Solana Price Prediction: Despite Price Dip, Open Interest Hits All-Time High – Big Move Coming Next

Solana defies price slump as traders pile into record-breaking positions.

The Contradiction That Speaks Volumes

While SOL's price takes a hit, the derivatives market tells a different story entirely. Open interest just smashed through previous records—traders are positioning for something big despite the current downturn.

What The Numbers Really Mean

This divergence between spot price and futures activity screams institutional accumulation. Smart money builds positions when retail panics. The all-time high in open interest while prices dip? That's not coincidence—it's calculated positioning.

The Imminent Catalyst

Markets coil before they spring. With this much leverage building in the system, any positive catalyst could trigger a violent move upward. Traders are essentially loading the spring—compression before explosion.

Because nothing says 'healthy market' like leveraged bets piling up during a price decline—what could possibly go wrong?

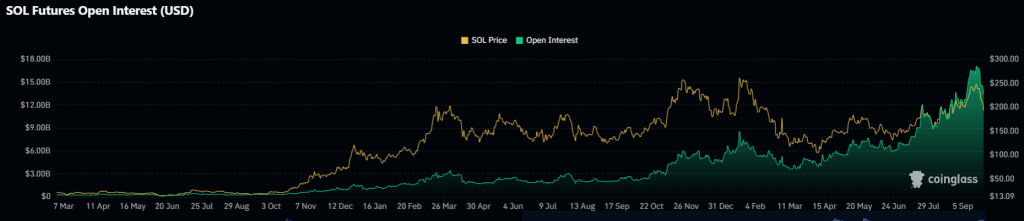

Solana Futures Open Interest Hits Record $17B

On September 20, Solana hit a new record in open interest at $17.10B while the price of SOL was closing in on its all-time high of $250.

Right now, SOL trades around $195, yet open interest is even higher than when it touched those highs earlier this year. Perpetual funding rates also flipped positive, climbing to 0.0043% from -0.0065% alongside the jump in OI.

In addition, DefiLlama data flags some weakness. Solana’s total value locked in DeFi protocols dropped 16% over the past week from 13B to 10B, and daily transactions slid by 11%.

Even with that dip, Solana continues to dominate key areas. It holds 58% of all tokenized stock volume, boasts 4M daily active addresses, generates $1.7B in annualized application revenue, and leads DEX volumes. All this has led uncertainty around SOL price, and the technicals right now lean more in favor of the bearish side.

Solana Price Prediction: Big Move Coming Next?

Solana recently slid under its ascending channel after that strong rally, showing it is tracking a bearish path. The $200 level is the key support right now, and if it breaks, SOL could dip toward $185 next.

The $198 zone is especially important since it overlaps mid-range support and the channel’s lower trendline. Holding this level could spark a rebound toward $255, and with stronger momentum, extend into the $330–$350 range.

If this support cracks, though, the downside opens toward $190 and even $174. RSI sits at 39, hinting at oversold and a possible bounce, but MACD remains bearish, keeping pressure heavy. Bulls must reclaim $215 to keep any higher breakout setup alive.

Snorter: One of the Best Trading Bots on Solana Doing Presale

Snorter is quickly setting itself apart as a leading bot built right inside Telegram for Solana traders. It packs the tools serious traders want: whale wallet mirroring, MEV protection, honeypot checks, and clean trades at just a 0.85% fee.

The presale already ripped past $4M, and the HYPE keeps climbing. With staking at% APY plus extra holder rewards, Snorter is designed not just for trading but for building long-term gains.

Among Solana bots, Snorter is already carving out a top spot, trusted by both early whales and retail piling in. If you want to catch the next wave of Solana action, Snorter is one of the best ways to play it.

Visit the Official Website Here