MrBeast’s Bold Move: ’MrBeast Financial’ Trademark Filing Signals Crypto & Banking Revolution

YouTube's biggest star just dropped a financial bombshell that could reshape how millions interact with money.

The Master Plan Revealed

Jimmy 'MrBeast' Donaldson's trademark filing for 'MrBeast Financial' isn't just another celebrity endorsement deal—it's a direct challenge to traditional banking's ivory towers. The application covers everything from cryptocurrency services to full-scale banking operations, suggesting Donaldson plans to build a financial ecosystem rather than just slap his name on someone else's product.

Why This Changes Everything

With over 100 million subscribers watching his every move, MrBeast possesses something traditional banks can't buy: genuine trust from a generation that views Wall Street with suspicion. His potential entry into crypto and banking could trigger the kind of mass adoption that industry insiders have been dreaming about for years—while giving legacy financial institutions their first real competition from someone who actually understands digital natives.

Traditional bankers are probably sweating over their martinis right about now—nothing scares established institutions more than someone who actually knows how to engage customers without charging hidden fees.

Crypto Liquidations: What the $19B Really Means

According to Patrick Heusser, head of lending and TradFi at Sentora, formerly IntoTheBlock, the $19 billion figure represents the face value of leveraged positions forced-closed, not the real dollar loss.

“When a long is liquidated, the trader typically loses their posted margin; the rest of that notional was borrowed exposure,” Heusser told Cryptonews, adding:

Think of liquidations as a speedometer for deleveraging intensity, not a profit and loss statement. Exchanges settle these events using margin, insurance funds, and, in rare cases, auto-deleveraging. This means money isn’t disappearing so much as it’s being redistributed.

Leverage allows traders to boost their bets, using, say $1 of capital to control $10, $50, or even $100 in crypto exposure. The cash at risk in any liquidation event is usually a fraction of the notional value, say analysts.

Heusser hazards that with an average leverage of around 10x on most spot or perpetual markets, the actual capital lost during the October 10 liquidations was between “$1 billion to several billion…not nineteen.”

“Open interest collapsing tells you leverage came out of the system,” he said. “It doesn’t mean an equal pile of cash evaporated.”

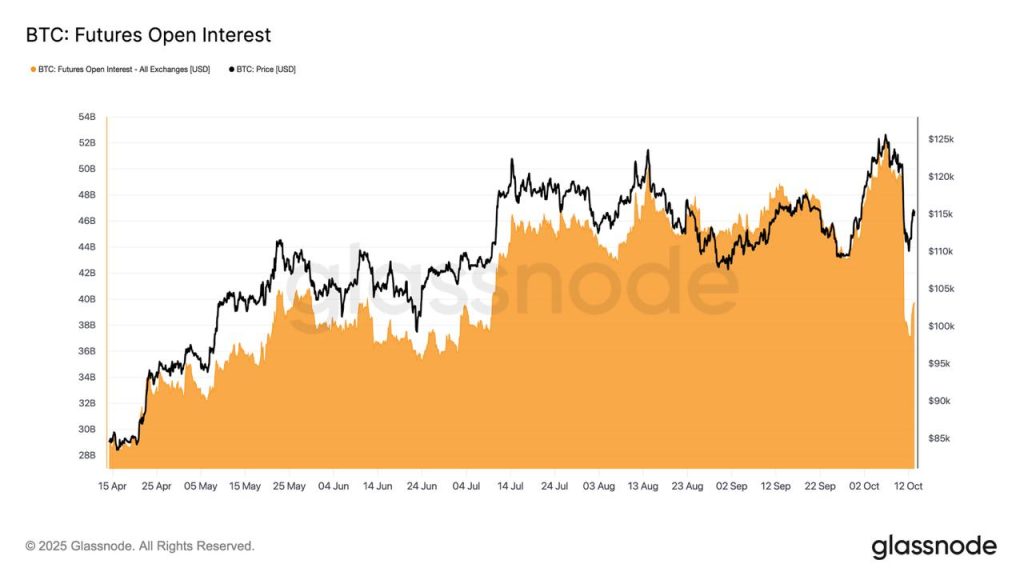

For example, Glassnode data shows that Bitcoin futures open interest tanked on Oct. 10, erasing over $10 billion in notional positions.

It is one of the largest single-day declines on record, said the firm, comparable in magnitude to the May 2021 liquidation and the FTX unwind in 2022.

Seo, the Kaia chairman, concurred with Heusser, saying $19 billion liquidation headlines are “dramatic, but misleading.” He noted that “the real loss for traders is their initial margin (the collateral they posted).”

Understanding this mechanic is the first step to realizing that our current market structure is built on a house of cards, where synthetic leverage distorts true price discovery and creates massive systemic risk.

Why the Market Panicked

Some crypto prices started to creep back up after China clarified that rare earth minerals exports were not completely banned. BTC ROSE above $116,000 earlier this week, for example, only to go lower after Jerome Powell’s ambivalent speech.

But if most of the $19 billion was just leveraged exposure, why did crypto prices crash and market sentiment take a hit? Sentora analyst Heusser says it comes down to mechanics and optics.

“Forced selling is mechanical,” he detailed. “Once margin thresholds break, the system sells at-risk positions, causing further price drops and even more liquidations. That cascade is what people feel.”

The optics grab people’s attention and drive market panic: ‘billions liquidated’ reads like ‘billions lost,’ even when the real equity damage is a fraction of the headline.

Matteo Greco, senior associate at Toronto Stock Exchange-listed crypto firm Fineqia, agrees that big liquidation numbers overstate real capital losses. But he also spoke against downplaying the impact.

“Leverage works both ways,” Greco tells Cryptonews. “The funding rate mechanism helps keep longs and shorts in balance, meaning one trader’s loss is often another’s gain.”

While traders only lose their margin, that margin represents real cash at risk. If a leveraged position is liquidated, the trader loses that collateral and the opportunity to recover the underlying asset.

He said traders only lose the margin collateral they posted, depending on the level of leverage used: at 2x leverage, margin equals 50% of the liquidated value; at 5x, 20%; and at 10x leverage, margin drops to 10%.

According to Greco, it is difficult to estimate precisely how much of a liquidation figure translates into actual capital losses, given that exchanges and jurisdictions allow vastly different leverage limits.

Still, he says the figure, $19 billion in this case, serves as a barometer for systemic stress.

“Liquidations are not a perfect measure of total losses,” he said. “But a gauge of how much leveraged exposure was forcibly closed. They signal a material reduction in traders’ capital and confidence.”

The psychological toll often exceeds the financial one. Greco said sudden liquidation forces investors to reassess risk, withdraw liquidity, and shift to safer positions.

Such sharp moves prompt investors to rebalance portfolios, close positions, or post more collateral to avoid being liquidated themselves. The result is a feedback loop that often spills over into the spot market…

How Exchanges Inflate Liquidation Numbers

CoinGlass data shows that liquidations on Hyperliquid, Bybit, and Binance accounted for most of the $19 billion purge that occurred between Oct. 10 and Oct. 11.

Experts say the size of liquidation figures has as much to do with how exchanges calculate them as with the underlying losses.

Ray Youssef, CEO of peer-to-peer (P2P) crypto platform NoOnes, said exchanges calculate liquidation based on the full position size that was forced closed, not the collateral or margin that was actually lost.

“When a leveraged position drops below its maintenance margin, the exchange’s risk engine closes the position at market price to cover exposure,” Youssef told Cryptonews in an interview. “Each of these positions is then summed up by notional value, which drastically inflates the headline number.”

Much of the problem lies in how the derivative market is structured: thin liquidity, extreme leverage options, and a handful of platforms controlling a large portion of the derivative trading infrastructure volume.

Youssef said:

Once a sharp drop begins on the market, these platforms’ liquidation systems kick in simultaneously, triggering a liquidation cascade across different trading venues. It becomes a feedback loop and creates a technical chain reaction.

Despite the chaos, the NoOnes CEO believes that such large-scale liquidation events are needed to “cleanse the system from running on excess leverage fumes.”

In every cycle, the crypto market goes through these forced resets. They are ugly, but can help purge the system from the casino-like speculative momentum that builds up when overleveraging becomes a norm.

The October 10 crash may ultimately be remembered less for the losses it caused and more for what it revealed about the maturity, or lack thereof, in crypto market literacy.

“As bad as this [liquidation] event was,” said Wertheimer, the Bitcoin developer. “It wasn’t nearly as bad as everyone thinks. [It’s] very possible that everyone forgets this happened in a week.”