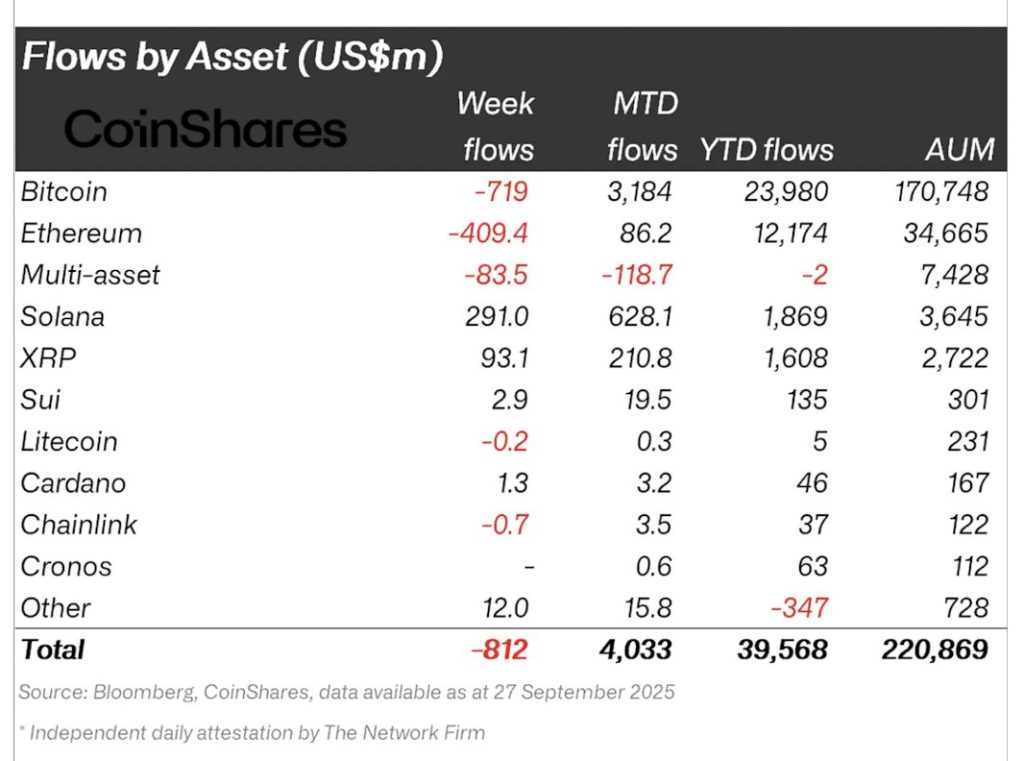

Digital Asset Funds Bleed $812M While Solana Defies Trend with $291M Inflows: CoinShares Report

Bloodbath or buying opportunity? The crypto fund space just witnessed its largest capital exodus in months.

The Great Divergence

While the broader digital asset market saw funds hemorrhage $812 million in outflows last week, Solana emerged as the lone wolf with a stunning $291 million influx. The numbers don't lie - institutional money is playing favorites in this volatile landscape.

Follow the Smart Money

Solana's resilience amid widespread selling pressure signals where sophisticated investors are placing their bets. The rest of the market? Well, let's just say Wall Street's crypto flirtation appears to be experiencing one of its trademark commitment issues.

When the tide goes out, you discover who's been swimming naked - and apparently most crypto funds forgot their trunks this quarter.

Stronger-than-anticipated economic data — including revised GDP and durable goods figures — has tempered expectations of two interest rate cuts this year, weighing on digital asset markets.

Despite the pullback, year-to-date inflows remain substantial at $39.6 billion, close to 2023’s record inflows of $48.6 billion. On a monthly basis, inflows total $4 billion, suggesting that overall demand for digital assets remains resilient.

Regional Divergence: U.S. Outflows vs. European Strength

The U.S. accounted for the bulk of the negative flows, registering $1 billion in outflows. However, the weakness was largely confined to the American market.

Other jurisdictions, including Switzerland, Canada, and Germany, demonstrated more positive sentiment. Switzerland led with inflows of $126.8 million, followed by Canada with $58.6 million and Germany with $35.5 million.

This divergence suggests that while U.S. macroeconomic uncertainty is dampening institutional flows, global demand for digital assets remains broadly intact.

Bitcoin and Ethereum Under Pressure

Bitcoin bore the brunt of the outflows, losing $719 million last week. However, CoinShares notes the absence of significant demand for short-bitcoin products, indicating that the bearish positioning may be low conviction and temporary.

Ethereum also faced headwinds, with $409 million in outflows during the week. This sharp reversal brings Ethereum’s YTD inflows of roughly $12 billion to a NEAR standstill, with September contributing only $86.2 million.

The data suggests that while both Bitcoin and ethereum remain dominant digital assets, near-term investor sentiment has softened as markets recalibrate expectations around monetary easing.

Solana and XRP Buck the Trend

Amid the broad outflows, solana stood out as a bright spot, attracting $291 million in inflows. XRP also saw a strong performance with inflows of $93.1 million.

CoinShares attributed the positive momentum to growing anticipation of upcoming U.S. exchange-traded fund (ETF) launches, which are expected to expand investor access and boost institutional participation in alternative digital assets beyond Bitcoin and Ethereum.

Solana’s inflows highlight the growing confidence in the network’s role as a scalable, efficient blockchain platform, while XRP’s demand reflects renewed institutional appetite ahead of potential regulatory clarity in the U.S.

While the short-term picture was dominated by large outflows, the sustained YTD inflows suggest continued institutional engagement in the sector. If momentum persists, 2025 could still rival or surpass the record-breaking inflows of the previous year.