in Washington DC today![]()

Is that Chuck Schumer?![]() $LINK https://t.co/ScvA640BBR pic.twitter.com/HZOA8AONaF

$LINK https://t.co/ScvA640BBR pic.twitter.com/HZOA8AONaF

The meetings included separate sessions with Democratic and Republican lawmakers. Democrats raised questions about illicit finance and DeFi oversight, while Republicans reiterated support for advancing the bill.

Senate Banking Committee spokesperson Jeff Naft described the meetings as productive, with participants reaffirming their commitment to a bipartisan path forward.

The CLARITY Act follows the earlier passage of the GENIUS Act, a stablecoin-focused bill signed into law by President Donald TRUMP in July, which laid the foundation for broader digital asset regulation.

Together, the two bills FORM the centerpiece of Congress’s ongoing effort to create a coherent national framework for cryptocurrencies.

Senator Cynthia Lummis (R-WY), a key sponsor of the market structure initiative, has also expressed confidence that Congress will pass the bill this year.

![]() Senator Cynthia Lummis is looking to have digital asset market structure legislation completed before the end of 2025.#CynthiaLummis #cryptolegislationhttps://t.co/brkZvGtCgH

Senator Cynthia Lummis is looking to have digital asset market structure legislation completed before the end of 2025.#CynthiaLummis #cryptolegislationhttps://t.co/brkZvGtCgH

Speaking at the SALT Wyoming Blockchain Symposium in August, Lummis said she expects the legislation to reach the president’s desk “before the end of the year — hopefully before Thanksgiving.”

Senate Banking Chair Tim Scott, who previously set a September 30 target for finalizing the bill, has echoed similar optimism. “We’ve been working since June toward a markup,” Scott’s spokesperson said, emphasizing the thousands of pages of stakeholder feedback already reviewed.

Scott believes the Senate “should not fall behind” after the House’s decisive action earlier this summer.

Only 20% Expect CLARITY Act Passage by 2025

However, progress in the Senate has not been without setbacks. Internal divisions within both parties and the ongoing government shutdown have delayed the markup process.

Senator John Kennedy (R-LA) has voiced skepticism, saying that he does not believe the committee is ready to MOVE forward, citing unresolved questions about how much authority the crypto industry might gain under the new framework.

![]() @SenJohnKennedy says “we’re not ready” on the GOP crypto bill, raising doubts about the Senate’s plan to advance market structure legislation. #Crypto #USPolitics #cryptobillhttps://t.co/g3VFg6LKQ3

@SenJohnKennedy says “we’re not ready” on the GOP crypto bill, raising doubts about the Senate’s plan to advance market structure legislation. #Crypto #USPolitics #cryptobillhttps://t.co/g3VFg6LKQ3

Meanwhile, a group of twelve Senate Democrats, led by Senators Gillibrand, Booker, and Warner, have urged Republicans to adopt a fully bipartisan drafting process.

In a joint statement last month, they described digital assets as a $4 trillion global market requiring “mutual understanding” and equal participation from both parties.

Despite the friction, industry Optimism remains high. Armstrong described the recent bipartisan meetings as a “turning point,” while SEC Chair Paul Atkins has also called on lawmakers to accelerate the process, emphasizing the need for joint rulemaking between the SEC and CFTC.

Still, uncertainty persists about the bill’s timeline. On the decentralized prediction market Polymarket, only about 20% of bettors believe the CLARITY Act will be signed into law by the end of 2025, a steep drop from 87% in mid-July.