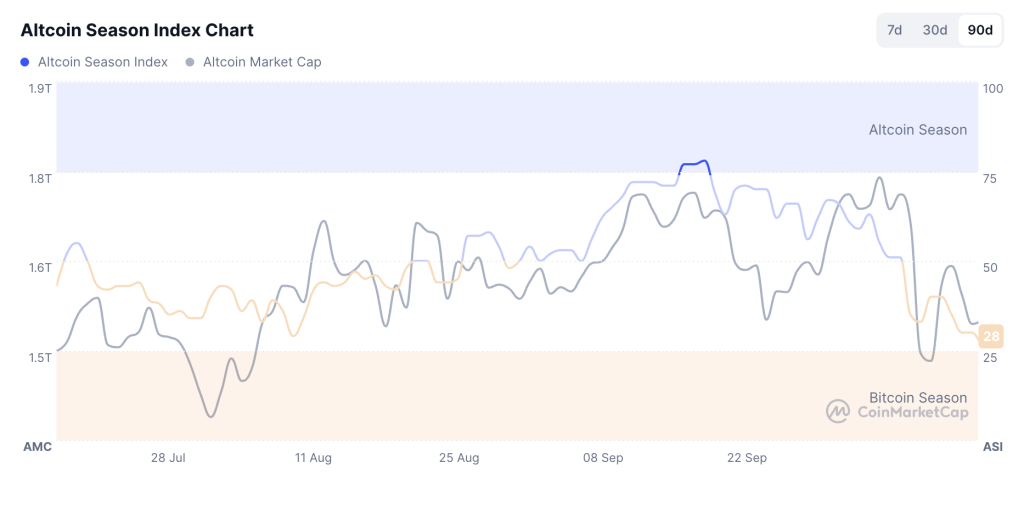

Altcoin Season Index Plunges to 28 as DeXe Surges, Tron Holds Steady, and Jupiter Activity Explodes

Altcoin markets hit turbulence as the seasonal indicator nosedives - but three tokens are bucking the trend.

DeXe's Defiance

While the broader altcoin market stumbles, DeXe charges ahead with impressive gains that leave traditional finance returns looking like pocket change.

Tron's Stability Play

TRON maintains its footing amid the chaos, proving some projects can actually deliver on their 'stable growth' promises - a rare feat in crypto.

Jupiter's Rising Orbit

Activity on Jupiter protocol spikes upward, showing that even when altcoin season cools, quality projects still attract capital and users.

The altcoin season index sitting at 28 tells you everything about current market sentiment - most investors are playing it safe while a few bold projects carve their own path. Because nothing says 'mature market' like 90% of tokens underperforming while the remaining 10% make all the headlines.

Altcoin Season Index (Source: CoinMarketCap)

DeXe: Measured Gain With Supportive Structure

DeXe is currently trading near $7.12, up by 5% over 24 hours. The MOVE is not a spike. Intraday ranges tightened through the session while bids held reclaimed levels from earlier in the week. That combination often indicates accumulation rather than a brief squeeze.

The interest links to steady usage around governance and social-trading features and to consistent visibility on market trackers. Liquidity has been sufficient across major pairs, allowing larger clips without heavy slippage. If volume holds near today’s pace and spreads stay orderly, DEXE can keep its slot on rotation screens even while the index stays weak.

AI develops faster than governance frameworks can catch up.

This piece explores how Human-AI collaboration can be coded: translating trust, oversight, and accountability into executable rules, making on-chain governance the next logical step.

More detail in the original post![]() https://t.co/mb2vxHGgD1

https://t.co/mb2vxHGgD1

“From agent reputation to policy-as-code and human-in-the-loop feedback—we’re sketching a future where AI creates value fast, and Web3 makes it trustworthy,” DeXe posted on social media.

A sequence of higher lows on short time frames helped trend followers stay involved. A close above today’s intraday shelf WOULD confirm that playbook and leave room for a continuation attempt.

Tron: Support Near $0.32 Invites Patience

Tron is priced around $0.321, up 1.3% in 24 hours. The price sits on a well-watched band near $0.32 that many desks treat as short-term support. Stabilization there matters because it reduces downside pressure while the broader market cools.

Tron Price (Source: CoinMarketCap)

Reports cite steady on-chain activity and consistent venue depth as reasons the level has held. The trade here is position management rather than chasing. If $0.32 continues to act as a base, the next checkpoint sits closer to $0.35, where earlier attempts stalled. A clear loss of the base would shift the focus back to risk control.

Jupiter: Flat Price With A Clear Volume Bump

Jupiter is trading near $0.362, roughly unchanged on the day, while 24-hour volume ROSE about 17% to $43M. The rise in tickets without a directional print often appears when liquidity providers and programmatic strategies get busier, but buyers and sellers remain balanced.

A flat close with rising turnover does not ensure a break. It does indicate deeper participation, which often precedes cleaner moves once order FLOW skews. Traders will watch whether the extra activity persists through the next session and whether liquidity migrates toward one side of the book.

Altcoin Season Read

An index at 28 says breadth is thin, yet today’s tape is instructive. DeXe posts a controlled advance with supportive structure and liquid pairs. TRON offers a read on patient positioning at $0.32, useful in a market that is not chasing. Jupiter’s higher volume without a price change suggests engaged participants and healthier books than the headline would imply.

The checklist is straightforward. For DeXe, track volume against spreads and whether higher lows continue to form. For Tron, monitor the $0.32 base and the reaction on approaches to $0.35. For Jupiter, watch if the $43M turnover becomes a trend and whether Flow skews enough to push price out of balance. If these markers hold, selective rotation can continue even while the altcoin season index stays soft.