Zcash Defies Market Trends with Stunning Rally - But Warning Signs Flash as Momentum Peaks

Zcash rockets past competitors while bitcoin stumbles - privacy coin's surge defies gravity

The Anomaly That Has Traders Buzzing

While major cryptocurrencies bled red across exchange screens, Zcash charted its own course upward. The privacy-focused digital asset posted gains that left market veterans scratching their heads and retail investors chasing momentum.

Technical Signals Scream Caution

Every parabolic move eventually meets reality. Resistance levels loom overhead like storm clouds, with trading volume patterns suggesting the smart money is already taking profits. The same traders who cheered the rally now watch for reversal patterns.

Regulatory Shadows Lengthen

Privacy coins dance in regulatory gray zones - and Zcash's recent spotlight attracts more than just investors. Compliance departments at major exchanges grow increasingly nervous about supporting assets that might draw unwanted regulatory attention.

Another classic crypto story: massive gains followed by the inevitable 'what were we thinking' moment when fundamentals finally matter. The rally was fun while it lasted - now watch the exit doors.

Bitcoin Market Enters Speculative Phase as New Whales Dominate

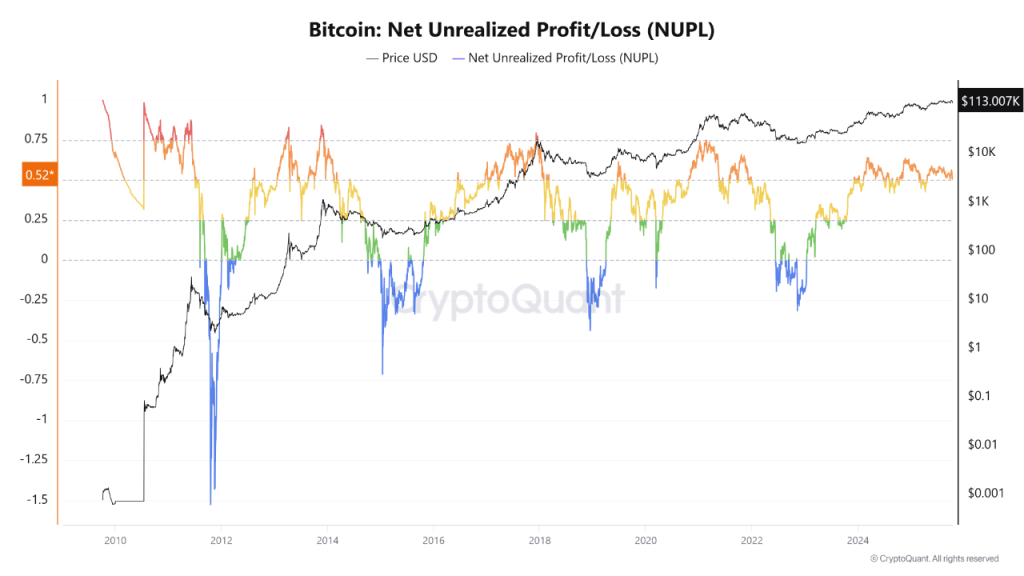

According to a CryptoQuant analyst, Bitcoin’s Net Unrealized Profit/Loss (NUPL) currently stands at +0.52, a zone historically associated with the shift from Optimism to euphoria.

In previous cycles during 2017 and 2021, NUPL readings above 0.5 signaled most investors were in profit, driving speculative activity before corrections.

According to the analyst, short-term holders now control 44% of Bitcoin’s realized capitalization while long-term holders realize profits, transferring dominance to “.”

This shift typically coincides with the final expansion phase of bull markets.

However, ETF inflows, expanding stablecoin liquidity, and institutional participation are effectively absorbing sell pressure.

According to CryptoQuants’ October 14 report, the stablecoin market capitalization ROSE by $14.9 billion over 60 days, the fastest pace since January, providing capital capacity to support the recovery.

XwinFinance analysts noted “the key signal to watch next will be a decline in STH share, which WOULD mark the start of a renewed accumulation phase led by long-term investors.“

Bitcoin’s Bull Score Index dropped from 80 to 20 following the liquidation, while Apparent Demand shows a 30-day decline of 111,000 BTC, which is the steepest since April.

Despite weakened fundamentals, whale accumulation remains strong, with 1-year holdings change crossing above its moving average on October 8.

Infrastructure Expansion Supports Bull Case Despite Structural Weakness

Melker emphasized that infrastructure development continues regardless of volatility.

“Public companies are adding BTC to balance sheets. Luxembourg just made Eurozone history. CME is prepping for 24/7 trading. States are preparing to buy Bitcoin.“

He quoted Howard Marks: “.”

This perspective acknowledges elevated prices while rejecting the assumption of inevitable correction.

Bitcoin broke above $114,000 to $117,000, reaching $126,000 before the liquidation, driven by record ETF inflows of over $2.2 billion.

The breakout flipped 190,000 BTC into support, providing structural depth.

Notably, rising leverage preceded the crash.

A Glassnode report earlier this month shows that Futures open interest set new highs while funding rates exceeded 8% annualized.

Options markets also showed crowded positioning with 25-Delta Skew narrowing from 18 volatility points to just 3, a 21-point swing in under a week.

While Uptober has been both rosy and stormy, data from Timothy Peterson suggests that “,” indicating that historical precedent supports continued strength.

October has constantly delivered gains in 10 of the past 12 years.

Technical Outlook: Wick Fill Expected Before Recovery Attempt

Bitcoin currently trades at $112,600 after the flash crash to $102,000, with analysts expecting a wick fill toward $109,513, which is the 50% retracement level.

Similarly, MVRV analysis from Ali Martinez also shows Bitcoin approximately 19.4% above the Mean fair value band at $96,526, creating vulnerability to correction if the +0.5σ resistance at $119,018 cannot be reclaimed.

Bitcoin $BTC must reclaim $119,000 to keep bullish momentum alive! Otherwise, the Pricing Bands signal a correction toward $96,530. pic.twitter.com/I7IGhKcXjX

— Ali (@ali_charts) October 15, 2025The current positioning between the Mean and +0.5σ suggests a greater downside risk toward fair value than upside potential.

Bitcoin stabilized above the 135-day moving average, while the Young Supply MVRV reset toward 1.0, a level that often means the market is cooling from speculative extremes while maintaining its structure.

Looking forward,Bitcoin faces a probable downside toward $109,500 wick-fill target and potentially $105,000-$107,000 if selling pressure intensifies.

The critical test remains whether these levels provide recovery support or merely pause deeper correction toward the $96,500 MVRV fair value.

Failure to reclaim $115,000 Traders’ Realized Price confirms weakened momentum, while breaking above $119,000 would validate the “” narrative and resume bullish structure toward year-end.