Crypto Carnage: Bitcoin & Ethereum ETFs Bleed $755M as Post-Wipeout Panic Spreads

Wall Street's crypto darlings are taking a brutal beating—$755 million vanished from Bitcoin and Ethereum spot ETFs in a single bloodbath session.

The Fear Factor

Traders are hitting the panic button hard after last week's market wipeout. What looked like a temporary correction is morphing into full-blown capitulation as institutional money flees at lightning speed.

ETF Exodus Accelerates

The flagship funds that were supposed to bring mainstream legitimacy to crypto are now leading the charge toward the exits. That $755 million hemorrhage represents one of the largest single-day outflows since these products launched.

Market Psychology Shifts

This isn't just about numbers—it's about sentiment swinging from greedy to fearful in record time. The 'buy the dip' crowd has gone suspiciously quiet while short positions pile up.

Traditional finance types are probably sipping champagne and muttering 'told you so' between bites of their artisanal sandwiches. But crypto has survived worse—and come back stronger every time.

Source: SoSoValue

Source: SoSoValue

The outflows mark a sharp reversal from the strong inflows seen earlier in the month, suggesting heightened caution among institutional investors.

BlackRock’s Bitcoin ETF Holds Firm as Crypto Funds Face $500M Outflows

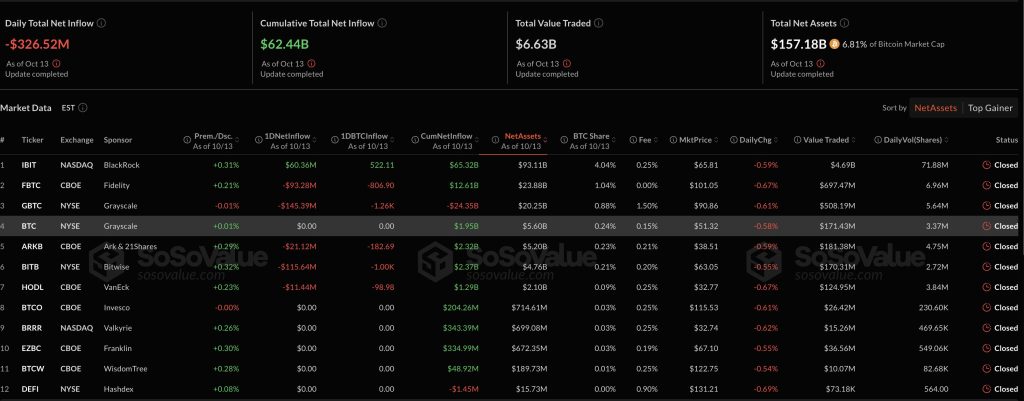

Among Bitcoin ETFs, BlackRock’s iShares Bitcoin Trust (IBIT) was the only product to record inflows, adding $60.36 million on the day. IBIT now holds $93.11 billion in total net assets and maintains cumulative inflows of $65.32 billion, continuing to dominate the sector.

In contrast, Grayscale’s bitcoin Trust (GBTC) posted the highest daily outflow at $145.39 million, bringing its cumulative net outflow to $24.35 billion. Fidelity’s Wise Origin Bitcoin Fund (FBTC) also reported withdrawals of $93.28 million.

As of October 13, the total net asset value of Bitcoin spot ETFs stood at $157.18 billion, representing 6.81% of Bitcoin’s total market capitalization. Trading volumes reached $6.63 billion for the day, underscoring elevated activity amid market uncertainty.

Ethereum spot ETFs experienced even deeper redemptions. BlackRock’s Ethereum ETF (ETHA) led the decline with $310.13 million in outflows, followed by Grayscale’s ETHE with $20.99 million and Fidelity’s FETH with $19.12 million.

The total net asset value of Ethereum spot ETFs fell to $28.75 billion, equal to 5.56% of Ethereum’s market capitalization. Cumulative inflows across all Ether ETFs now stand at $14.48 billion, down from $15.08 billion earlier in the week.

The broader market downturn was triggered after U.S. President Donald TRUMP confirmed plans to impose a 100% tariff on Chinese imports, sparking fears of an extended trade war.

![]() Over 1.66 million crypto traders were liquidated as the market experienced a sharp downturn, wiping out $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

Over 1.66 million crypto traders were liquidated as the market experienced a sharp downturn, wiping out $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

Beijing responded by warning it was ready to “fight to the end,” deepening global market jitters. Bitcoin prices dropped 2.54% to $112,283, while Ethereum fell 3.39% to $4,030.

Despite the weekend’s volatility, data from CoinShares earlier this week showed that crypto investment products had attracted $3.17 billion in inflows over the previous week, even as markets faced heavy selling pressure.

Bitcoin funds led with $2.7 billion in inflows, while Ether funds gained $338 million before the latest reversal.

![]() Digital asset funds logged $3.17 billion in inflows last week, defying market turbulence triggered by renewed US–China tariff tensions. #Funds #Inflowshttps://t.co/0BSiRhgdtW

Digital asset funds logged $3.17 billion in inflows last week, defying market turbulence triggered by renewed US–China tariff tensions. #Funds #Inflowshttps://t.co/0BSiRhgdtW

However, total assets under management for crypto funds slipped to $242 billion from $254 billion the week prior.

CoinShares noted that trading volumes during the correction reached record highs, with $10.4 billion traded on Friday alone, reflecting heightened activity as investors adjusted positions.

Bitcoin and Ethereum Slide Ahead of Powell Speech as Traders Brace for Volatility

Bitcoin and Ethereum extended their declines this week as traders brace for Federal Reserve Chair Jerome Powell’s upcoming speech, which could determine whether the crypto market stabilizes or faces further losses.

![]() Fed Chair Jerome Powell’s speech tomorrow could trigger a crypto market crash as traders await guidance on interest rates and economic policy amid U.S.-China trade tensions. #CryptoMarket #Powell #FederalReserve https://t.co/uYtW13jgYK

Fed Chair Jerome Powell’s speech tomorrow could trigger a crypto market crash as traders await guidance on interest rates and economic policy amid U.S.-China trade tensions. #CryptoMarket #Powell #FederalReserve https://t.co/uYtW13jgYK

Bitcoin (BTC) fell 3.1% in the past 24 hours and nearly 10% over the week, trading at $111,700, about 11% below its record high of $126,080.

Ethereum (ETH) dropped to $3,974, down 5.1% on the day and 15.2% over seven days. The broader market slipped 3.2%, bringing total capitalization to $3.8 trillion.

Analysts say Powell’s comments at the National Association for Business Economics (NABE) meeting in Philadelphia could influence sentiment on interest rate cuts. A more hawkish tone could extend selling pressure across risk assets, including crypto.

Meanwhile, traders are closely watching Bitcoin’s tightening volatility. According to analyst Tony “The Bull” Severino, the cryptocurrency’s Bollinger Bands on the weekly chart are showing “record compression,” a condition that has historically preceded large price swings.

Severino warned that the current setup could lead to either a parabolic breakout or the end of the ongoing bull cycle within the next 100 days.

![]() @BitMNR acquires $827M in $ETH during market dip, adding 202,037 tokens to reach 3,032,188 held — ~2.5% of circulating supply#Bitmine #Ethereum #ETHhttps://t.co/OxpHoZMO4x

@BitMNR acquires $827M in $ETH during market dip, adding 202,037 tokens to reach 3,032,188 held — ~2.5% of circulating supply#Bitmine #Ethereum #ETHhttps://t.co/OxpHoZMO4x

Despite the downturn, institutional interest remains firm. BitMine, the world’s largest corporate Ether holder, disclosed that it had increased its ETH holdings during last weekend’s crash, purchasing over 202,000 ETH valued at $827 million.

The MOVE raised its total stake to more than 3 million ETH, roughly 2.5% of the total supply, at an average price of $4,154.