Bitcoin Braces for Impact: $1.2B ETF Exodus Tests Critical $107K Defense Line

Bitcoin faces its moment of truth as massive ETF outflows threaten to breach crucial support levels.

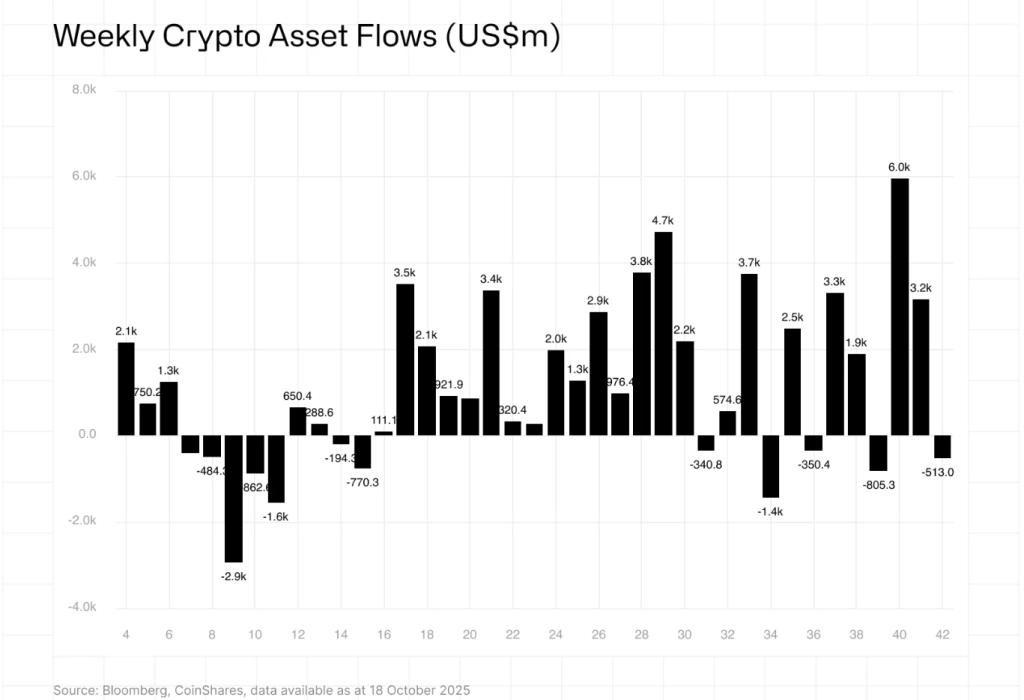

The Great Unwinding

A staggering $1.2 billion has fled Bitcoin ETFs in recent sessions—creating the most significant liquidity test since the last bull run. Market makers are watching the $107,000 level like hawks, knowing a breakdown here could trigger cascading liquidations across derivatives markets.

Support or Surrender

Traders are deploying every technical tool in their arsenal to defend the $107K zone. Options markets show concentrated put walls forming just below current prices, while spot buyers appear ready to scoop up any panic-selling. The battle lines are drawn—this is where institutional conviction meets retail sentiment.

Meanwhile, traditional finance veterans are probably sipping champagne and muttering 'told you so' about volatile digital assets—right before quietly adding to their own crypto exposure through backdoor channels.

Despite the downturn, activity remained high, with exchange-traded product (ETP) volumes NEAR $51 billion, nearly double the yearly average. This indicates traders are still repositioning rather than exiting the market entirely.

U.S. Leads the Selling, Europe Buys the Dip

Outflows were concentrated in the United States, where funds shed roughly $621 million in a single week. In contrast, European investors took the opposite stance, Germany, Switzerland, and Canada saw combined inflows of about $144 million, reflecting dip-buying sentiment after the October 10 liquidation event that erased nearly $19 billion from crypto exchanges.

Among providers, BlackRock’s iShares and Grayscale saw the heaviest redemptions, totaling more than $1 billion combined. Fidelity and Bitwise experienced smaller withdrawals, while multi-asset funds in Europe posted only mild outflows of around $29 million.

Bitcoin Technical Analysis and Price Forecast

Bitcoin’s chart shows price consolidation within an ascending channel, holding near $107,950 after a rejection at $111,730. The 20-EMA and 50-EMA are flattening, signaling short-term indecision. However, a long lower wick on the recent candle suggests dip-buying interest around $107,700, aligning with the channel’s lower boundary.

The RSI near 45 indicates neutral momentum, with a potential bullish divergence forming. If BTC holds above $107,400, it could rebound toward $111,700 and $115,900. A decisive break below that level WOULD expose downside targets near $104,400 and $101,100.

For traders, a long entry near $107,700 with a stop at $106,900 and target between $111,600–$115,900 offers a favorable setup. As volatility narrows, a breakout in either direction could define Bitcoin’s Q4 trajectory, potentially reviving Optimism for a renewed institutional rally into year-end.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana VIRTUAL Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $24.3 million, with tokens priced at just $0.013145 before the next increase.

As bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale