Bitcoin ETFs Explode With Record $241M Inflows While ETH ETFs Continue Bleeding Out

Bitcoin ETFs just staged a massive comeback that's shaking Wall Street to its core.

RECORD-BREAKING INFLOWS

The crypto king's exchange-traded funds smashed records with a staggering $241 million pouring in—proving institutional money isn't just dipping toes but diving headfirst into digital gold.

ETHEREUM'S UNRAVELING

Meanwhile, Ethereum ETFs continue their painful bleed-out, looking more like abandoned ghost ships than the 'next big thing' Wall Street promised. The divergence couldn't be more stark—Bitcoin charging ahead while ETH struggles to keep pace.

The smart money's voting with their wallets, and the results are clear: when traditional finance finally embraces crypto, they go straight for the original. Almost makes you wonder why institutions bother with the altcoin circus when the main event's right there.

Bitcoin ETF Holdings Near $150B After Strong Daily Inflows

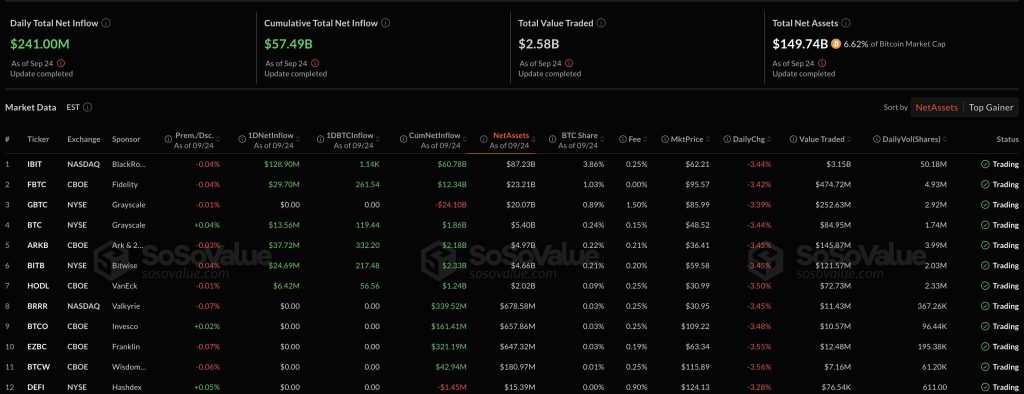

BlackRock’s iShares Bitcoin Trust (IBIT) led yesterday’s inflows with $128.9 million, bringing its cumulative net inflows to $60.78 billion and total net assets to $87.2 billion.

Ark Invest and 21Shares’ ARKB followed with $37.7 million in net inflows, raising its historical total to $2.18 billion. Fidelity’s FBTC also attracted $29.7 million, while Bitwise’s BITB added $24.7 million.

Smaller inflows were recorded by VanEck’s HODL at $6.4 million and Grayscale’s BTC fund at $13.5 million.

In total, bitcoin spot ETFs now hold $149.7 billion in assets, equal to 6.62% of Bitcoin’s total market capitalization.

Cumulative inflows have reached $57.49 billion, while daily trading volume on September 24 came in at $2.58 billion.

The renewed demand highlights the resilience of Bitcoin products following heavy redemptions earlier in the week. On September 23, Bitcoin ETFs lost $103.6 million, led by Fidelity’s FBTC with $75.6 million in outflows and ARKB with $27.9 million.

That followed an even steeper session on September 22, when Bitcoin funds shed $363 million, including $276.7 million from Fidelity’s FBTC alone.

Ethereum ETFs, however, continued to see outflows. On September 24, ETH products recorded $79.4 million in net redemptions, extending a trend of sustained investor withdrawals.

Fidelity’s FETH saw the largest daily outflow at $33.2 million, followed by BlackRock’s ETHA with $26.5 million and Grayscale’s ETHE with $8.9 million.

Bitwise’s ETHW lost $4.5 million, while VanEck’s ETHV and Grayscale’s ETH fund reported no significant flows.

The redemptions build on heavy losses earlier in the week. On September 23, ethereum ETFs saw $140.7 million in outflows, with Fidelity’s FETH leading at $63.4 million, followed by $36.4 million from Grayscale’s ETH product and $23.9 million from Bitwise’s ETHW.

A day earlier, on September 22, ETH funds posted $76 million in outflows, again led by Fidelity.

As of September 24, Ethereum spot ETFs hold $27.4 billion in assets, representing 5.45% of ETH’s total market value. Cumulative inflows now stand at $13.6 billion, despite the recent wave of redemptions.

Institutional Pause Weighs on Bitcoin—Armstrong Still Predicts $1M BTC

Institutional demand for Bitcoin has cooled after a strong start to September, with spot ETF inflows falling sharply.

According to Glassnode, net inflows dropped 54% last week to $931.4 million from $2.03 billion the week before.

Analysts said the slowdown points to a pause in institutional buying, even as overall accumulation remains intact.

Earlier this month, Bitcoin’s climb toward $118,000 was matched by heavy ETF inflows, including $741 million in a single day. But momentum has faded as retail traders continue selling.

CryptoQuant’s spot taker CVD indicator has remained sell-dominant since mid-August, raising concerns of a deeper correction into October if flows do not recover.

Bitcoin is currently trading below $110,600, down 6.9% in 24 hours.

Ethereum has also faced heavy pressure. Ether fell below $4,000 on Thursday, triggering a $36.4 million liquidation of one large position and contributing to a $331 million long squeeze in the past day, CoinGlass data shows.

Over the week, ETH traders have seen $718 million in long liquidations versus $79.6 million in shorts. The token is trading at $3,882, down 7.3% in 24 hours and 15% over the week.

Despite short-term weakness, Optimism persists. Coinbase CEO Brian Armstrong said Bitcoin could reach $1 million by 2030, citing progress on U.S. legislation, potential government adoption, and rising institutional interest.

With ETF custody already concentrated in Coinbase, he argued that long-term fundamentals remain strong as supply tightens and sovereign demand potentially emerges.