XRP Plunges 17% to $2.38 Amid Ripple’s $1B GTreasury Acquisition - Can $2.20 Support Hold?

Ripple's billion-dollar power play triggers XRP bloodbath as markets react to strategic acquisition.

The $1B Gamble

Ripple drops a billion-dollar bombshell with GTreasury purchase while XRP investors watch their portfolios bleed red. The timing couldn't be more brutal - or more strategic.

Technical Breakdown

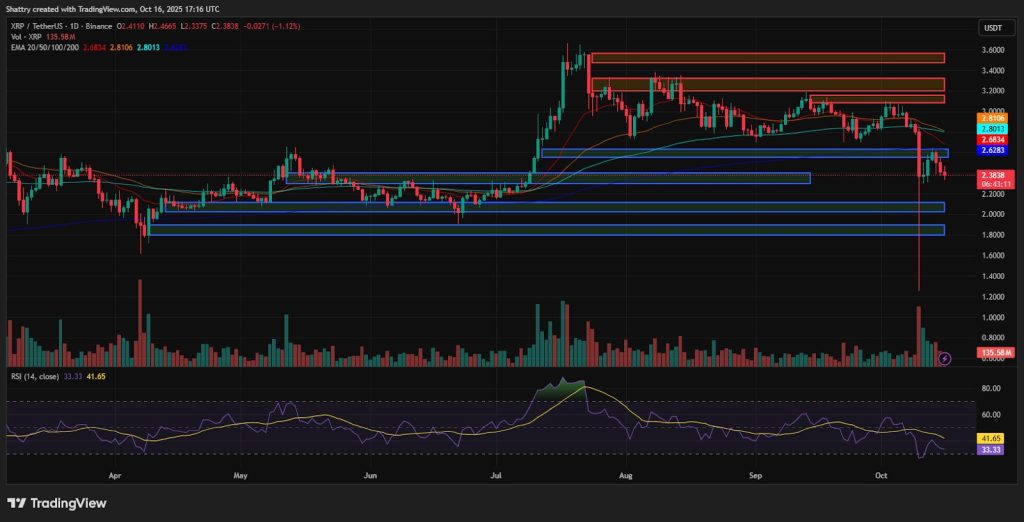

XRP slashes through key support levels like a hot knife through butter. Seventeen percent evaporated in what traders are calling a classic 'buy the rumor, sell the news' scenario. The $2.20 line now stands as the last bastion against further carnage.

Market Psychology

When a company spends more on acquisitions than most small nations' GDP while its flagship asset tanks, you've got to wonder - are they building for the future or just burning other people's money? Classic crypto: fundamentals improve while prices crater.

Will this strategic move pay off long-term or simply become another expensive lesson in crypto corporate finance? The charts will tell the story - and they're screaming right now.

Technical Analysis: Complete Bearish Breakdown

XRP atreflects adecline from, with aplunge fromrepresenting adecline through all key support levels. Volume atXRP confirms strong selling pressure.

RSI atapproaches oversold. Moving averages show a complete bearish structure:at(),at(),at(),at(). All EMAs act as overhead resistance.

The MACD is deeply bearish, currently atwith a signal line atand a histogram at. ATR atconfirms high volatility. Failed recovery attempts validate bearish continuation toward–support zone.

$1B GTreasury Acquisition Meets ETF Filing

Ripple announced its third majoracquisition, purchasing GTreasury forto target the corporate treasury market serving Fortunecompanies.

Community analysis emphasizes “trillions in idle capital will now MOVE through the XRP Ledger.”

BREAKING: Ripple Announces Major Acquisition of GTreasury for $1 Billion, Its Third Major Deal of 2025, Targets Multi-Trillion Dollar Corporate Treasury Market.

This spending spree further cements Ripple as the #1 most aggressive acquirer in crypto.#Ripple $XRP #Crypto… pic.twitter.com/rTyPyYMaKQ

Nasdaq received the CoinShares XRP ETF filing ahead of the Octoberdecision. Garlinghouse expressed Optimism about “potential for XRP ETFs to launch this year.”

Speaking with Cryptonews, Ray Youssef, CEO of NoOnes, observes that “high-beta altcoins like ethereum leading market recovery bounces,” with “ETH, BNB, XRP, and DOGE [usually] posting double-digit gains” following the recent deleveraging event.

Additionally, African expansion also accelerates through Absa Bank’s partnership in South Africa and crypto custody solutions for leading banks.

Ripple is also progressing toward obtaining an operational license in Luxembourg while strengthening XRP Ledger’s DeFi expansion.

Distribution During Acquisition Strategy

XRP maintainsmarket cap () withfully diluted valuation. Volume increasedto, producing avolume-to-market cap ratio.

XRP’s market dominance ofpositions it as the fourth-largest cryptocurrency.

Holder count reaches. Circulating supply ofXRP againstmaximum indicatescirculation.

Historical:(January),(February),(July peak), before the currentcorrection.

Community debates Ripple’s cash deployment with analysts noting “companies they’re buying should benefit XRP in the long run when partners decide to use it.“

Social Sentiment: ETF Optimism Meets Technical Weakness

LunarCrush shows AltRank at(), Galaxy Score at(). Engagements at() and mentions at().

Social dominance surges to(), sentimentpositive ().

Lark Davis notes, “XRP facingmajor resistances – previous support now acting as resistance,Fib right above it.” Technical discussions emphasize “XRP looks like it wants to revisit.”

$XRP is facing two major resistances right now

– Previous support (yellow line), now acting as resistance

– 0.618 Fib right above it

Bulls need to punch out a weekly close above ~$2.8

Otherwise, we could see further downside.

Watching closely. pic.twitter.com/jjA6rNovQP

The community remains divided between acquisition optimism, with some emphasizing “ETFs around the corner, regulatory clarity, institutions coming into market,” and technical analysts warning, “XRP crashesin justhours.“

ChatGPT’s XRP Analysis: Treasury Integration Tests Support

ChatGPT’s XRP analysis reveals XRP at ckey breakdown testing. Immediate support at, major support at–. Breaking these indicates correction toward.

Resistance at, followed by EMA cluster at–. Recovery requires reclaim above.

Three-Month XRP Forecast

ETF Approval Catalyst (40% Probability)

OctoberETF approval with a hold abovedrives recovery toward–(–upside). Requiresreclaim and GTreasury momentum.

Extended Consolidation (35% Probability)

Breakdown belowresults in–consolidation during acquisition integration and regulatory clarity.

Deeper Correction (25% Probability)

Failure attriggers selling toward–(–downside).

ChatGPT’s XRP Analysis: Acquisition Strategy Tests Patience

Holding aboveprevents a breakdown toward.

The OctoberETF approval could catalyze a recovery toward, with other catalysts driving the price towardor higher.

Failure atindicates correction towardbefore institutional adoption and treasury market penetration drive XRP toward+ targets.