Global Markets Panic: Investors Flee Bonds for Gold & Crypto as Currency Values Tumble

Financial markets enter uncharted territory as traditional safe havens lose their shine.

The Great Rotation Begins

Massive capital movements shake global finance as institutional investors abandon government bonds en masse. The flight to safety takes an unexpected turn—straight into digital assets and precious metals.

Gold's Digital Cousin Shines

While gold sees predictable inflows, cryptocurrency markets experience unprecedented institutional interest. Bitcoin and Ethereum lead the charge, with trading volumes surging 300% in Asian and European sessions.

Central Banks Scramble

Monetary authorities worldwide face their toughest test since 2008. Emergency meetings yield little beyond the usual 'monitoring the situation closely' statements that reassure exactly nobody.

When the dust settles, one thing's clear: the old rules no longer apply—and the smart money's betting on assets that don't depend on government promises. Because when currencies falter, hard assets and decentralized networks become the only lifeboats left.

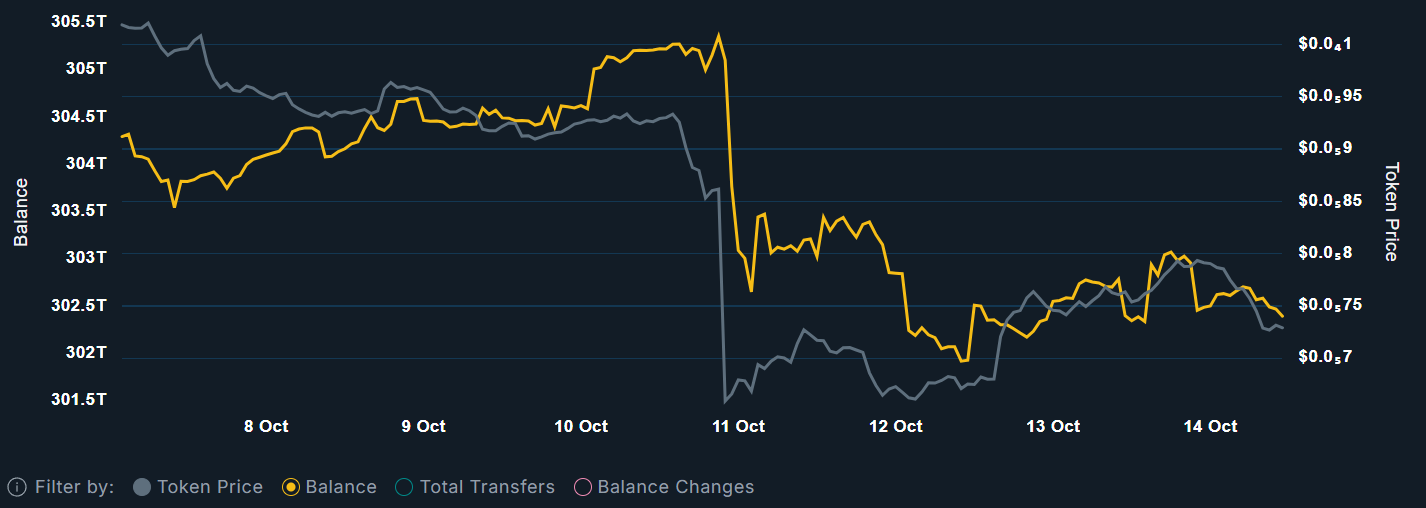

Top 100 PEPE whale holdings over the past week. Source: Nanasen.

Top 100 PEPE whale holdings over the past week. Source: Nanasen.

This de-risking has only persisted despite a rebound this week, with whale holdings still trending lower, suggesting expectations of further downside and a better buy-the-dip opportunity ahead.

PEPE Coin Price Prediction: How Much Further Could Pepe Fall?

While it’s unlikely whales acted early on the news, two bearish chart patterns likely informed their MOVE to reduced exposure.

The most recent, a 6-month descending triangle, marked the start of last week’s sell-off after breaking below its lower support at $0.000009.

This breakdown feeds into the second, broader head-and-shoulders pattern spanning the past year and a half. Fully realized, the setup targets a 40% decline toward the late-2024 market bottom at $0.0000046.

A credible scenario, as momentum indicators suggest the Pepe coin price downtrend still has strength. The RSI has faltered in a push back towards the neutral line, while the MACD histogram keeps a wide gap below the signal line, suggesting sellers still control the wider trend.

Much like in 2024, however, late-year U.S. interest rate cuts have the potential to stimulate demand for risk assets running into 2026. This could be a bear trap for the wider PEPE bull run.

Still, much like in 2024, late-year U.S. interest rate cuts could stimulate risk appetite heading into 2026. If so, this downturn may yet prove a bear trap in the wider Pepe Price bull run.

This could be the play Smart money is positioning for.

PepeNode: The Next Pepe Iteration is Gaining Traction?

Much like Dogecoin’s success sparked a wave of inspired-by coins, this cycle has seen Pepe take center stage as one of crypto’s biggest cultural moments. Feeding off that social momentum, its new offshoot PepeNode ($PEPENODE) is adding something the original never had: real passive income.

It’s happened before; shiba inu gave Doge staking, but PepeNode goes a step further with a fresh mine-to-earn model, bringing things in line with the current market.

All the complexity usually tied to mining is stripped away. Just log in, acquire nodes, stack rigs, and start earning rewards across proven meme coins.

The stats look solid too. The presale has already exceeded $1.8 million, while early stakers are still earning up to 706% APY.

And with 70% of all $PEPENODE spent on nodes and rigs burned, scarcity is built directly into the system, helping support long-term value growth.

The timing couldn’t be better.

Visit the Official Website HereThe macro narrative is driving capital back into risk assets like meme coins—making PepeNode’s rewards and model even stronger as momentum builds across the sector.